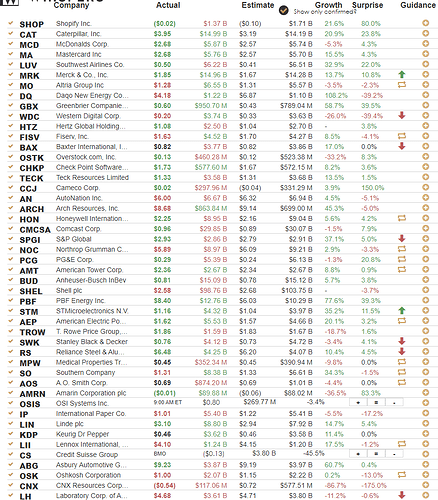

Watchlist today. V & CAT prob top plays.

V calls at 202.25/201. Resistance 205/206. BUD calls at 49, resistance 52/55. CAT calls 204/206, resistance 210/216. META puts 115/120 resistance only. SPY 383/385 resistance and 388 big resistance. Watch if they also turn into support. 381.50/380 support. Will change near open. Remember GDP comes out at 8:30 and will change all of this. Will repost before open.

Adjusted numbers a bit. V calls at 202.25/201. Resistance 205/206. BUD calls at 49/48, resistance 52/55. CAT calls 204/206, resistance 210/216. META puts 110/115resistance only. SPY 383/385 resistance and 388 big resistance. Watch if they also turn into support. 381.50/380 support.

ook a few calls here on V per support 202. for next week. safer at 200@Scalping Alerts

Adjusted numbers a bit. V calls at 202/201. Resistance 205/206. BUD calls at 49/48, resistance 52/55. CAT calls 208/210, resistance 210/216. META puts 110/115resistance only. SPY 383/385 resistance and 388 big resistance. Watch if they also turn into support. 381.50/380 support.

Up a lot on V and actually holding

Out of V for about 80% gains from that 202 bounce. May look to reenter CAT & V on the support bounces for calls next week.

**Going to be watching TMUS, CAT, CVX and XOM if we have Green Day. And COF if we are red today.

TMUS- had good report with growth in customers had PT upgrade this morning raised guidance for rest of year and what I think is really strong

The company’s sustained performance and significant progress on integration allowed T-Mobile to receive full investment grade ratings from all three rating agencies and board approval to commence a share repurchase program for up to $14 billion of the company’s common stock through September 2023. That’s a big buyback.

CAT got multiple PT upgrades this morning. Ranging from 221-255.

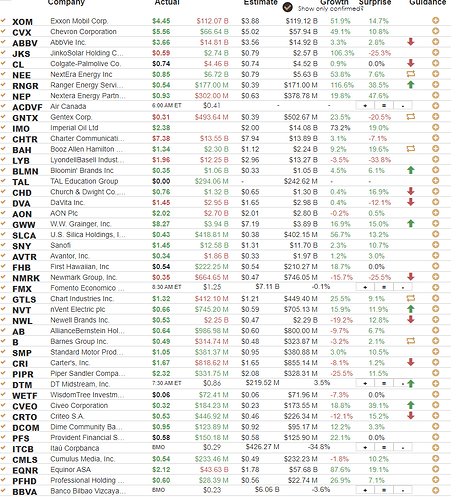

CVX and XOM both big beats. And records for them. Both are sitting near their highs though.

COF missed and was down YOY big in auto lending and credit cards and showed and increase in their provision for credit losses.

All this will likely depend on news coming this morning. Also will of course watch AAPL to upside on their beat and recovery. But don’t really like the tickers that are so correlated to SPY.

Oops… Looks like I forgot to save earnings from after-hours yesterday. Here’s this mornings results:

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.