[color=#d4a218]Royal Philips, ($PHG)[/color]

Royal Philips, ($PHG) is confirmed to report earnings on Monday 24th before market open, although a specific time has not yet been announced. The consensus estimate by the Earnings Whisper is for $0.24 per share on a revenue of $18.17 billion. PHG reported 2nd Quarter June 2022 earnings of $0.15 per share on revenue of $4.5 billion. Revenue grew 0.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 46% expecting an earnings beat. Short interest is considered to be healthy with 0.23% of the float being sold short. The stock has drifted lower by 39.26% from its open following the earnings release. Option traders are pricing in a 12.4% move on earnings.

[color=#d4a218]General Motors Corp., ($GM)[/color]

General Motors Corp., ($GM) is confirmed to report earnings at approximately 6:00 AM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for $1.91 per share on a revenue of $41.78 billion. GM reported 2nd Quarter June 2022 earnings of $1.14 per share on revenue of $35.8 billion. Revenue grew 4.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 40% expecting an earnings beat. Short interest is considered to be healthy with 1.67% of the float being sold short. The stock has drifted lower by 1.63% from its open following the earnings release. Option traders are pricing in a 6.4% move on earnings.

[color=#d4a218]United Parcel Service, Inc., ($UPS)[/color]

United Parcel Service, Inc., ($UPS) is confirmed to report earnings at approximately 6:00 AM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for $2.84 per share on a revenue of $24.42 billion. UPS reported 2nd Quarter June 2022 earnings of $3.29 per share on revenue of $24.8 billion. Revenue grew 5.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 38% expecting an earnings beat. Short interest is considered to be healthy with 1.12% of the float being sold short. The stock has drifted lower by 10.13% from its open following the earnings release. Option traders are pricing in a 6.6% move on earnings.

[color=#d4a218]General Electric Co., ($GE)[/color]

General Electric Co., ($GE) is confirmed to report earnings at approximately 6:20 AM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for $0.47 per share on a revenue of $19.02 billion. GE reported 2nd Quarter June 2022 earnings of $0.78 per share on revenue of $18.6 billion. Revenue grew 2.0% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat. Short interest is considered to be healthy with 1.04% of the float being sold short. The stock has drifted higher by 5.60% from its open following the earnings release. Option traders are pricing in a 5.9% move on earnings.

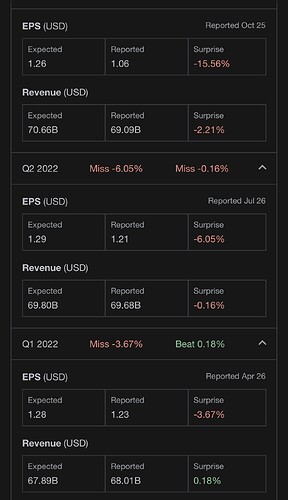

[color=#d4a218]Google, ($GOOG)[/color]

Google, ($GOOG) is confirmed to report earnings at approximately 4:10 PM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for $1.25 per share on a revenue of $70.98 billion. GOOG reported 2nd Quarter June 2022 earnings of $1.21 per share on revenue of $69.7 billion. Revenue grew 12.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 68% expecting an earnings beat. Short interest is considered to be healthy with 0.30% of the float being sold short. The stock has drifted lower by 11.88% from its open following the earnings release. Option traders are pricing in a 6.3% move on earnings.

[color=#d4a218]Microsoft Corp., ($MSFT)[/color]

Microsoft Corp., ($MSFT) is confirmed to report earnings at approximately 4:05 PM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for $2.30 per share on a revenue of $50.08 billion. MSFT reported Quarter June 2022 earnings of $2.23 per share on revenue of $51.9 billion. Revenue grew 12.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Short interest is considered to be healthy with 0.48% of the float being sold short. The stock has drifted lower by 8.10% from its open following the earnings release. Option traders are pricing in a 6.3% move on earnings.

[color=#d4a218]Spotify Technology S.A., ($SPOT)[/color]

Spotify Technology S.A., ($SPOT) is confirmed to report earnings at approximately 4:00 PM EST on Tuesday 25th. The consensus estimate by the Earnings Whisper is for ($0.88) per share on a revenue of $3.06 billion. SPOT reported a 2nd Quarter June 2022 loss of $0.91 per share on revenue of $3.1 billion. Revenue grew 8.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 34% expecting an earnings beat. Short interest is considered to be healthy with 4.16% of the float being sold short. The stock has drifted lower by 17.63% from its open following the earnings release. Option traders are pricing in a 10.8% move on earnings.

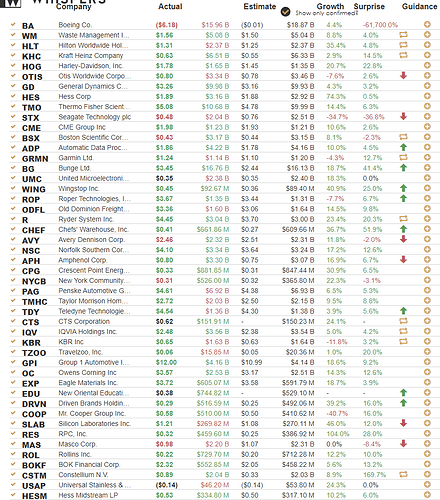

[color=#d4a218]Boeing Co., ($BA)[/color]

Boeing Co., ($BA) is confirmed to report earnings at approximately 7:30 AM EST on Wednesday 26th. The consensus estimate by the Earnings Whisper is for ($0.09) per share on a revenue of $18.87 billion. BA reported a 2nd Quarter June 2022 loss of $0.37 per share on revenue of $16.7 billion. Revenue fell 1.9% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Short interest is considered to be healthy with 1.52% of the float being sold short. The stock has drifted lower by 12.03% from its open following the earnings release. Option traders are pricing in a 6.2% move on earnings.

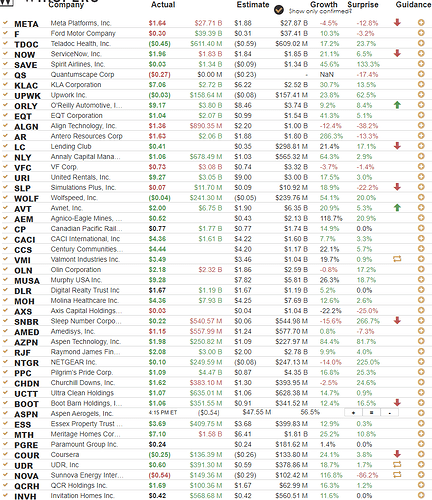

[color=#d4a218]Ford Motor Company, ($F)[/color]

Ford Motor Company, ($F) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 26th. The consensus estimate by the Earnings Whisper is for $0.37 per share on a revenue of $37.41 billion. F reported 2nd Quarter June 2022 earnings of $0.68 per share on revenue of $40.2 billion. Revenue grew 50.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 58% expecting an earnings beat. Short interest is considered to be healthy with 3.34% of the float being sold short. The stock has drifted lower by 4.45% from its open following the earnings release. Option traders are pricing in a 7.1% move on earnings.

[color=#d4a218]Meta Platforms, Inc., ($META)[/color]

Meta Platforms, Inc., ($META) is confirmed to report earnings at approximately 4:05 PM EST on Wednesday 26th. The consensus estimate by the Earnings Whisper is for $1.82 per share on a revenue of $27.87 billion. META reported 2nd Quarter June 2022 earnings of $2.46 per share on revenue of $28.8 billion. Revenue fell 0.9% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 43% expecting an earnings beat. Short interest is considered to be healthy with 1.13% of the float being sold short. The stock has drifted lower by 25.30% from its open following the earnings release. Option traders are pricing in a 11.2% move on earnings.

[color=#d4a218]Comcast Corp., ($CMCSA)[/color]

Comcast Corp., ($CMCSA) is confirmed to report earnings at approximately 7:00 AM EST on Thursday 27th. The consensus estimate by the Earnings Whisper is for $0.89 per share on a revenue of $30.07 billion. CMCSA reported 2nd Quarter June 2022 earnings of $1.01 per share on revenue of $30.0 billion. Revenue grew 5.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 32% expecting an earnings beat. Short interest is considered to be healthy with 1.71% of the float being sold short. The stock has drifted lower by 26.36% from its open following the earnings release. Option traders are pricing in a 6.3% move on earnings.

[color=#d4a218]Amazon.com, Inc., ($AMZN)[/color]

Amazon.com, Inc., ($AMZN) is confirmed to report earnings at approximately 4:00 PM EST on Thursday 27th. The consensus estimate by the Earnings Whisper is for $0.23 per share on a revenue of $126.42 billion. AMZN reported 2nd Quarter June 2022 earnings of $0.10 per share on revenue of $121.2 billion. Revenue grew 7.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. Short interest is considered to be healthy with 0.77% of the float being sold short. The stock has drifted lower by 2.23% from its open following the earnings release. Option traders are pricing in a 7.5% move on earnings.

[color=#d4a218]Apple, Inc., ($AAPL)[/color]

Apple, Inc., ($AAPL) is confirmed to report earnings at approximately 4:30 PM EST on Thursday 27th. The consensus estimate by the Earnings Whisper is for $1.26 per share on a revenue of $90.00 billion. AAPL reported 3rd Quarter June 2022 earnings of $1.20 per share on revenue of $83.0 billion. Revenue grew 1.9% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 61% expecting an earnings beat. Short interest is considered to be healthy with 0.64% of the float being sold short. The stock has drifted lower by 4.80% from its open following the earnings release. Option traders are pricing in a 5.4% move on earnings.

[color=#d4a218]Intel Corp., ($INTC)[/color]

Intel Corp., ($INTC) is confirmed to report earnings at approximately 4:00 PM EST on Thursday 27th. The consensus estimate by the Earnings Whisper is for $0.34 per share on a revenue of $18.62 billion. INTC reported 2nd Quarter June 2022 earnings of $0.29 per share on revenue of $15.3 billion. Revenue fell 22.0% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 20% expecting an earnings beat. Short interest is considered to be healthy with 1.58% of the float being sold short. The stock has drifted lower by 35.68% from its open following the earnings release. Option traders are pricing in a 7.6% move on earnings.

[color=#d4a218]Exxon Mobil Corp., ($XOM)[/color]

Exxon Mobil Corp., ($XOM) is confirmed to report earnings at approximately 6:30 AM EST on Friday 28th. The consensus estimate by the Earnings Whisper is for $3.59 per share on a revenue of $119.12 billion. XOM reported 2nd Quarter June 2022 earnings of $4.14 per share on revenue of $115.7 billion. Revenue grew 70.8% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 81% expecting an earnings beat. Short interest is considered to be healthy with 0.85% of the float being sold short. The stock has drifted higher by 14.20% from its open following the earnings release. Option traders are pricing in a 4.4% move on earnings.

[color=#d4a218]Chevron Corporation, ($CVX)[/color]

Chevron Corporation, ($CVX) is confirmed to report earnings at approximately 6:15 AM EST on Friday 28th. The consensus estimate by the Earnings Whisper is for $5.06 per share on a revenue of $57.94 billion. CVX reported 2nd Quarter June 2022 earnings of $5.82 per share on revenue of $68.8 billion. Revenue grew 82.9% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 81% expecting an earnings beat. Short interest is considered to be healthy with 1.00% of the float being sold short. The stock has drifted higher by 15.99% from its open following the earnings release. Option traders are pricing in a 4.4% move on earnings.

[color=#d4a218]Equinor ASA, ($EQNR)[/color]

Equinor ASA, ($EQNR) is confirmed to report earnings on Friday 28th before market open, although a specific time has not yet been announced. The consensus estimate by the Earnings Whisper is for $1.78 per share on a revenue of $57.68 billion. EQNR reported 2nd Quarter June 2022 earnings of $1.56 per share on revenue of $36.4 billion. Revenue grew 108.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Short interest is considered to be healthy with 0.25% of the float being sold short. The stock has drifted lower by 1.36% from its open following the earnings release. Option traders are pricing in a 8.7% move on earnings.