Introduction

Hey Bull Gang, hope you all managed to survive last week. $SPY literally moved more than 10$ every single day, leading to some nutty trading conditions. I have no idea why the indices are moving like meme stocks, but the volatility is nuts. To everyone’s relief, big tech reported stellar earnings last week, and had some relatively healthy moves. I feel much safer rolling the dice on some plays this week as a result. Let’s get into it!

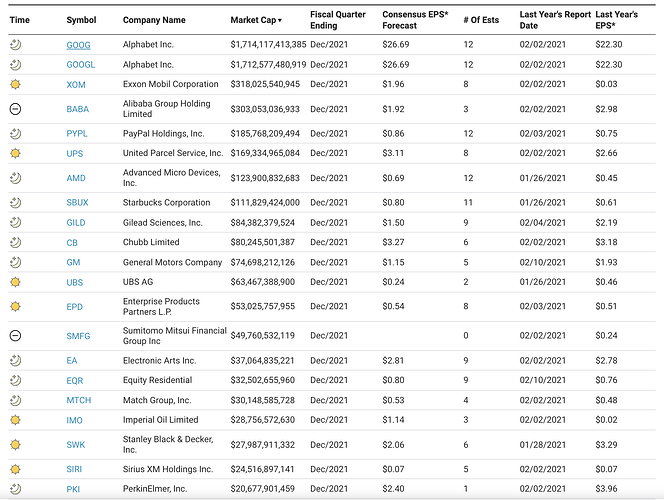

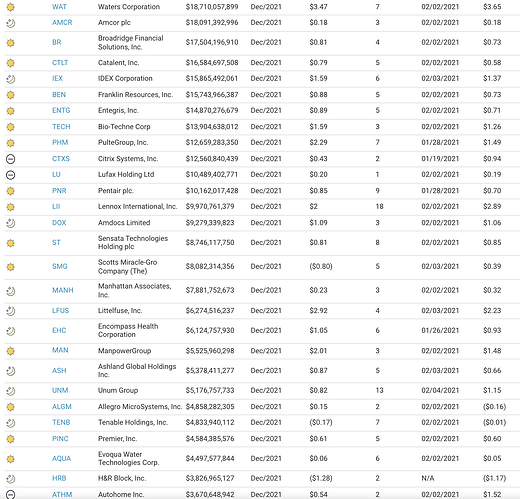

The Spreadsheet

To aid us in planning our trades this week, I’ve compiled a spreadsheet consisting of all of the Historical Post Earnings Moves of EVERY stock reporting earnings this week. Using this spreadsheet, we can determine which options to buy or sell to minimize risk and maximize probability for ANY given ticker. Obviously, past performance isn’t indicative of future success, but we can still use these numbers to gain a general idea of the expected earnings move of a given stock. Gone are the days of getting randomly blown out due to lack of information! If you’re struggling to find a given stock, click on the ticker symbol on the index page, it should hyperlink you straight to the table! If the above link isn’t working for you, refer to this link instead!

Interesting Observations and Sample Plays

Below I’ve compiled some interesting observations which can further aid us in making trades this week, alongside some sample plays for those who are new to playing earnings and need some guidance. If I missed anything, feel free to bring it to my attention!

- At the time of writing, almost EVERYTHING is inefficiently priced. Sell side reigns supreme. If you’re planning on making earnings gambles, consider selling options instead of buying them. Volatility is extremely high right now, and as result options are extremely expensive. We haven’t seen any abnormal moves come out of any companies these past three weeks, and there’s little reason for this week to be different. Instead of buying options to gamble with, sell them to the degenerate gamblers instead and collect some overinflated premiums. For each reporting company, almost every single priced move is significantly larger than the historical move. For more information on pricing inefficiencies, check out this article.

- Our free money glitch has finally been patched. $SNAP is efficiently priced. To those unaware, for the past four quarters, Snapchat options have been disgustingly cheap relative to the stocks historical move, allowing us to buy straddles and double our money consistently. MMs have finally clued in and jacked the prices up, meaning we’re sadly out of luck. Options are pricing in a move of 17%, while the historical move is around 18%. That being said, not all hope is lost. Since $SNAP reports Thursday after hours, if the market starts moving upwards and $VIX gets crushed, the combination of theta expansion and vega reduction may make these options cheap again, so be on the lookout for that - If the options end up pricing a move of less than 10%, buy straddles. If IV remains jacked up, you can look to sell the 23P for around 50$ a pop. You’ll keep your money so long as $SNAP stays above 22.50, meaning your covered for a move of nearly 30%.

- $PENN and $DKNG provide us with a collateral play opportunity. Pretty straightforward play this time around - if you’re bullish or bearish on either company, you should look to enter a $DKNG position before $PENN reports earnings on Thursday. Since $PENN and $DKNG are extremely similar companies within the same sector, the $PENN report will likely move $DKNG an equivalent amount as the market prices in a similar report from the similar company. By playing $DKNG instead of $PENN, we wont get IV crushed post ER AND IV will inflate if the move goes against us, shielding some of our losses. By playing $PENN directly, we run he risk of getting IV crushed, or having a move go against us. This was just a crude summary, but I hope you all got the idea. If you wish to learn more about this type of trade, check out my writeup on collateral plays here.

Summary and Conclusion

Stay safe out there everyone! With volatility high, and options prices even higher, this week will prove to be extremely gnarly. That being said, use the spreadsheet to determine which stocks offer the best risk to reward ratio, and play accordingly! If the sheet has helped you out in any way, please consider dropping an upvote or a comment, it would mean a lot to me! If you want access to more trading tools, have any specific questions or observations you’d like to share with the community, feel free to check out the community links in the spreadsheet. Happy Trading!

Disclaimer : This is my first post here on the forums, and I ported it over directly from my blog. If this is against the community rules, feel free to let me know and I’ll look to edit the content to make it more unique. Cheers everyone.