Share unlocks have the potential to be crazy profitable if played correctly and I’m thinking I need to create a main thread covering all upcoming IPO share unlocks (unless we already have that somewhere I’m not seeing). In regards to WEBR there is a significant share unlock next Tuesday 2/1. They IPOed around 14 and after a brief spike to 20 have done nothing but trade down since. On the first 18 million shares are unlocked and I personally do not see why it wont fall further unless there is a huge market rally next week. On the technical side it has support in the mid 10 range and this very well could be its floor but I’m betting it has more room to fall. Their earnings are not until 3/9 and until then I do not see any upcoming catalysts on the positive side. I personally am playing the 2/18 12.5p and 10p. At the time Im typing this you can get a 10p at 0.7 which IMO is worth a gamble sized position. With share unlocks the price usually doesnt drop huge the fist day of unlock so be patient and look for a good entry if you decide to take one. All insight is welcome and appreciated. Cheers.

Can you post the SEC fillings that contain the holdings and the unlock dates please. On a quick glance at openinsider.com we see that there was a handful of sales in august of 21, which can be indicative that insiders are not bullish on the company long term. If we were to see clustered buying it would indicate that the unlock would not drive the price down. However, since we see no insider purchases and only sales it is possible that this could be a play given more information.

I thumbed through the earnings reports on their website but they do not distinguish what categories of product the revenue comes from. Is it mainly from grill sales or accessories? How has entering the pellet smoker space changed revenue? I have a Weber Genesis that I bought in June 2012, only difference now is there is some patina on the stainless and I’ve had to replace the “flavorizer” bars once and the cover once… So in my case I am a 4 figure spend customer a decade ago and they have gotten about 10% more spend out of me in that time.

My personal feel is that this will eventually flatten and find a price and basically trade sideways forever.

Sorry on my phone at work right now and not sure how to link the SEC filings. When I get to my computer later ill attach them. But the most recent filings I found were sells from the COO, president, and CAO (nothing significant) at the end of 2021 (probably for tax reasons Im guessing). Before that however it looks like they exercised their warrants to obtain shares. I agree with Behemoth, I’m guessing they flatten out and trade sideways but im basing this play purely off the unlock next week. They make a great grill and with COVID their sales were up quite a bit but that may change now that people are much more comfortable leaving their houses to get food but that’s more for an earnings play in the future.

There was a huge amount of camping-related buying with COVID driving people to seek out lots of activities away from people. Given the previous comment from Behemoth about spending habits, I think that the buy-once-every-few-years customer is pretty standard, and likely a large majority of new customers who were going to make that purchase have already done so between the last two summers. Unless they start expanding their market by, for example, supplying directly to RV manufacturers to include in travel trailers from the factory (they did release an RV-specific grill last year but as far as I can tell it’s aftermarket and not standard equipment on any), I don’t see their demand increasing in the medium term. I’m not in this play but may change my mind on Monday morning.

This is a great idea.

Similarly the despac puts have been generally reliable.

IPO share unlock puts might also be a reliable play.

Not sure how best to find and consolidate the key dates and info of all the IPOs though. I’ll see if I can dig something up this weekend.

I’ve been tracking the IPO share unlocks on market beat. Their lay out is the best I’ve found. But yeah I agree the despac put plays have been great lately as well. I’ve been wanting to put together an easy to read forum with upcoming dates for share unlocks (both IPO and despac) so we can start conversations weeks ahead of time. Share unlocks don’t always have big price swings but if we can at least have them on our radar we can potentially target those who we think will have the best probability to drop or not. Especially if the market downtrend continues, I’m thinking the share unlocks could potentially drop prices even more than in normal conditions but that could just be wishful thinking.

This stock has some following due to its high short interest.

Interesting though somebody posted a bear case on r/shortsqueeze never seen a bear case posted before on that sub.

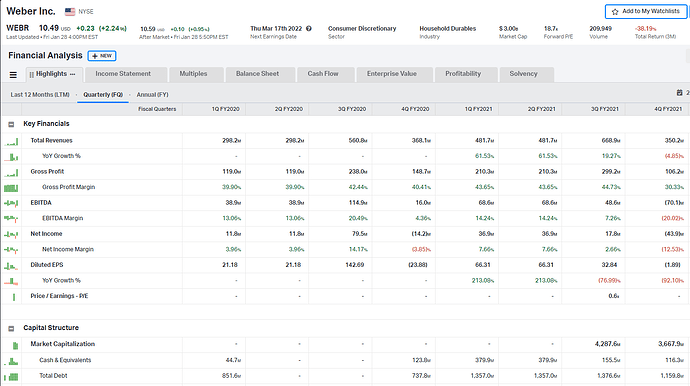

[size=4]Curious Valuation?[/size]

Marketcap: 3B

P/E: 63.12 — is this normal…?? They’re an American manufacturer of charcoal, gas, and electric outdoor grills with related accessories. Why such a high P/E of 63?

2021 Revenue: 2B

Cash: 116M

Debt: 1.16B

In Q4 2021 they had a really shitty quarter with gross profits at around half or a third of Q1 Q2 Q3, and a negative 70.1M EBITDA. Q4 2021 was the first time they reported negative EBITDA in the last eight quarters. It looks like it was associated with the IPO.

Q4 ER Press Release on December 8, 2021.

Net income decreased 94%, to $6 million, or 0.3% of net sales, compared to $89 million, or 5.8% of net sales in the prior year, primarily reflecting the non-cash, stock-based-compensation charge associated with the August 2021 IPO. Adjusted net income increased 28%, to $161 million, or 8.1% of net sales, compared to $126 million, or 8.3% of net sales in the prior year.

Market reaction to the Press Release:

[size=4]SEC Filing Shares Unlock[/size]

DISCLAIMER: I am not savvy at reading SEC filings, but I decided to shoot my shot.

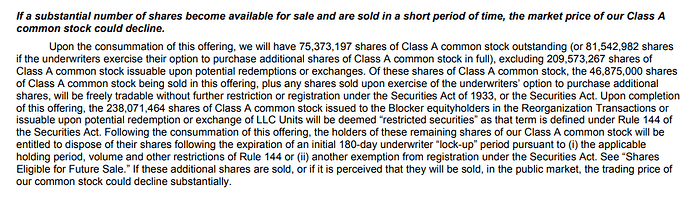

SEC Filing S-1/A on July 27, 2021.

On page 73 of the filing under Risks Related to This Offering and Ownership of Our Class A Common Stock, I found the following:

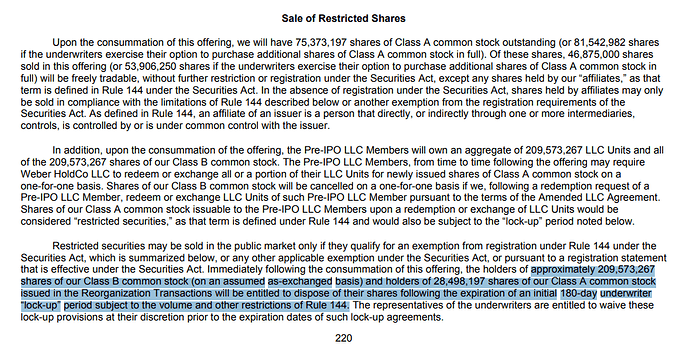

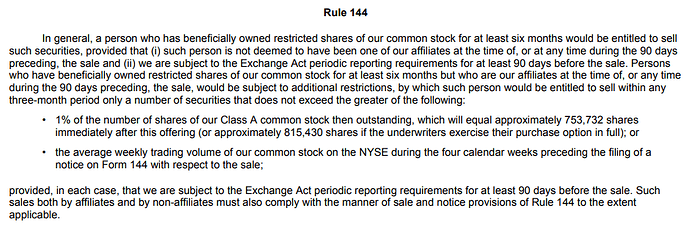

and on page 220, Sale of Restricted Shares:

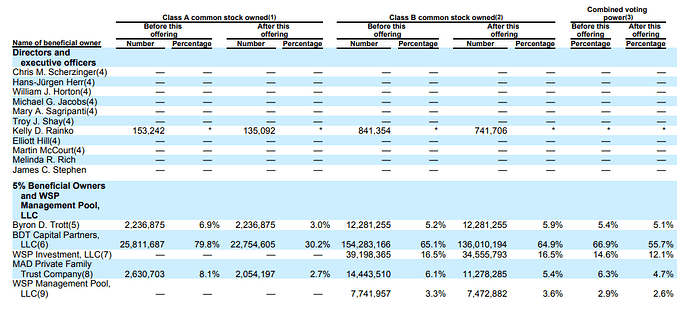

The paragraphs appear to say that 238,071,464 shares will be unlocked on February 1, 2022, as WEBR IPO’d on August 4, 2021, and 180 days after that is January 31, 2022.

However, I don’t think all of the shares will be free to sell at once. The sales are subject to Rule 144.

Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates at the time of, or any time during the 90 days preceding, the sale, would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of the following:

- 1% of the number of shares of our Class A common stock then outstanding, which will equal approximately 753,732 shares immediately after this offering (or approximately 815,430 shares if the underwriters exercise their purchase option in full); or

- the average weekly trading volume of our common stock on the NYSE during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale;

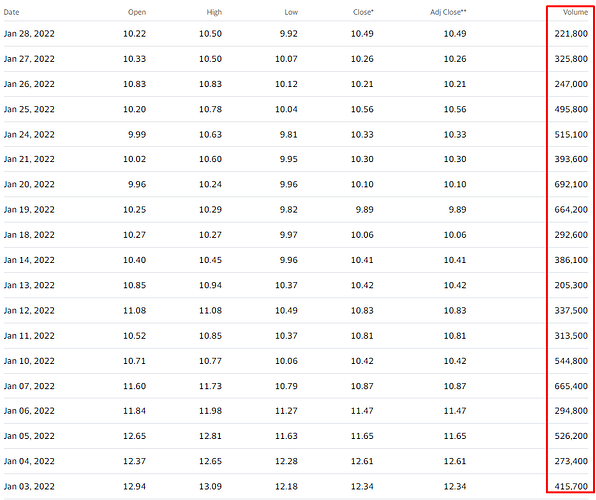

Each underwriter is restricted in their selling by the above noted factors. I am not sure how to calculate the average weekly trading volume aside from manually doing it myself, but the daily trading volume is ~300k to ~700k. Taking a rough average of 500k, 500k x 5 trading days in a week = 2.5M weekly volume.

So each underwriter can maybe sell ~750k to 2.5M shares in a 3 month period. How many underwriters are there? Based on page 207 I think there are 6 of them, but I am not 100% sure that I’m looking at the right place.

But if I am correct, then the maximum selling pressure on February 1 within a 3 month period based on Rule 144 could be approximately calculated as follows:

- 6 x 750k = 4.5M shares

- 6 x 2.5M = 15M shares

Remember that Rule 144 is based on the ‘greater of’ the two numbers, and my weekly trading volume calculation is super rough. Either way, it looks like on February 1, we have an immediate potential selling pressure of 4.5M to 15M shares. Based on a recent daily trading volume of 300k to 700k, the unlocked selling pressure does look pretty heavy.

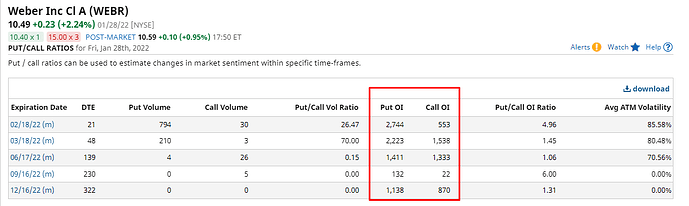

[size=4]Options Activity[/size]

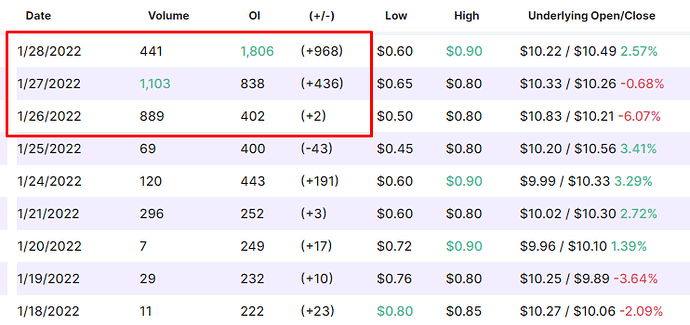

Nice call/put ratio here to the downside, especially for the February expiry. I think others are all thinking the same thing with this shares unlock.

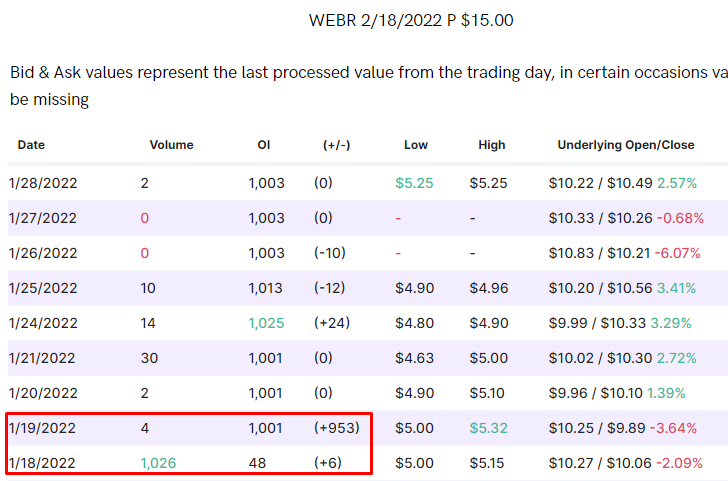

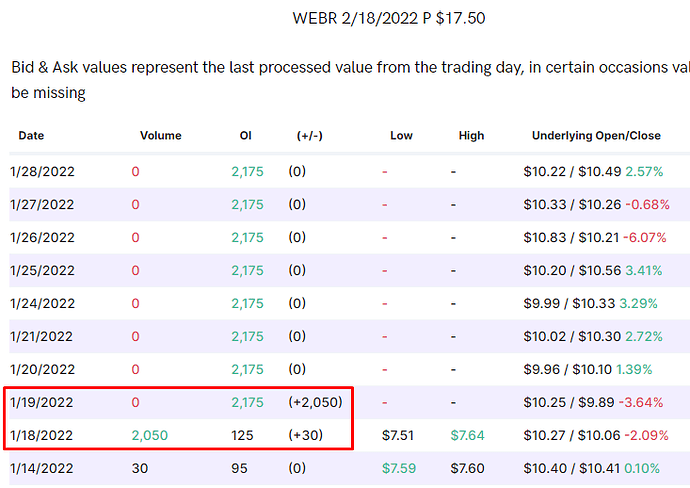

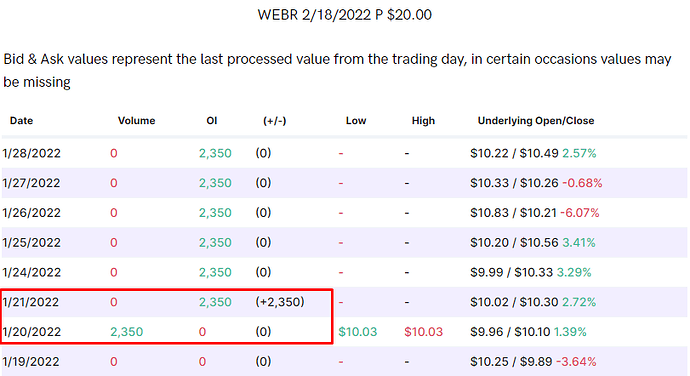

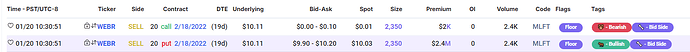

Kinda interesting that the deep ITM puts OI all got opened at around the same time. Based on the size of the few transactions this looks like a few Floor traders.

15p was largely opened on January 18.

17.5p was largely opened on January 19.

20p was largely opened on January 20.

Looking back in time, UW only allows you to see significant size flows. Can someone explain this? I assume that the 20p is a BTO and not a STO despite the UW tag and based on the price of the underlying and overall downtrend of the stock, but why the calls…???

Someone also did the same for the 15 strike…

And then 10p was opened largely on January 26 and 27.

[size=6]tl;dr please[/size]

- The valuation is curious on the high side.

- Around 4.5M to 15M shares are unlocked to sell on February 1, not 200M+ (but note that daily volumes are 300k to 700k, so this is still hefty sell pressure).

- Last week specifically, it looks like traders have been loading the puts in anticipation of the share unlock. Edit: actually apparently those large flows are synthetic longs or part of some straddle, but the strikes of the straddles still seem weird to me.

- I’m buying 10p and maybe 7.5p on Monday. Undecided between February or March.

[size=4]DISCLAIMER: I am not savvy at reading SEC filings, but I decided to shoot my shot.[/size]

I‘m trying my luck with March 10p‘s

Great job with this. I’ll be playing.

DISCLAIMER: I am a former Weber-Stephens employee.

Weber is a company that doesn’t have a lot of good things going for them. I was a part of the team in 2019-2020 that developed their Smokefire pellet grill from the culinary applications side and at the time it was touted as the next big thing for their future. It turned out that a grill company has no business getting into IoT appliances, who knew? Not only was the pellet smoker a huge failure from the beginning due to production and assembly issues, public opinion, and supply issues even before the pandemic, the concept of a grill you had to update for 4-6 hours through a wifi connection before you could use it just wasn’t worth thousands of dollars to their >45yr old consumer base. As a result their image took a massive hit, followed by them offering buybacks of all of their stock to retailers and discontinuing production during the pandemic. The new version launched with a new SKU to avoid being tied to the bad press of the first, but still flopped due to (again) software issues.

Weber has been pushing their iGrill products harder after that failure, to seemingly no avail. The company has little in the way of innovation or novelty coming down the line for them, their idea to implement a “Grill Academy” experience wherein you would come to a showroom or restaurant and learn about the best practices of grilling was another failure that I was well paid to participate in. Weber owns a handful of restaurants in Chicagoland, St Louis, and Indianapolis that were the test sites for these '“dinner and a show” hands on classes, unfortunately the pandemic hit a month after the classes were supposedly expanding nationwide and everything had to be scrapped. As a result, my time with Weber Stephens ended and I have only kept in touch with one fellow consultant after they had significant turnover. This is an old school family owned company that is only surviving on their reliance on an aging consumer base that doesn’t really need to buy another cast iron skillet attachment for their propane grill.

I remain, as ever, bearish on Weber.

Does the fact that webr is trading far below its ipo price have any bearing on this not dumping at unlock?

Wow that’s all pretty eye-openingly bearish and bleak sounding for the company. Thank you for your insights.

Hell of a job sifting through all that Kevin.

As for price being below IPO, some investors might not wanna sell immediately, but this company is looking like a dumpster fire and a lot of them might just want out.

Nice work by all above. I’d say this in turn presents two opportunities one with share unlock and one with upcoming earnings. If unlocked shares are dumped could foreshadow soft earnings coming as well.

In response to a couple people above, one minor thing to note is that I’ve been reading that people are cooking more at home and eating out less due to inflation and trying to save some money.

Grill sales are usually pretty low during winter time, but depending on how things are going with food costs for people and supply chain issues for weber, there could be a little uptick in sales this spring / summer. But that is something to think about come earnings this fall…

That number does coincide with my super roughly calculated number.

Where’s that screenshot from? Does it show all IPO unlocks from various tickers in a nice table?