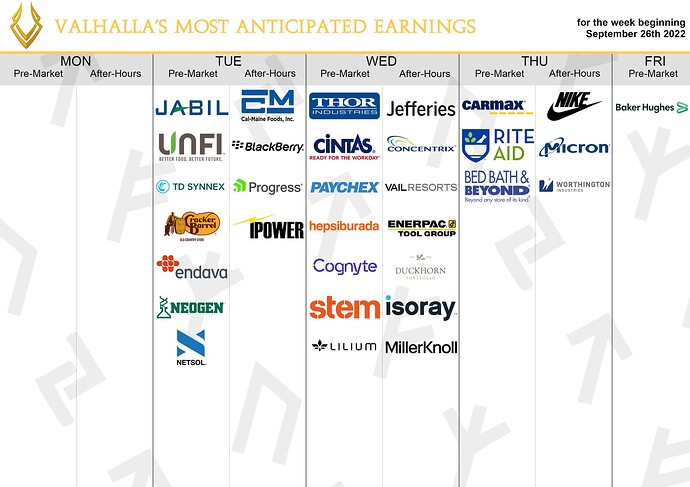

[color=#d4a218]Jabil Inc., ($JBL)[/color]

Jabil Inc., ($JBL) is confirmed to report earnings at approximately 7:30 AM EST on Tuesday 27th. The consensus estimate by the Earnings Whisper is for $2.14 per share on a revenue of $8.39 billion. JBL reported 3rd Quarter May 2022 earnings of $1.71 per share on revenue of $8.3 billion. Revenue grew 15.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 61% expecting an earnings beat. Short interest is considered to be healthy with 2.36% of the float being sold short. The stock has drifted higher by 9.97% from its open following the earnings release. Option traders are pricing in a 8.7% move on earnings.

[color=#d4a218]United Natural Foods, Inc., ($UNFI)[/color]

United Natural Foods, Inc., ($UNFI) is confirmed to report earnings at approximately 6:45 AM EST on Tuesday 27th. The consensus estimate by the Earnings Whisper is for $1.24 per share on a revenue of $7.33 billion. UNFI reported 3rd Quarter April 2022 earnings of $1.10 per share on revenue of $7.2 billion. Revenue grew 9.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 55% expecting an earnings beat. Short interest is considered to be healthy with 3.84% of the float being sold short. The stock has drifted higher by 3.61% from its open following the earnings release. Option traders are pricing in a 11.5% move on earnings.

[color=#d4a218]TD SYNNEX, ($SNX)[/color]

TD SYNNEX, ($SNX) is confirmed to report earnings at approximately 7:05 AM EST on Tuesday 27th. The consensus estimate by the Earnings Whisper is for $2.69 per share on a revenue of $15.06 billion. SNX reported 2nd Quarter May 2022 earnings of $2.79 per share on revenue of $15.3 billion. Revenue grew 160.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 43% expecting an earnings beat. Short interest is considered to be healthy with 2.58% of the float being sold short. The stock has drifted lower by 4.21% from its open following the earnings release. Option traders are pricing in a 8.5% move on earnings.

[color=#d4a218]BlackBerry Limited, ($BB)[/color]

BlackBerry Limited, ($BB) is confirmed to report earnings at approximately 5:05 PM EST on Tuesday 27th. The consensus estimate by the Earnings Whisper is for ($0.08) per share on a revenue of $690.00 million. BB reported a 1st Quarter May 2022 loss of $0.06 per share on revenue of $168.0 million. Revenue fell 3.4% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat. Short interest is considered to be healthy with 5.83% of the float being sold short. The stock has drifted higher by 0.38% from its open following the earnings release. Option traders are pricing in a 9.2% move on earnings.

[color=#d4a218]Concentrix Corporation, ($CNXC)[/color]

Concentrix Corporation, ($CNXC) is confirmed to report earnings at approximately 4:15 PM EST on Wednesday 28th. The consensus estimate by the Earnings Whisper is for $2.76 per share on a revenue of $1.59 billion. CNXC reported 2nd Quarter May 2022 earnings of $2.74 per share on revenue of $1.6 billion. Revenue grew 14.5% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. Short interest is considered to be healthy with 1.43% of the float being sold short. The stock has drifted lower by 14.92% from its open following the earnings release. Option traders are pricing in a 8.3% move on earnings.

[color=#d4a218]Bed Bath & Beyond, Inc., ($BBBY)[/color]

Bed Bath & Beyond, Inc., ($BBBY) is confirmed to report earnings at approximately 7:30 AM EST on Thursday 29th. The consensus estimate by the Earnings Whisper is for ($1.59) per share on a revenue of $1.45 billion. BBBY reported a 1st Quarter May 2022 loss of $2.83 per share on revenue of $1.5 billion. Revenue fell 25.1% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 17% expecting an earnings beat. Short interest is considered to be unhealthy with 40.26% of the float being sold short. The stock has drifted higher by 6.85% from its open following the earnings release. Option traders are pricing in a 16.4% move on earnings.

[color=#d4a218]Nike Inc, ($NKE)[/color]

Nike Inc, ($NKE) is confirmed to report earnings at approximately 4:15 PM EST on Thursday 29th. The consensus estimate by the Earnings Whisper is for $0.92 per share on a revenue of $12.29 billion. NKE reported Quarter May 2022 earnings of $0.90 per share on revenue of $12.2 billion. Revenue fell 0.9% compared to the same quarter a year ago. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Short interest is considered to be healthy with 0.92% of the float being sold short. The stock has drifted lower by 4.89% from its open following the earnings release. Option traders are pricing in a 6.6% move on earnings.

[color=#d4a218]Micron Technology, Inc., ($MU)[/color]

Micron Technology, Inc., ($MU) is confirmed to report earnings at approximately 4:00 PM EST on Thursday 29th. The consensus estimate by the Earnings Whisper is for $1.32 per share on a revenue of $6.71 billion. MU reported 3rd Quarter May 2022 earnings of $2.62 per share on revenue of $8.6 billion. Revenue grew 16.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 47% expecting an earnings beat. Short interest is considered to be healthy with 2.91% of the float being sold short. The stock has drifted lower by 11.08% from its open following the earnings release. Option traders are pricing in a 7.0% move on earnings.

super late this week, sry