[color=#d4a218]Johnson & Johnson, ($JNJ)[/color]

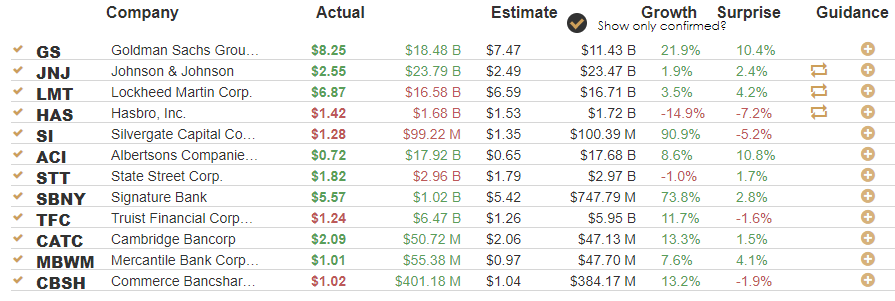

Johnson & Johnson, ($JNJ) is confirmed to report earnings at approximately 6:25 AM EST on Tuesday 18th. The consensus estimate by the Earnings Whisper is for $2.57 per share on a revenue of $23.47 billion. JNJ reported 2nd Quarter June 2022 earnings of $2.59 per share on revenue of $24.0 billion. Revenue grew 3.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 58% expecting an earnings beat. Short interest is considered to be healthy with 0.54% of the float being sold short. The stock has drifted lower by 8.76% from its open following the earnings release. Option traders are pricing in a 3.1% move on earnings.

[color=#d4a218]Albertsons Companies, Inc., ($ACI)[/color]

Albertsons Companies, Inc., ($ACI) is confirmed to report earnings at approximately 7:30 AM EST on Tuesday 18th. The consensus estimate by the Earnings Whisper is for $0.64 per share on a revenue of $17.68 billion. ACI reported 1st Quarter May 2022 earnings of $0.95 per share on revenue of $23.3 billion. Revenue grew 9.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 14% expecting an earnings beat. Short interest is considered to be unhealthy with 6.87% of the float being sold short. The stock has drifted lower by 2.59% from its open following the earnings release. Option traders are pricing in a 6.7% move on earnings.

[color=#d4a218]Lockheed Martin Corp., ($LMT)[/color]

Lockheed Martin Corp., ($LMT) is confirmed to report earnings at approximately 7:30 AM EST on Tuesday 18th. The consensus estimate by the Earnings Whisper is for $6.63 per share on a revenue of $16.71 billion. LMT reported 2nd Quarter June 2022 earnings of $6.32 per share on revenue of $15.4 billion. Revenue fell 9.3% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat. Short interest is considered to be healthy with 1.04% of the float being sold short. The stock has drifted lower by 0.71% from its open following the earnings release. Option traders are pricing in a 4.3% move on earnings.

[color=#d4a218]United Airlines, ($UAL)[/color]

United Airlines, ($UAL) is confirmed to report earnings at approximately 4:30 PM EST on Tuesday 18th. The consensus estimate by the Earnings Whisper is for $2.21 per share on a revenue of $12.62 billion. UAL reported 2nd Quarter June 2022 earnings of $1.43 per share on revenue of $12.1 billion. Revenue grew 121.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 88% expecting an earnings beat. Short interest is considered to be No Estimated Short Interest Data for UAL with nan of the float being sold short. The stock has drifted lower by 7.45% from its open following the earnings release. Option traders are pricing in a 9.3% move on earnings.

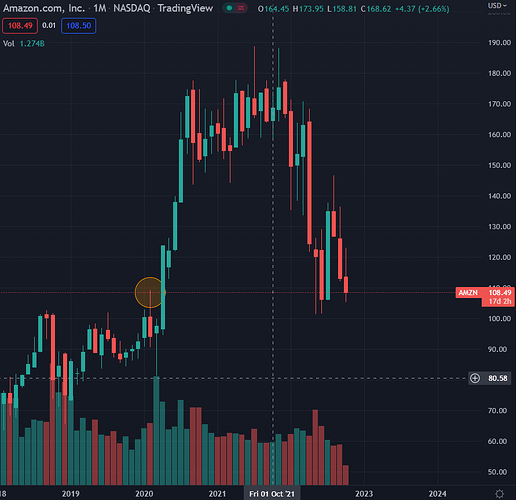

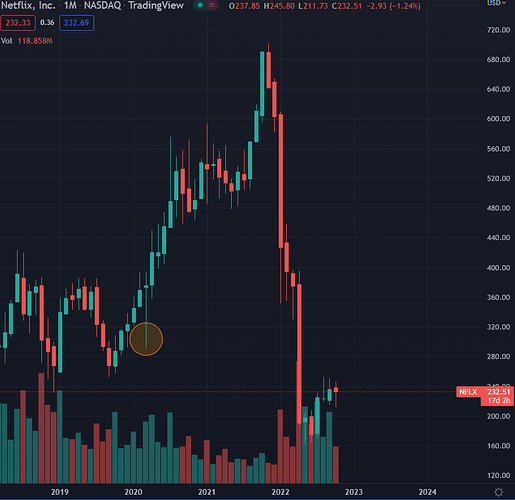

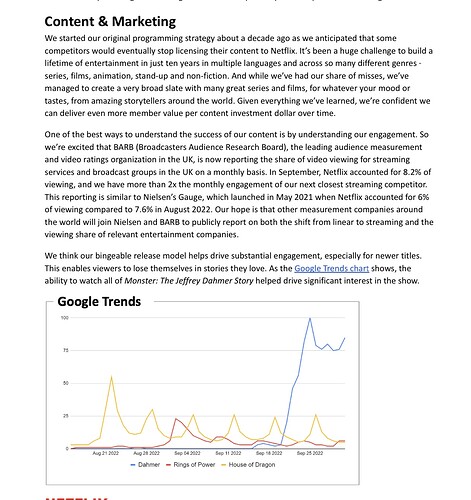

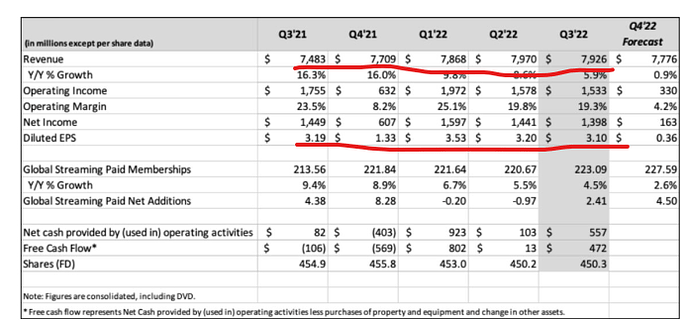

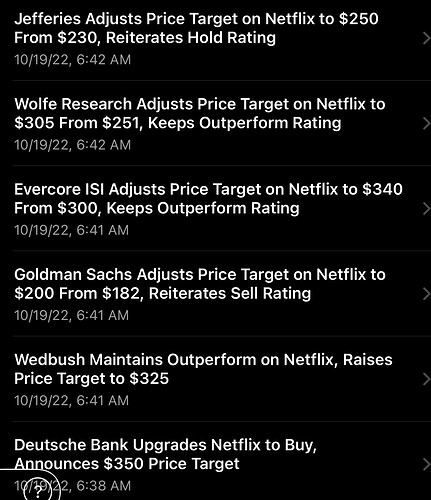

[color=#d4a218]Netflix, Inc., ($NFLX)[/color]

Netflix, Inc., ($NFLX) is confirmed to report earnings at approximately 4:00 PM EST on Tuesday 18th. The consensus estimate by the Earnings Whisper is for $2.12 per share on a revenue of $7.84 billion. NFLX reported 2nd Quarter June 2022 earnings of $3.20 per share on revenue of $8.0 billion. Revenue grew 8.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 33% expecting an earnings beat. Short interest is considered to be healthy with 2.23% of the float being sold short. The stock has drifted higher by 22.84% from its open following the earnings release. Option traders are pricing in a 12.7% move on earnings.

[color=#d4a218]Procter & Gamble Co., ($PG)[/color]

Procter & Gamble Co., ($PG) is confirmed to report earnings at approximately 6:55 AM EST on Wednesday 19th. The consensus estimate by the Earnings Whisper is for $1.56 per share on a revenue of $20.56 billion. PG reported Quarter June 2022 earnings of $1.21 per share on revenue of $19.5 billion. Revenue grew 3.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 41% expecting an earnings beat. Short interest is considered to be healthy with 0.59% of the float being sold short. The stock has drifted lower by 14.18% from its open following the earnings release. Option traders are pricing in a 4.7% move on earnings.

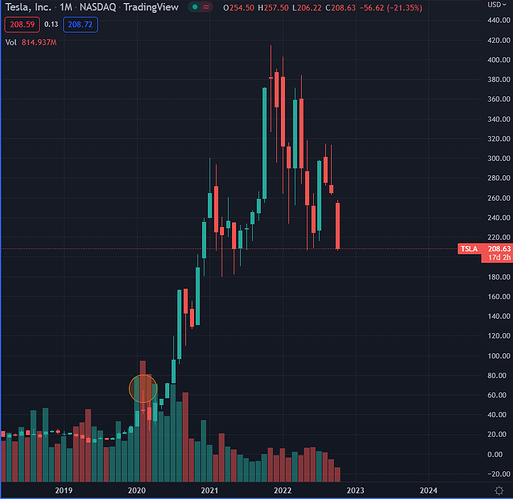

[color=#d4a218]Tesla, Inc., ($TSLA)[/color]

Tesla, Inc., ($TSLA) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 19th. The consensus estimate by the Earnings Whisper is for $1.03 per share on a revenue of $22.52 billion. TSLA reported 2nd Quarter June 2022 earnings of $1.95 per share on revenue of $16.9 billion. Revenue grew 41.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 65% expecting an earnings beat. Short interest is considered to be healthy with 2.05% of the float being sold short. The stock has drifted lower by 7.11% from its open following the earnings release. Option traders are pricing in a 9.4% move on earnings.

[color=#d4a218]International Business Machines Corp., ($IBM)[/color]

International Business Machines Corp., ($IBM) is confirmed to report earnings at approximately 4:10 PM EST on Wednesday 19th. The consensus estimate by the Earnings Whisper is for $1.78 per share on a revenue of $13.55 billion. IBM reported 2nd Quarter June 2022 earnings of $2.31 per share on revenue of $15.5 billion. Revenue fell 17.1% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 49% expecting an earnings beat. Short interest is considered to be healthy with 2.85% of the float being sold short. The stock has drifted lower by 15.36% from its open following the earnings release. Option traders are pricing in a 6.0% move on earnings.

[color=#d4a218]Steel Dynamics, Inc., ($STLD)[/color]

Steel Dynamics, Inc., ($STLD) is confirmed to report earnings at approximately 4:30 PM EST on Wednesday 19th. The consensus estimate by the Earnings Whisper is for $4.97 per share on a revenue of $5.43 billion. STLD reported 2nd Quarter June 2022 earnings of $6.73 per share on revenue of $6.2 billion. Revenue grew 39.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 64% expecting an earnings beat. Short interest is considered to be healthy with 2.80% of the float being sold short. The stock has drifted higher by 20.41% from its open following the earnings release. Option traders are pricing in a 6.4% move on earnings.

[color=#d4a218]AT&T Corp., ($T)[/color]

AT&T Corp., ($T) is confirmed to report earnings at approximately 6:35 AM EST on Thursday 20th. The consensus estimate by the Earnings Whisper is for $0.61 per share on a revenue of $29.83 billion. T reported 2nd Quarter June 2022 earnings of $0.65 per share on revenue of $29.6 billion. Revenue fell 32.7% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 30% expecting an earnings beat. Short interest is considered to be healthy with 1.14% of the float being sold short. The stock has drifted lower by 28.11% from its open following the earnings release. Option traders are pricing in a 16.4% move on earnings.

[color=#d4a218]Philip Morris International Inc, ($PM)[/color]

Philip Morris International Inc, ($PM) is confirmed to report earnings at approximately 7:00 AM EST on Thursday 20th. The consensus estimate by the Earnings Whisper is for $1.40 per share on a revenue of $7.40 billion. PM reported 2nd Quarter June 2022 earnings of $1.48 per share on revenue of $20.4 billion. Revenue fell 0.1% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 33% expecting an earnings beat. Short interest is considered to be healthy with 0.50% of the float being sold short. The stock has drifted lower by 8.16% from its open following the earnings release. Option traders are pricing in a 4.1% move on earnings.

[color=#d4a218]American Airlines Group Inc., ($AAL)[/color]

American Airlines Group Inc., ($AAL) is confirmed to report earnings at approximately 7:00 AM EST on Thursday 20th. The consensus estimate by the Earnings Whisper is for $0.44 per share on a revenue of $13.25 billion. AAL reported 2nd Quarter June 2022 earnings of $0.76 per share on revenue of $13.4 billion. Revenue grew 79.5% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat. Short interest is considered to be unhealthy with 12.50% of the float being sold short. The stock has drifted lower by 8.71% from its open following the earnings release. Option traders are pricing in a 9.9% move on earnings.

[color=#d4a218]Snap Inc., ($SNAP)[/color]

Snap Inc., ($SNAP) is confirmed to report earnings at approximately 4:10 PM EST on Thursday 20th. The consensus estimate by the Earnings Whisper is for $0.00 per share on a revenue of $1.07 billion. SNAP reported a 2nd Quarter June 2022 loss of $0.06 per share on revenue of $1.1 billion. Revenue grew 13.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 25% expecting an earnings beat. Short interest is considered to be healthy with 5.64% of the float being sold short. The stock has drifted lower by 26.67% from its open following the earnings release. Option traders are pricing in a 16.8% move on earnings.

[color=#d4a218]Verizon Communications, ($VZ)[/color]

Verizon Communications, ($VZ) is confirmed to report earnings at approximately 7:30 AM EST on Friday 21st. The consensus estimate by the Earnings Whisper is for $1.28 per share on a revenue of $33.90 billion. VZ reported 2nd Quarter June 2022 earnings of $1.31 per share on revenue of $33.8 billion. Revenue grew 0.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Short interest is considered to be healthy with 0.81% of the float being sold short. The stock has drifted lower by 28.83% from its open following the earnings release. Option traders are pricing in a 4.7% move on earnings.

[color=#d4a218]HCA Healthcare, Inc., ($HCA)[/color]

HCA Healthcare, Inc., ($HCA) is confirmed to report earnings at approximately 6:30 AM EST on Friday 21st. The consensus estimate by the Earnings Whisper is for $3.89 per share on a revenue of $15.00 billion. HCA reported 2nd Quarter June 2022 earnings of $4.21 per share on revenue of $14.8 billion. Revenue grew 2.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. Short interest is considered to be healthy with 2.03% of the float being sold short. The stock has drifted higher by 19.15% from its open following the earnings release. Option traders are pricing in a 6.9% move on earnings.

[color=#d4a218]American Express Co., ($AXP)[/color]

American Express Co., ($AXP) is confirmed to report earnings at approximately 7:00 AM EST on Friday 21st. The consensus estimate by the Earnings Whisper is for $2.38 per share on a revenue of $13.49 billion. AXP reported 2nd Quarter June 2022 earnings of $2.57 per share on revenue of $13.4 billion. Revenue grew 30.8% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 48% expecting an earnings beat. Short interest is considered to be healthy with 1.22% of the float being sold short. The stock has drifted lower by 2.30% from its open following the earnings release. Option traders are pricing in a 6.0% move on earnings.