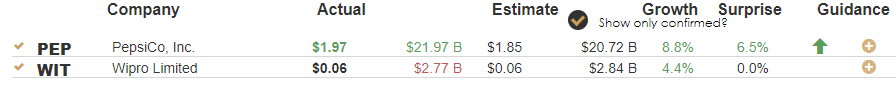

[color=#d4a218]PepsiCo, Inc., ($PEP)[/color]

PepsiCo, Inc., ($PEP) is confirmed to report earnings at approximately 6:00 AM EST on Wednesday 12th. The consensus estimate by the Earnings Whisper is for $1.84 per share on a revenue of $20.72 billion. PEP reported 2nd Quarter June 2022 earnings of $1.86 per share on revenue of $20.2 billion. Revenue grew 5.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 40% expecting an earnings beat. Short interest is considered to be healthy with 0.85% of the float being sold short. The stock has drifted lower by 3.74% from its open following the earnings release. Option traders are pricing in a 3.3% move on earnings.

[color=#d4a218]Walgreens Boots Alliance Inc, ($WBA)[/color]

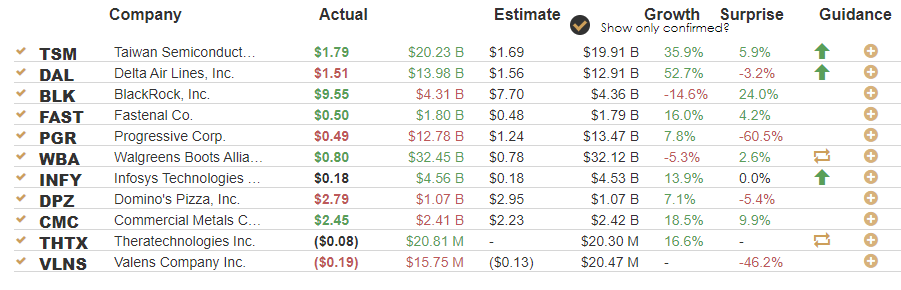

Walgreens Boots Alliance Inc, ($WBA) is confirmed to report earnings at approximately 7:00 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $0.78 per share on a revenue of $32.12 billion. WBA reported 3rd Quarter May 2022 earnings of $0.96 per share on revenue of $32.6 billion. Revenue fell 4.2% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 61% expecting an earnings beat. Short interest is considered to be healthy with 3.16% of the float being sold short. The stock has drifted lower by 9.24% from its open following the earnings release. Option traders are pricing in a 6.1% move on earnings.

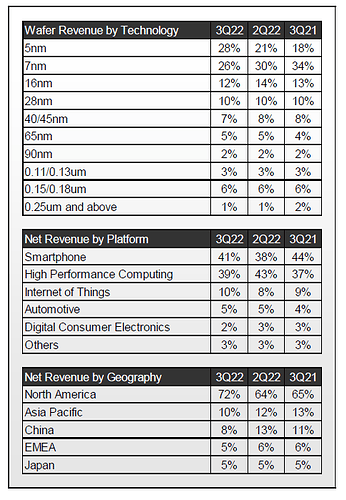

[color=#d4a218]Taiwan Semiconductor Manufacturing Company Limited, ($TSM)[/color]

Taiwan Semiconductor Manufacturing Company Limited, ($TSM) is confirmed to report earnings at approximately 5:00 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $1.66 per share on a revenue of $19.91 billion. TSM reported 2nd Quarter June 2022 earnings of $1.55 per share on revenue of $18.2 billion. Revenue grew 36.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 78% expecting an earnings beat. Short interest is considered to be healthy with 0.41% of the float being sold short. The stock has drifted lower by 15.25% from its open following the earnings release. Option traders are pricing in a 5.9% move on earnings.

[color=#d4a218]Progressive Corp., ($PGR)[/color]

Progressive Corp., ($PGR) is confirmed to report earnings at approximately 8:15 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $1.54 per share on a revenue of $13.47 billion. PGR reported 2nd Quarter June 2022 earnings of $0.95 per share on revenue of $11.5 billion. Revenue fell 3.2% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 75% expecting an earnings beat. Short interest is considered to be healthy with 0.75% of the float being sold short. The stock has drifted lower by 2.64% from its open following the earnings release. Option traders are pricing in a 5.0% move on earnings.

[color=#d4a218]Delta Air Lines, Inc., ($DAL)[/color]

Delta Air Lines, Inc., ($DAL) is confirmed to report earnings at approximately 6:30 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $1.58 per share on a revenue of $12.91 billion. DAL reported 2nd Quarter June 2022 earnings of $1.44 per share on revenue of $13.8 billion. Revenue grew 94.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Short interest is considered to be healthy with 2.65% of the float being sold short. The stock has drifted lower by 8.53% from its open following the earnings release. Option traders are pricing in a 7.4% move on earnings.

[color=#d4a218]Commercial Metals Company, ($CMC)[/color]

Commercial Metals Company, ($CMC) is confirmed to report earnings at approximately 6:45 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $2.23 per share on a revenue of $2.42 billion. CMC reported 3rd Quarter May 2022 earnings of $2.61 per share on revenue of $2.5 billion. Revenue grew 36.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Short interest is considered to be healthy with 2.87% of the float being sold short. The stock has drifted lower by 3.53% from its open following the earnings release. Option traders are pricing in a 7.8% move on earnings.

[color=#d4a218]Fastenal Co., ($FAST)[/color]

Fastenal Co., ($FAST) is confirmed to report earnings at approximately 6:50 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $0.48 per share on a revenue of $1.79 billion. FAST reported 2nd Quarter June 2022 earnings of $0.50 per share on revenue of $1.8 billion. Revenue grew 18.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 23% expecting an earnings beat. Short interest is considered to be healthy with 2.26% of the float being sold short. The stock has drifted lower by 6.56% from its open following the earnings release. Option traders are pricing in a 5.9% move on earnings.

[color=#d4a218]Domino’s Pizza, Inc., ($DPZ)[/color]

Domino’s Pizza, Inc., ($DPZ) is confirmed to report earnings at approximately 7:30 AM EST on Thursday 13th. The consensus estimate by the Earnings Whisper is for $2.96 per share on a revenue of $1.07 billion. DPZ reported 2nd Quarter June 2022 earnings of $2.82 per share on revenue of $1.1 billion. Revenue grew 3.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 41% expecting an earnings beat. Short interest is considered to be healthy with 4.21% of the float being sold short. The stock has drifted lower by 14.45% from its open following the earnings release. Option traders are pricing in a 6.7% move on earnings.

[color=#d4a218]UnitedHealth Group, Inc., ($UNH)[/color]

UnitedHealth Group, Inc., ($UNH) is confirmed to report earnings at approximately 5:55 AM EST on Friday 14th. The consensus estimate by the Earnings Whisper is for $5.45 per share on a revenue of $80.52 billion. UNH reported 2nd Quarter June 2022 earnings of $5.57 per share on revenue of $80.3 billion. Revenue grew 12.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 45% expecting an earnings beat. Short interest is considered to be healthy with 0.54% of the float being sold short. The stock has drifted lower by 1.31% from its open following the earnings release. Option traders are pricing in a 4.2% move on earnings.