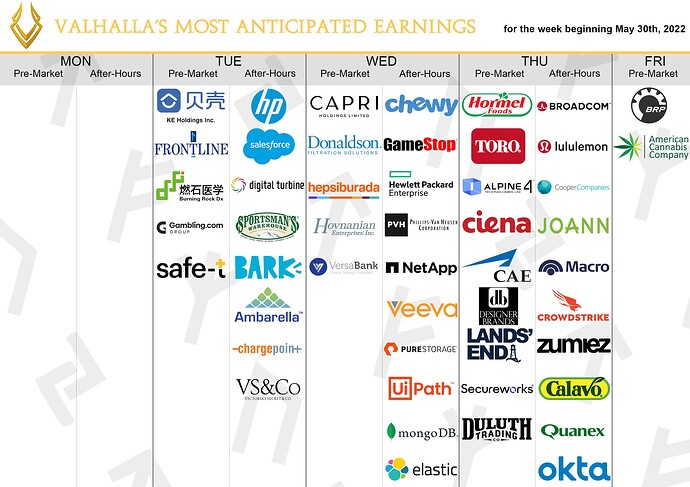

[color=#d4a218]HP Inc. ($HPQ)[/color]

HP Inc., ($HPQ) is confirmed to report earnings at approximately 4:15 PM EST on Tuesday 31st. The consensus estimate by the Earnings Whisper is for $1.06 per share on a revenue of $16.15 billion. HPQ reported 1st Quarter January 2022 earnings of $1.10 per share on revenue of $17.0 billion. Revenue grew 8.8% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Short interest has increased by 38% since the company’s last earnings release while the stock has drifted higher by 1.51% from its open following the earnings release. There has been an inflow of $560 million and an outflow of $1.64 billion by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]0.3[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $36.93 billion. Option traders are pricing in a 9.0% move on earnings.

[color=#d4a218]Salesforce ($CRM)[/color]

Salesforce, ($CRM) is confirmed to report earnings at approximately 4:05 PM EST on Tuesday 31st. The consensus estimate by the Earnings Whisper is for $0.34 per share on a revenue of $7.34 billion. BBY reported 1st Quarter January 2022 earnings of $2.73 per share on revenue of $16.4 billion. Revenue fell 3.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 35% expecting an earnings miss. Short interest has decreased by 27% since the company’s last earnings release while the stock has drifted lower by 15.86% from its open following the earnings release. There has been an inflow of $3.85 billion and an outflow of $2.72 million by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]1.4[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $158.78 billion. Option traders are pricing in a 9.2% move on earnings.

[color=#d4a218]Hewlett Packard Enterprise ($HPE)[/color]

Hewlett Packard Enterprise, ($HPE) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 1st. The consensus estimate by the Earnings Whisper is for $0.25 per share on a revenue of $6.79 billion. HPE reported 1st Quarter January 2022 earnings of $0.39 per share on revenue of $7.0 billion. Revenue grew 1.9% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 50% expecting an earnings beat. Short interest has decreased by 28% since the company’s last earnings release while the stock has drifted lower by 10.71% from its open following the earnings release. There has been an inflow of $733 million and an outflow of $635 million by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]1.2[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $18.86 billion. Option traders are pricing in a 9.6% move on earnings.

[color=#d4a218]Chewy, Inc. ($CHWY)[/color]

Chewy, Inc., ($CHWY) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 1st. The consensus estimate by the Earnings Whisper is for ($0.13) per share on a revenue of $2.43 billion. CHWY reported 1st Quarter January 2022 loss of $0.15 per share on revenue of $2.4 billion. Revenue grew 16.9% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 24% expecting an earnings beat. Short interest has decreased by 42% since the company’s last earnings release while the stock has drifted lower by 38.65% from its open following the earnings release. There has been an inflow of $112 million and an outflow of $302 million by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]0.4[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $10.47 billion. Option traders are pricing in a 19.3% move on earnings.

[color=#d4a218]GameStop ($GME)[/color]

GameStop Corp., ($GME) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 1st. The consensus estimate by the Earnings Whisper is for ($1.37) per share on a revenue of $1.32 billion. GME reported 1st Quarter January 2022 loss of $1.86 per share on revenue of $2.3 billion. Revenue grew 6.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 28% expecting an earnings beat. Short interest has increased by 12% since the company’s last earnings release while the stock has drifted lower by 16.85% from its open following the earnings release. There has been an inflow of $150 million and an outflow of $52 million by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]2.9[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $7.34 billion. Option traders are pricing in a 16.0% move on earnings.

[color=#d4a218]Broadcom Limited ($AVGO)[/color]

Broadcom Limited, ($AVGO) is confirmed to report earnings at approximately 4:15 PM EST on Thursday 2nd. The consensus estimate by the Earnings Whisper is for $7.88 per share on a revenue of $7.90 billion. AVGO reported 1st Quarter January 2022 earnings of $8.46 per share on revenue of $7.7 billion. Revenue grew 15.8% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 82% expecting an earnings beat. Short interest has decreased by 14% since the company’s last earnings release while the stock has drifted lower by 6.87% from its open following the earnings release. There has been an inflow of $6.41 billion and an outflow of $7.98 billion by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]0.8[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $214.90 billion. Option traders are pricing in a 7.4% move on earnings.

[color=#d4a218]Lululemon athletica inc. ($LULU)[/color]

Lululemon athletica inc., ($LULU) is confirmed to report earnings at approximately 4:05 PM EST on Thursday 2nd. The consensus estimate by the Earnings Whisper is for $1.43 per share on a revenue of $1.50 billion. LULU reported 1st Quarter January 2022 earnings of $3.37 per share on revenue of $2.1 billion. Revenue grew 23.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 41% expecting an earnings beat. Short interest has increased by 39% since the company’s last earnings release while the stock has drifted lower by 12.09% from its open following the earnings release. There has been an inflow of $1.44 billion and an outflow of $1.66 billion by institutions since their last earnings release (buy/sell ratio of [color=#3abf00]0.9[/color]:[color=#d90f00]1[/color]). In comparison the market cap is $34.90 billion. Option traders are pricing in a 10.7% move on earnings.