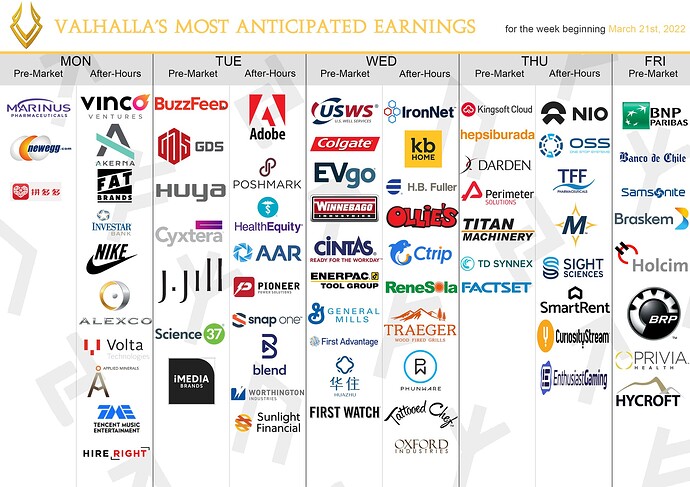

I had to run through an average of 50 companies for each day and pick out what I think were the best ones (best chance at moving either way based on previous earnings and estimates). That was a lot of work, and I could use a hand next week.

Disclaimer:

As of the 14th of MARCH, NEGG, BBIG, AMNL, PPSI, HCMLY & IRNT have not yet confirmed their earnings date.

[color=#d4a218]Marinus Pharmaceuticals $MRNS[/color]

Marinus Pharmaceuticals ($MRNS) is confirmed to report earnings at approximately 7:00AM ET on Monday 21st. The consensus estimate is for $(0.81) per share on revenue of $3.60 million by the Earnings Whisper ®. Investor sentiment going into the company’s earnings release has 57.1% expecting an earnings beat. Short interest has decreased by 30% since the company’s last earnings release while the stock has drifted lower by 40% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. It is notable that this past quarter institutional holding has decreased by 30%. Option traders are pricing in a 32.9% move on earnings and the stock has averaged a 21% move in recent quarters.

[color=#d4a218]HireRight $HRT[/color]

HireRight $HRT is confirmed to report earnings at approximately 4:05PM ET on Monday 21st. The consensus estimate is of $0.08 per share and the Earnings Whisper ® number is $0.06 per share on revenue of $183.35 Mil. Investor sentiment going into the company’s earnings release has 71.4% expecting an earnings beat. Based on current Company expectations and economic conditions, HireRight is providing full-year 2021 outlook including revenue in a range of $713.0 million to $716.0 million and Adjusted EBITDA in a range of $157.0 million to $160.0 million. Short interest has decreased by 5% since the company’s last earnings release while the stock has drifted lower by 65% from its open following the earnings release. The stock is not optionable.

[color=#d4a218]NIKE $NKE[/color]

NIKE $NKE is confirmed to report earnings at approximately 4:15 PM ET on Monday 21st. The consensus estimate is for $0.73 per share on revenue of $10.62 billion by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 77% expecting an earnings beat. The company said during its conference call it expects fourth quarter revenue of approximately $10.62 billion. The current consensus revenue estimate is $10.64 billion for the quarter ending February 28, 2022. Short interest has increased by 5% since the company’s last earnings release while the stock has drifted lower by 30% from its open following the earnings release. It is important to note there has been insider selling amounting to $15 Million since their last earnings release. Option traders are pricing in a 11% move on earnings and the stock has averaged a 9.75% move in recent quarters.

[color=#d4a218]ADOBE $ADBE[/color]

ADOBE $ADBE is confirmed to report earnings at approximately 4:05 PM ET on Tuesday 22nd. The consensus estimate is for $3.34 per share on revenue of $4.24 billion by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. The current consensus estimate is earnings of $3.38 per share on revenue of $4.34 billion for the quarter ending February 28, 2022. Short interest has increased by 23% since the company’s last earnings release while the stock has drifted lower by 32% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in an 8.8% move on earnings and the stock has averaged a 4.4% move in recent quarters.

[color=#d4a218]U.S Wells Services $USWS[/color]

U.S Wells Services $USWS is confirmed to report earnings at approximately 6:30 AM ET on Wednesday 23rd. The consensus estimate is for ($0.32) per share on revenue of $46.80 Million by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 40% expecting an earnings beat. Short interest has increased by 20% since the company’s last earnings release while the stock has drifted lower by 50% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. It is important to note there has been insider selling amounting to $33 Million since their last earnings release. This stock is not optionable.

[color=#d4a218]Colgate-Palmolive Co. $CL[/color]

Colgate-Palmolive Co. $CL is confirmed to report earnings at approximately 6:55 AM ET on Wednesday 23rd. The consensus estimate is for $0.76 per share on revenue of $4.41 billion by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 71% expecting an earnings beat. Short interest has increased by 8% since the company’s last earnings release while the stock has drifted lower by 11% from its open following the earnings release. Option traders are pricing in a 4.2% move on earnings and the stock has averaged a 6.2% move in recent quarters.

[color=#d4a218]EVgo Services, LLC $ EVGO[/color]

EVgo Services, LLC $ EVGO is confirmed to report earnings at approximately 7:00 AM ET on Wednesday 23rd. The consensus estimate is for ($0.07) per share on revenue of $6.07 Million by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. The company said it expects 2021 revenue of $20.0 million to $22.0 million. The current consensus revenue estimate is $20.78 million for the year ending December 31, 2021. The stock has drifted higher by 17% from its last earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. It is important to note there has been insider buying amounting to $82 Million and selling amounting to $24 Million since their last earnings release. Option traders are pricing in a 25% move on earnings and the stock has averaged a X% move in recent quarters.

[color=#d4a218]Tattooed Chef Inc. $ TTCF[/color]

Tattooed Chef Inc. $ TTCF is confirmed to report earnings at approximately 4:05 PM ET on Wednesday 23rd. The consensus estimate is for ($0.06) per share on revenue of $51.07 Million by the Earnings Whisper ®. Investor sentiment going into the company’s earnings release has 48% expecting an earnings beat. The company said it expects 2021 revenue of $210.0 million to $215.0 million. The company’s previous guidance was revenue of $235.0 million to $242.0 million and the current consensus revenue estimate is $239.40 million for the year ending December 31, 2021. The stock has drifted lower by 30.7% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. Option traders are pricing in a 22.1% move on earnings and the stock has averaged a 16% move in recent quarters.

[color=#d4a218]NIO Inc. $NIO[/color]

NIO Inc. $NIO is confirmed to report earnings at approximately 4:30 PM ET on Thursday 24th. The consensus estimate is for a revenue of $1.55 Billion and the Earnings Whisper ®. Investor sentiment going into the company’s earnings release has 67% expecting an earnings beat. The company said it expects fourth quarter revenue of $1.455 billion to $1.568 billion. The current consensus revenue estimate is $1.69 billion for the quarter ending December 31, 2021. Short interest has decreased by 20% since the company’s last earnings release while the stock has drifted lower by 62% from its open following the earnings release. Overall earnings estimates have been revised lower since the company’s last earnings release. It is notable that between Q3 and Q4 there has been insider selling totalling of $4.976 Billion. Option traders are pricing in a 20.4% move on earnings and the stock has averaged a 7% move in recent quarters.