Walgreens Boots (WBA) is a holding company that operates three difference segments: Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical Wholesale. They operate the chain of Walgreens stores and pharmacies as well as distributing multiple different products under their brand.

On Thursday 01/06/2022, WBA will be reporting their Q1 earnings before market open.

For past earnings, WBA appears to have a $5 range of movement in the positive or negative from whatever it’s price is going into earnings. It is currently trading slightly above $52. It’s 52 week high is $57.05 which was set in 04/2021. It’s 52 week low is around $39.

WBA is currently trading around the same price it was at before the Covid crash in 03/2020, and from the charts it appears to have kinda traded mostly sideways from that time until now so it was not one that seems to have benefited much from the Covid pump over 2021.

I will probably be picking up some calls ATM and maybe one OTM around the $56 strike. If it maintains it’s current price going into earnings, then the $5 movement up would have it bouncing off it’s 52 week high price.

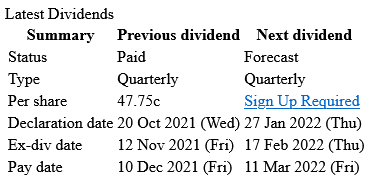

But then about a month after earnings, WBA has a dividend expiration date. And what does WBA like to do on that date? It likes to go down. So on that note, regardless if the share price goes up or down I will probably be playing puts on this sometime in February since that would correlate with the expiration date.

From my research, they like to have dividends paid out in March, June, September, and December so this makes February, May, August, and November a great time for a put play. Looking at the daily chart on dividend dates, it almost looks like guaranteed free money.

This is not financial advice. Please do your own research.