I was curious about BMBL, with their earnings coming up this week (Tuesday, 11/9, after hours), so I looked a little into them. After my digging, I am still undecided about the way I think it will play out, but I would love to get some other thoughts/discussion going.

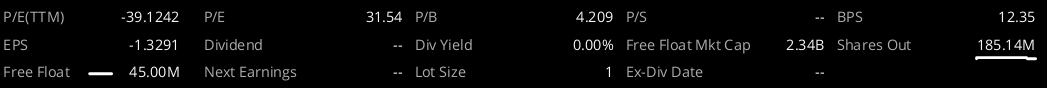

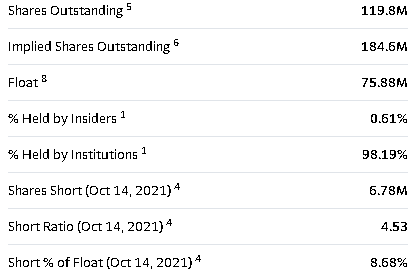

Digging into the Institutional Ownership, I found the following information:

- 97.26% of the shares are owned by institutions

- In terms of active positions, there are 252 institutional holders for a total of 116,516,000 shares, according to NASDAQ website.

- 108 of these holders increased positions by a total of 17,500,000 shares

- 104 of these holders decreased positions by a total of 43,665,000 shares

- This leaves a reduction of ~26m shares, which is ~20% reduction in holdings.

- This Yahoo finance article outlines that some of the hedge funds are dumping BMBL coming into this next ER, as well.

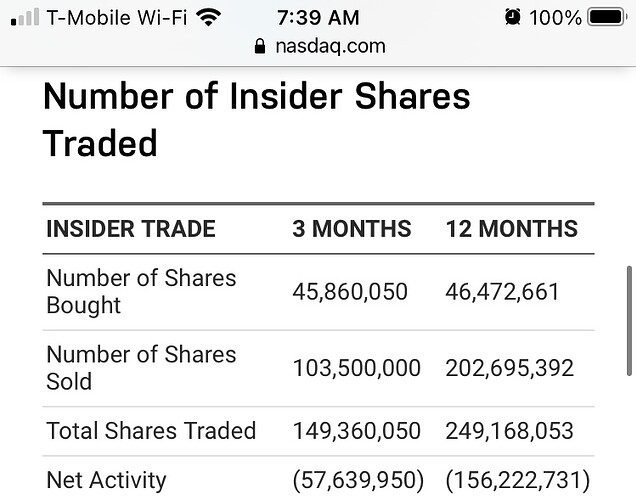

For the Insiders, we have seen a similar trend in reduction of the size of their positions:

- In the past 3 months, we have seen the number of shares held by insiders reduced by 57,639,9450 shares

- In the past 12 months, we have seen the number of shares held by insiders reduced by 156,222,731 shares.

- 0.61% of the total shares are held by insiders of the company

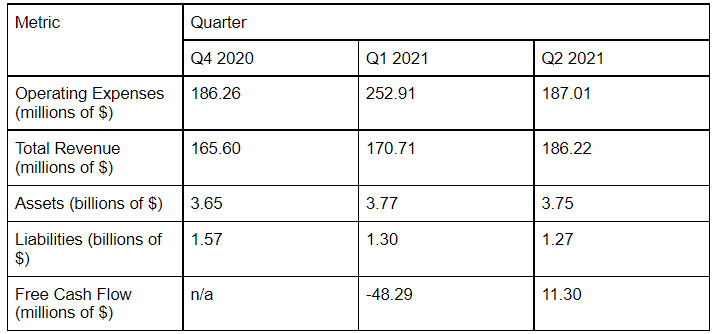

I will now provide a look into the financials of the company for the Q4 2020 until the present and a look into the earnings reports for 2021 thus far.

It can be seen that revenue has been seen to be increasing at a decent rate since Q4 2020. Along with this trend, operating expenses seemed to be following, however, the operating expenses dropped significantly from Q1 to Q2 of 2021. If these two metrics act the same this next quarter, the company could see to turn a profit. Along with this, it can be seen that the company has established a positive free cash flow this past quarter, which could be utilized in future projects. The company has a healthy assets:liabilities ratio, as well.

The earnings report for Q1 of 2021 beat expectations in revenue and EPS greatly. They obtained an actual EPS of -0.03 with an estimate of -1.69. This can be attributed to a pandemic bounce-back with downtrending cases and easing restrictions. Looking forward, there was good guidance provided, with the company having a plan for recovery going into 2021. They provided information on their BFF program and planned future monetizations, which would help to improve future revenue.

The earnings report for Q2 of 2021 missed expectations in both revenue and EPS. With an estimate of 0.0, they had a reported value of -0.06. However, this “miss” was coupled with stellar guidance going into the second half of 2021. There was heavy focus on the development and rolling out of their two-tiered subscription program. This was paired with increased subscriptions and repeat users of the app. They touched upon their BFF program once again. I will go into this later in the DD.

Despite less than stellar EPS on their ER’s, they have been historically associated with trend reversals in the charts of BMBL. This could be ascribed to the positive guidance provided by the past two conferences. The upward movement following both of the ER’s were slightly delayed and did not occur immediately afterwards. The chart below demonstrates these occurrences:

Bull Case Scenario:

- It looks like BMBL has been decreasing operating expenses, while managing to increase revenue streams. If this can continue, I believe that financially they can look better.

- BMBL has provided substantial guidance in their future actions the past two ER’s; they could do this again, and this could be a reason for a bullish movement out of the ER.

- I can see this guidance coming in the form of more information on their BFF program.

- The Bumble Friend Finder (BFF) Program is Bumble’s section of the app where people can meet new friends that have similar interests.

- The CEO was very excited about this and its possible future monetization, but gave no further information besides the following:

- “This is an advertising megawatt opportunity down the road. And I don’t want to spend the time on today’s earnings call talking about the way we would approach that.”

- The CEO called the friend finding market “an explosive category” that parallels the online dating scene of 2012

- The CEO was very excited about this and its possible future monetization, but gave no further information besides the following:

- I think this BFF program works well with coming out of COVID, as well. It could serve to attract a new user-base and helps BMBL branch into new spheres untapped by competitors.

- Could bring in some college-aged students who have had trouble making friends after online classes for past 1.5years.

- Personally, I have seen a lot of underclassmen struggle with this during this semester

- Could bring in some college-aged students who have had trouble making friends after online classes for past 1.5years.

- The Bumble Friend Finder (BFF) Program is Bumble’s section of the app where people can meet new friends that have similar interests.

- BMBL fills a Niche; it is marketed as a Women’s first dating app and as a platform to find long-term relationships…. This helps distinguish them from their competition.

- Could help bring in more of the older or more responsible crowd (looking for long-term relationships)

- Women First App

- Women have to send the first message; this creates a safer space

- This could increase female usage of the app, but may hurt male usage

- Women have to send the first message; this creates a safer space

- Monetization of Badoo (adoption of the two-tiered subscription model used in Bumble)

- Badoo is the largest dating app in EU, however, its revenue model is not on par with the other dating apps.

- The CEO hinted at implementing the same system that Bumble uses to help increase revenue

- Increased Usage of Bumble in the EU

- The CEO stated the Bumble was becoming increasingly popular in the DACH (Germany, Austria, and Switzerland) region.

- Subscriptions and downloads increasing (revenue and membership)

- The CEO stated the Bumble was becoming increasingly popular in the DACH (Germany, Austria, and Switzerland) region.

Bear Case Scenario:

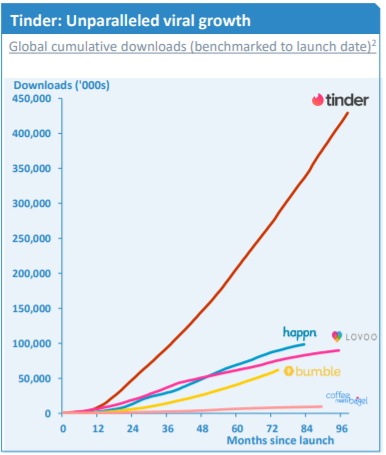

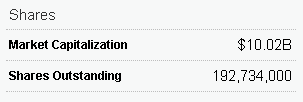

- BMBL is a company that owns two dating apps (Bumble & Badoo) and is valued at 9B USD. MTCH (BMBL’s largest competitor has a market cap of 41.5B)

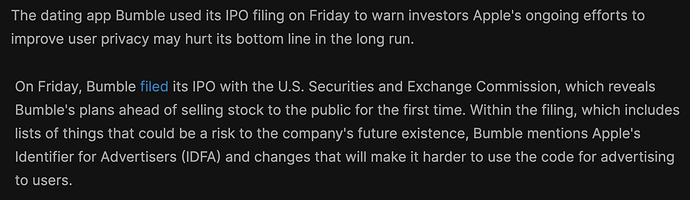

- BMBL has not had a profitable quarter as of yet and has a 9.1B market cap, with no real mind-blowingly awesome contribution to the online dating community.

- Looking at the dating app market: (Data from: Dating App Revenue and Usage Statistics (2024) - Business of Apps)

- Globally:

- 222m dating app users globally

- MTCH (Tinder, match.com, and more) holds 53% of the market

- BMBL holds 36% of that market

- Other sources claim MTCH holds 90% of the online dating market

- In the U.S:

- 23.4M dating app users

- MTCH holds 72% of the market

- BMBL holds 21% of the market

- U.S market is the largest space for revenue

- U.S users spend the most on subscriptions and consumables

- Globally:

- BMBL sits at an incredibly high market cap, in an oversaturated sector, and is competing against a highly established member of the field.

- If they failed to provide guidance on how to increase their users, subscriptions, or mentioned they were losing more market share to their competitors, it would be a large blow to the company.

- I believe that BMBL needs to be profitable this quarter or show how they will become profitable via reducing operating costs or increasing revenue, or it will lead to a poor outcome.

- They are moving off of the “covid recovery” boom, where they can claim people are joining the app more and more because of the world opening up more.

- They will have to provide ways that they will improve their company and business without relying on the world opening back up.

- They are moving off of the “covid recovery” boom, where they can claim people are joining the app more and more because of the world opening up more.

Technical Analysis (My Attempt)

(1 Hour Chart)

- At the red line, I believe that there has been a triple top at 60$ , and the stock is poised to continue its downward trend.

- I have found these three possible Support Levels:

- 48$

- 42.50$

- 39$

My Closing Thoughts:

Overall, I was more bearish on the company before conducting my research. However, I still think I am leaning to the bearish side. I believe that their valuation is too high and they are hanging on to their stock-price because of their post-covid recovery. I think that once this stops fueling their positive news and guidance, they will move to a more appropriate value.

I think that BMBL needs to provide guidance on how they will continue to move forward in obtaining more users and increasing subscriptions in order to become a profitable company. I do not think this will happen.

I am currently considering buying shorter-dated calls and longer-dated puts for this ER. Hopefully, this will protect me from any short-term upwards movement because of good guidance and post-covid recovery numbers, while allowing me to capitalize on the general down-trend the stock has been moving.