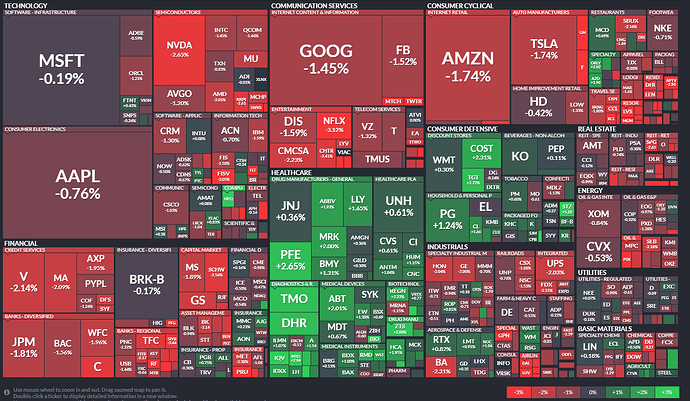

Was talked about yesterday in VC and today, though never posted on the forums. Basically, this is relating to the current state of the Market and SPY. While some sectors are green, a larger majority are red, which brings SPY down. Whether you knew or not, you can play these specific sectors and outperform SPY in some cases.

Example for today’s heat map…

You can see things such as Healthcare and Consume Defensive being up while the rest are doing poorly. In this situation, you’d likely be in XLV as it’s currently the strongest of the bunch. You can find a list of Sectors and their tickers from CNBC.

So far this week, XLV has been outperforming SPY as it struggles with Tech. It’s definitely going to be worth looking into more specific sectors rather than playing SPY so it seems. While we were dealing with the start of the Russia-Ukraine crisis, XLE was the best play to get into as it covered the Energy Sector which was running heavily.

Hopefully this information proves helpful to those of us unaware of the current state of these sectors and also ends up being beneficial for calling out movement in these sectors in the future.