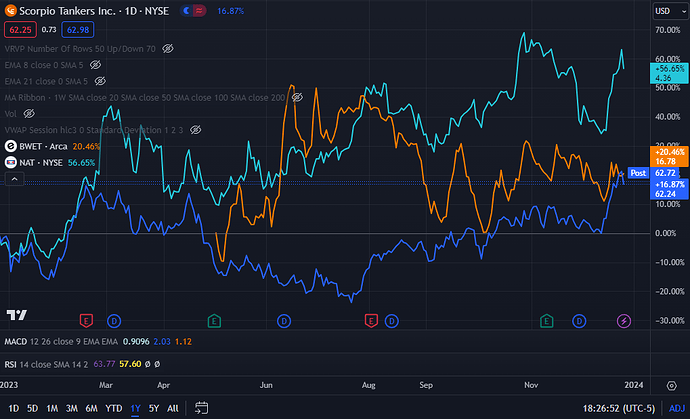

There is a good chance 2024 treats oil tankers well - both crrude tankers, and product tankers.

Reasons:

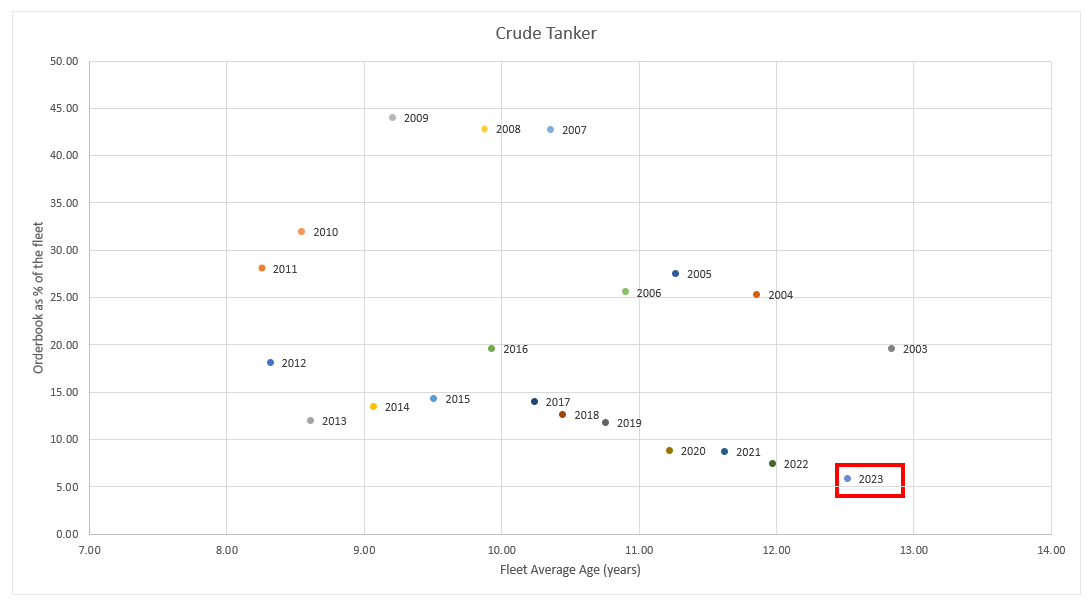

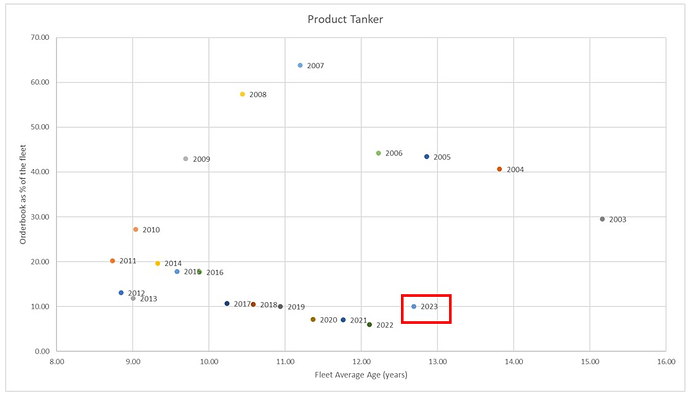

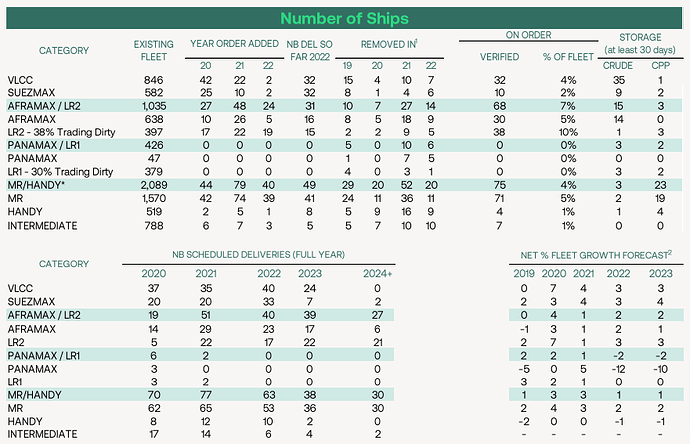

- The tanker fleet is getting quite old, but the orderbook is historically low levels. (Images 1, 2 and 3) A lot of the old ships that were supposed to be scrapped became part of the dark fleet that operated to circumvent sanctions on Russia. They are increasingly on their last legs.

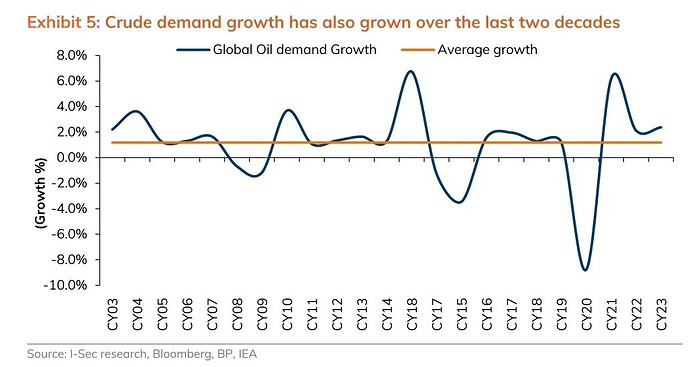

- Global oil demand is still growing, despite ESG efforts. Mostly because developing countries have rapidly growing energy needs that can only be met with significant contribution from fossil fuels. (Image 4) Most crude oil transport is seaborne, so demand for tankers is likely to increase.

- Saudis have artificually kept supply low by at least 1 mbpd for a few months now. Almost 2, if you believe OPEC+ is cooperating with their cuts too. If these self-imposed limits go away, more oil will hit the waters immediately, also increasing the demand for tankers.

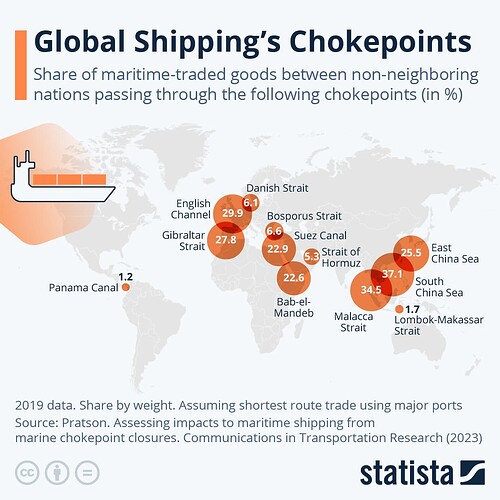

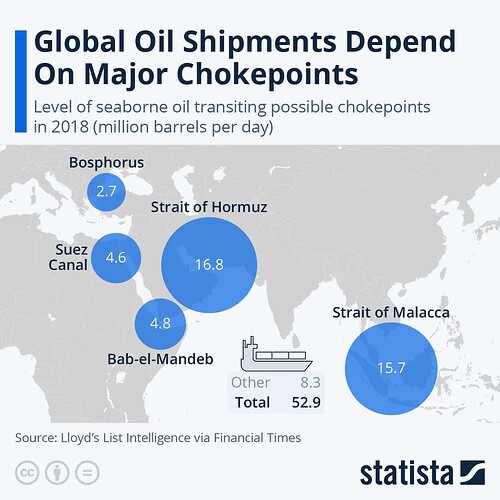

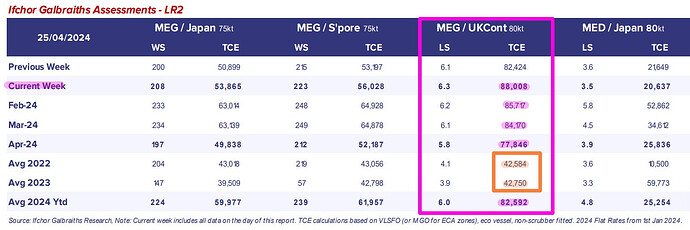

- If the Suez Canal is significantly disrupted, it can make oil fright rates skyrocket, given current oil traffic patterns.

1-3 make 2024 and 2025 look quite bullish for tankers in general; 4 has to potential to make this combustive.

The main risk is that global oil demand actually does fall, either due to recessions or ESG efforts.

Tickers on my radar:

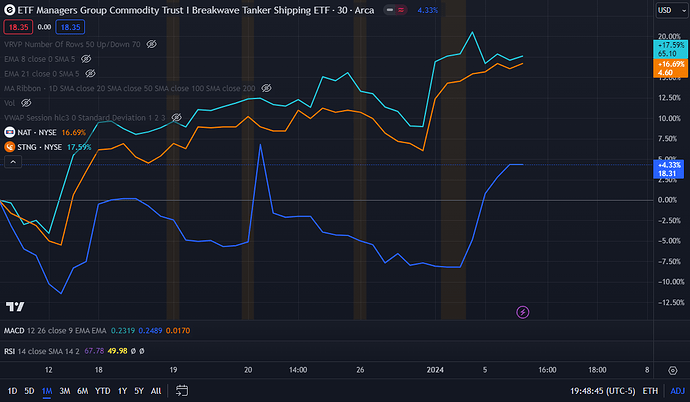

- BWET - blended crude oil fright rate tracking ETF. Bought in starter position at $16.75.

- NAT - crude tanker company with Suezmaxes only - they are designed to go through the Suez, and will likely see most disruption. However, longer voyages mean more $$, so it should not be a bad thing for the stock. Got some 1/19 call spreads for $0.10 as a speculative position. No commons yet.

- STNG - moves both crude and product, has a great balance sheet, little debt, and might do more buybacks later in the year. No positions yet.

Am expecting a pullback around Jan/Feb for the entire market, will initiate starter positions in the companies them.

Other less exciting tickers: EURN, FRO, INSW, DHT, ASC, HAFNF, TRMD

Anyone looking for an intro to this fascinating corner of the markets can check out this interview from two shipping OGs:

Images

(Source)

(Source)

(Source)