This thread is for general discussion and analysis of the listed commodity.

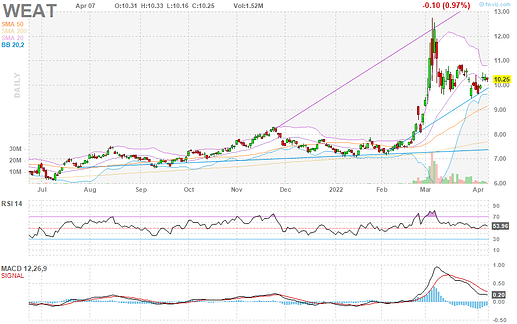

What’s the thesis behind buying into WEAT again? Still thinking the war could be a catalysts or something else?

Continued price increases from lackluster crops and fear. A lot of “starvation imminent” from the media at the moment. Being mindful to keep the position sizing smaller this time and cut quicker.

Also with oil prices going up, that causes a bunch of increase to the cost of most food goods (transportation l, harvesting, manufacturing, etc)

I tossed a bid in on $9 Call 4/14 @ 1.65 - will see if it fills

https://vm.tiktok.com/ZTdPor6a4/

Seen this on tik tok. Guy seems pretty intelligent and explains the situation quick as fast asf boyyyyy

Looking into sympathy tickers- off road tire manufacturers for the tractors etc. CAT and DE are the big ones, and there’s a very low volume one that’s slightly interesting, TWI. Might’ve missed it as it did gap up today. But it’s an idea, it feels like commodities and their ETFs are underperforming and/or near ATH, so I figure we could look at who supplies the needed equipment

Shared with beaker this morning, good read updated weekly

Got filled on the 1.65 - planning to sell for 1.85 @ open - profit is profit

From Wall Street Journal:

In Egypt, the government said the Ukraine crisis would add about $1 billion to the cost of subsidizing bread, and it is seeking new suppliers. The government introduced price controls on unsubsidized bread to halt a sharp increase. https://on.wsj.com/3wvdL0y https://twitter.com/WSJ/status/1506355073798049799/photo/1

Found this tool where you can check OI on futures for different commodities.

https://www.cmegroup.com/tools-information/quikstrike/open-interest-heatmap.html

Found this thread very informative. It’s specific to the UK, but the conclusions probably apply across large parts of the globe.

https://twitter.com/MikeNeaverson/status/1506396924022509569

Summary:

- Fertilizer prices have gone up 4x

- Wheat prices have gone up 2x

- There are diminishing marginal returns to fertilizer usage - doubling the amount of fertilizer may increase yield by 50% for the first doubling, and only by 25% for the second doubling

- Farmers, as rational economic actors, will attempt to maximize profits

- This will involve using less fertilizer, which will result in lower yields, but still make the farmer a pretty penny given expected wheat prices

- He anticipates a fall in yield by up to 5%

For poorer countries where labor is cheap and agriculture is more labor intensive, fertilizer is a larger component of crop production. The implications of this fertilizer-wheat dynamic might therefore be even more dire for developing countries, both in terms of yield produced as a farmer and price paid as a consumer.

I’m not exactly sure where to put this, but I’ll start it here and see if I can cross link it to the Ukraine Invasion Plays and Beyond WEAT and CORN topics, but apparently on TD Ameritrade, currently

wheat futures (/KE)

soybean oil futures (/ZL)

and oil (/CL) weekly call options are set to closing only

tomorrow at 12 EDT the World Agricultural Supply and Demand Estimates (WASDE) report is going to be released. Also, the briefing will be livestreamed for the first time per below:

On April 8, the Secretary of Agriculture briefings on World Agricultural Supply and Demand Estimates (WASDE) report and the Crop Production report will be livestreamed for the first time at 12:05 pm EDT on USDA’s National Agricultural Statistics Service (NASS) https://www.youtube.com/usdanass

Heres the link WASDE Report | USDA - should be available here tomorrow

Most people in Valhalla probably don’t trade futures, but for those that do I thought this was worth calling out. I’ll see if I can get more information and add to this post. Tagging with weat #soyb uso.

This sounds like something we can take advantage of by trading a non-futures ticker as well? No need for futures trading. Did anyone figure out the correct ticker for wheat? We wanted soft wheat, not hard heat. Or was it the other way around? LOL

Haha, yes I think WEAT itself should still be tradeable. Going to try to check with TDA shortly to confirm no impacts on the regular non-futures tickers. I was actually tracking WEAT earlier this week and was looking at some calls now that it seems to have consolidated a bit so I’ll want to make sure that I, and others can do so.

Thanks for flagging this, @khalidad - could get interesting.

WEAT, USO and DBC have been consolidating since the invasion-related spike, though CORN and UNG don’t seem to have gotten the message. (Or more likely are telling us something different.) Breakout for the first three potentially in the works?

Wait there was some DD posted in here before about how WEAT is the wrong wheat ticker because we wanted soft wheat, or hard wheat. WEAT is one of those. We want the other one.

Today coincidentally I took DBC 05/20 27c. Hope this report serves as a good catalyst.

Started looking into that @Kevin (e- meant to reply to your post to tag you), stumbled onto this SA article which made me search for CBOT/KCBT, which led to this in the old thread posted by @snoodking1 . Looks like WEAT tracks CBOT, the Chicago based futures.

Dropping another relevant article that popped up, could be useful

Quick update - hard red winter wheat is /KE which is set to closing only.

![]()