I wanted to start this thread and hopefully @PaperhandsJB and @TheMadBeaker can put their feedback in as well along with anyone else to share ideas.

JB Beak and myself were tagged to share what we look for in Post ER plays. So I am counting on everyone to scour these things going forward to help out. It’s a lot of data to digest in short amount of time especially premarket.

So there is a multitude of data that comes with these drops. Some big some small. I’ll try to share a few examples as well here with most recents that are fresh on everyone’s mind.

1:) First thing is EPS or earnings per share. Earnings whisperer has this information at no charge listed for every ticker reporting on their estimates. I tend to use HOOD as much as it sucks and I don’t trade there the estimated EPS is listed on every ticker along with their earnings date. Also shows the previous quarters. This shows me a lot of times if they are forecasting higher EPS than previous quarter. This shows growth or slowing.

EPS beat bullish EPS miss bearish.

2:) Revenue this is also foreshadowed on earnings whisperer. This to me has seemingly been a big one the last few quarters. Some may miss EPS but show revenue growth. @TheMadBeaker shares this on his spreadsheet in the earnings thread and updates as they post. Ultimately this is what I tend to look at hardest. If growth is good especially in current times that’s major bullish. If it’s slowing it may signal bad news.

3:) Guidance most companies issue guidance as it pertains to the following quarters estimates above. This can largely be the most important thing that comes from the print. Example FDX front running their earnings and adjusting guidance and they crashed same with SNAP awhile back. These same types of remarks come on their calls to their investors. Maybe not as impactful as those two but they do make a difference.

4:) if the company sells some kind of product or service I like to look at sales numbers. We’re they up ? We’re they down ? If down and revenue is down bad combo.

5:) Share buybacks. These are almost always announced to their investors on earnings calls. This is typically bullish as fuck. Especially depending on the size as we saw LMT today. Think of it as reverse dilution.

I often read the press releases and the SEC filings premarket from the earnings that reported. Usually will try to share the bullet points of this on the earnings thread.

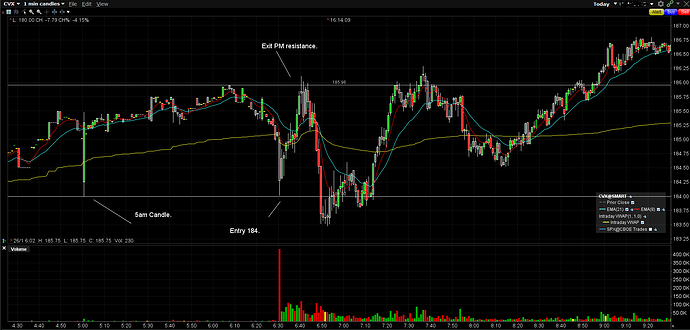

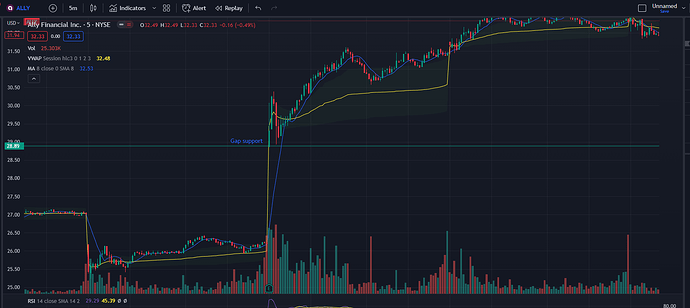

Now on to what to look for when you decide to play one. I know I’ve mentioned this before but I’ll put here again. I always always watch premarket for divergence from SPY or SPX if it’s drilling and SPY is going up that’s a pretty solid puts play most likely. If it’s going up or holding off to SPY drop it’s likely really bullish. These aren’t full proof but when they work they work big.

Have seen multiple 3-400 percent plays and some as much as 40x plays. Some you can be in for 10 minutes ar open and be up 2-300 percent.

I typically try to capitalize on the IV crush near open and any kind of a dip to support to try to get cheap fills.

Hopefully this is helpful to those that asked or were curious. I know Beak and JB can share some more insight on this.