A day late with this maybe as it’s down 11% AH on yet another bad ER and some pretty heavy news, but playing ERs are risky anyway, this should (hopefully) set a trend for us tomorrow going into next week, next month, next Christmas? We’ll see, but ever since the merger this company has been dropping bad news and disappointment faster than my dignity leaving my body when ordering three Chik-Fil-A’s at the register alone.

It’s already fallen to $15.40 AH, but we should have some serious gravity on our side. Beginning of July to today pumped from $13-$17.50 with only four(count em, 4) red days. Lots of rosy promises that were effectively broken today. I know, hurr Stonks go up gotta come down etc, but that’s not even close to the only headwind for the company.

The quarterly report numbers as per Yahoo! Finance¹:

Revenue: $9.82 billion versus $11.91 billion expected

Total DTC subscribers: 1.7 million net additions versus 1.65 million net additions expected

In total, the company said it ended the second quarter with 92.1 million subscribers across its streaming platforms, up about 1.7 million from the first quarter. It expects to see 130 million global streaming subscribers by 2025.

The leadership team doubled down on the importance of high content spend, explaining that reducing churn remains the number one factor amid increased competition.

Kinda kicking myself, I honestly should have caught this one earlier, I had seen last night or the previous that a pretty damn big Batgirl film has been totally scrapped; this was a somewhat anticipated film with a budget somewhere between $75m-$90m. The reporters seem to like leaning towards $90m down the drain. Shelved, never coming out. This move was highly unusual, leaving both supporters and detractors of this project confused. A Scooby Doo holiday film in the middle of production was also tossed in the trash. The T.V. show Demimonde from J.J. Abrams that was set to debut on HBO Max is also officially scrapped. Add to the list LeBron James’ House Party which was supposed to drop on July 28th. All three were big budget projects in the middle-to-late stages of production.

Oh, and in a very strange move, at least SIX (6!) HBO MAX Originals have been removed from the app as well³. There is a show based on a hit video game called The Last of Us that is now being worried about in the media, will that get axed next?⁵ Potential catalyst, I don’t think it will, that’s generally very highly anticipated, announcements around that should be important. Not sure what they were thinking with these moves…oh wait, there’s this from newly seated CEO David Zaslav, he gave this genius remark in an article from CNBC today²:

This idea of expensive films going direct to streaming, we cannot find an economic case for it," Zaslav said. “We can’t find an economic value for it. And so we’re making a strategic shift.”

Maybe he’s right, with theatres opening it’s not such a preposterous idea, but I disagree. I think people have gotten used to streaming and would like at least the option of watching new releases on streaming. Everybody likes more choices than less. Top Gun: Maverick is a good counterpoint, (and I bet what got this guy hard for theatre releases), but of all the things in this bad report, streaming is the one that met or exceeded expectations! Then also scrapping a decidedly streaming-only TV show from a big budget director, and six existing shows with no good reason? Hmm…But wait! There’s more!

The company scrapped plans for an entire CNN+ streaming service, another confusing move given their annouced strategy and their finacial strengths and weaknesses. (Though honestly, thankfully this happened, streaming is becoming ridiculous lol)

They’ve also cut back on ‘scripted programs’ on TNT and TBS, leaning more into sports and ‘unscripted fare’ (things like 60 Minutes, Game Shows, Reality TV and the like). To me, all this says they don’t have or don’t want to spend the money to produce high quality fictional TV anywhere. It certainly doesn’t scream a newly merged company running smoothly to me. What I hear is “We can’t afford actors, directors, editors, and all the rest that goes into a high quality entertainment, but we can try to get some rights to show sports, maybe throw together some cheap game shows.”

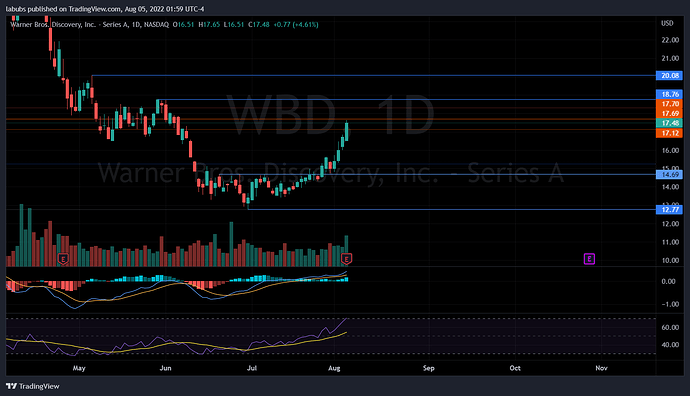

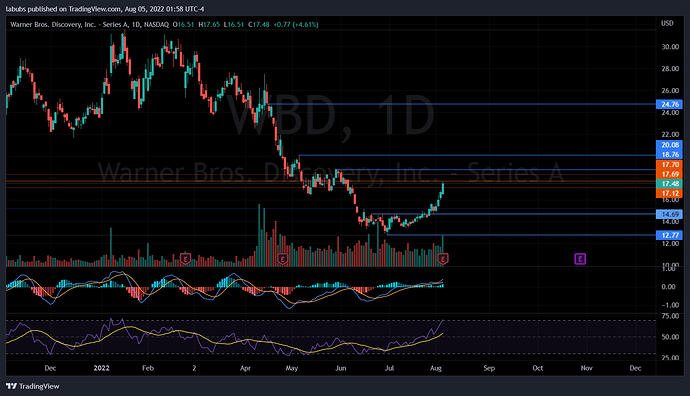

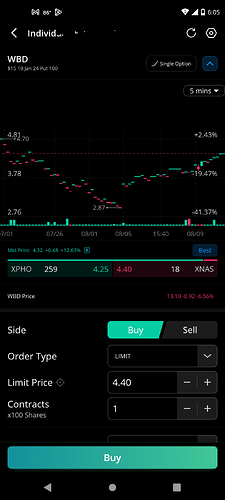

For a technical note, RSI on the daily touched oversold today, and this sharp rise is bumping up against an area of support from May on all timeframes up to weekly (also slightly with some days after the 2020 COVID drop, two in particular wicked down big but closed at this level). Weekly is kinda a cup without a handle, but I don’t think we’ll have to worry about that just yet. Will re-evaluate if we somehow get a couple weeks of consolidation.

I roughly laid out some levels based on daily closes and/or clusters. Dark Blue is recent/2022, Very Opaque Orange is the COVID wicks, the last time the chart was at this level. Only on here to show that visually. Edit- I should have drawn the AH price on the daily charts, though for those not on TV it is there as a default showing bid. It’s the Dark Blue dotted full screen line at $15.40, it just doesn’t paint a price.

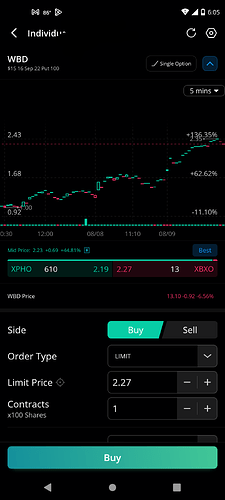

Dailies, the first is zoomed in from May til now, the second is all of 2022. Note RSI juuuust barely touching oversold, and MACD feels like it wants to flip red…(please chime in on anything else you may notice looking at the charts yourselves, this is the most basic of the basic as it’s 2am now lol)

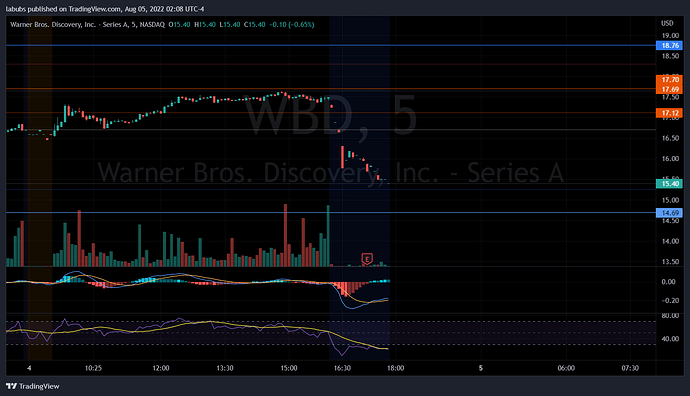

Here is the 5m from today, there was some higher than usualy volume in morning and afternoon, with AH gap down…RSI etc is obviously showing overbought, so definitely not gonna rush into anything til there’s a confirmation of trend.

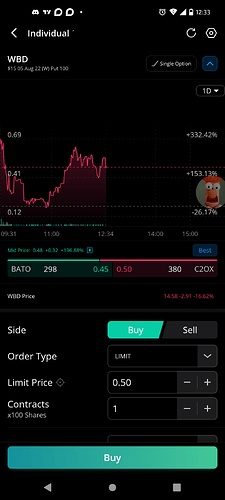

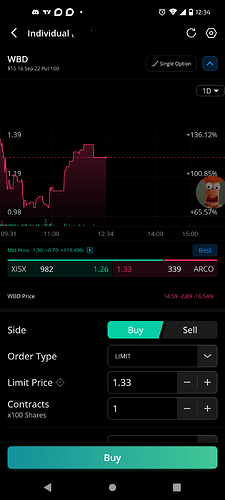

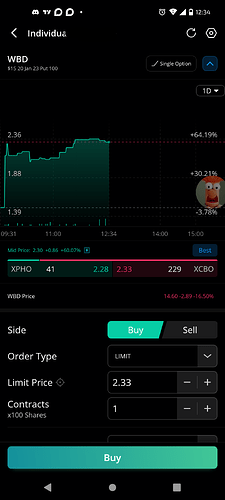

Options aren’t very expensive on this one at all, (as of close 8-4) sub $2 for ITM Sep. 17.5p, but trades in 2.50 increments. The puts obviously are looking a little sad on the chain currently, though tomorrow will change that (sadly for entries, hopefully there’s a pop back above $16 for an hour or day or two hah).

Top of the breakout range is around 14.50, so I’d imagine the 15p would probably get the most OI tomorrow and going forward followed by the 12.5p, I’m not sure on the 12.5p for now, as that low has not yet been created (I only consider staying away for now because the breakout range daily wick low is 12.77, and as mentioned a minute ago the safer ITM September 17.5s were less than $2 (ehh, well, at close, we’ll see what an 11% AH drop brings them to. The 15s will most likely be around there instead…maybe the 12.5s will have to be the way to go after all. We’ll see if thers any pullback).

Gonna keep an eye on this for a few days, see if it continues to straight drill or retraces and goes for a double top first. Nothing below to bounce off of, though if the market stays up it may get pulled along. Not 100% on that yet, literally just thought of this potential play three hours ago, so I need to see how it reacts to overall changes (this is part of SPY).

There are some better looking plays tomorrow 8-5 (I plan to look at YELP and/or DASH after reading JB’s post), though as for WBD I really don’t see where it might find a bounce in this ~ 1-2 dollar range though, there is nothing below til 14.50 even going back a few years, and the support there is only around a week or two’s worth. Hitting that sub-$13 may actually come very soon if the momentum continues (tomorrow? ![]() I don’t know, that may be too dramatic a move. Should be some retracements…). AH alone brought it to $15.40, we’ll see what happens in PM. Also not discounting calls off potential bounces from those levels, though if we fall through 12.75 things could get interesting. Hopefully there’s still some juice to be squeezed here, after reading this CEO’s quotes and plans, I do think there should be.

I don’t know, that may be too dramatic a move. Should be some retracements…). AH alone brought it to $15.40, we’ll see what happens in PM. Also not discounting calls off potential bounces from those levels, though if we fall through 12.75 things could get interesting. Hopefully there’s still some juice to be squeezed here, after reading this CEO’s quotes and plans, I do think there should be.

Footnotes/References

-

Yahoo Finance: Warner Bros. Discovery sinks on $3.42 billion loss, HBO Max restructuring plan revealed

-

/Popculture.com (Video Ad Warning, annoying loud autoplay):

HBO MAX Just Axed Six Titles

4.See #3

- Comicbook.com (shutup) Opinion Piece

/https://comicbook.com/gaming/news/the-last-of-us-tv-show-hbo-max-canceled-concerns-playstation/

Relevant Links (will update as needed):

Hollywood Reporter going for a positive spin on today’s report:

/Warner Bros. Discovery First Earnings Report as Combined Company

AdAge, from May 15…shows that the merger stumbled out of the gate, and the focus on ‘unscripted’ media was already being tossed around:

WARNER BROS. DISCOVERY HEAVILY PLUGS UNSCRIPTED IN ITS FIRST UPFRONT

Well, this ended up being a lot more than I expected, jeez, ya see one video on YouTube about $90m being burned haha…there’s honestly probably a lot more to be dug up, but it is 2am here, so I’m gonna call it here ![]() Will be watching a few tickers in the morning tomorrow, but this company now seems woefully misled, and should be interesting to follow. If anyone is familiar with WBD please do post!

Will be watching a few tickers in the morning tomorrow, but this company now seems woefully misled, and should be interesting to follow. If anyone is familiar with WBD please do post!

Really interested to see if they manage to break 12.50, if the price does get down there and the action looks playable, I would probaly start opening straddles/strangles to hedge that level. Beyond the very recent and a few dips in the past, there really isn’t anything below since 2009. Feel free to chime in with thoughts or constructive criticisms (except that the day to buy was yesterday, that one I already know ![]() …let’s see what we can get from this going forward, in both directions over time)

…let’s see what we can get from this going forward, in both directions over time)