Would like to get a community opinion on the technology sector for the s&p going into the end of the week.

I am thinking we are going to see a tech bull run coming into the end of the week for the following reasons.

Amd earnings, while only making up 1.53% of the etf it still outperformed earnings as well as raised guidance I believe we’ll see it steadily climb throughout the day. I think this serves as a relief for people weary of tech.

Google earnings. While not part of tech again I think it will serve as a bit of a rallying cry for the s&p.

Chart

Yesterday we saw xlk attempt to bounce off of the 20 day sma but was bought up and closed above the 20 day. Keep In mind this was before the relief of good earnings. With the added earnings and already present bullish chart as well as the turn around on the macd I think it’ll push to the upper band of the bollinger bands in the coming days.

The big dogs.

Xlk’s top two holdings are aapl at 23.46% and msft at 21.41% so what’s going on with them.

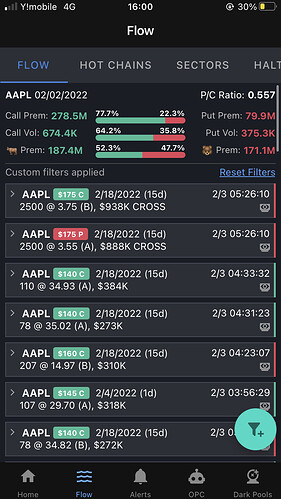

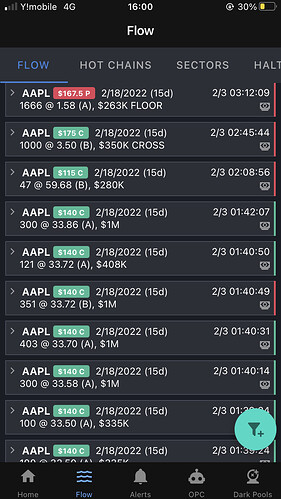

Apple. If you haven’t read @bajilion post on apple I think it does a great job breaking down what’s going on there so definitely would check it out.

Apple chart.

Similar to xlk (obviously since it’s 23% apple) we saw it show a similar pattern where it rejected down ward momentum and a flip in the macd.

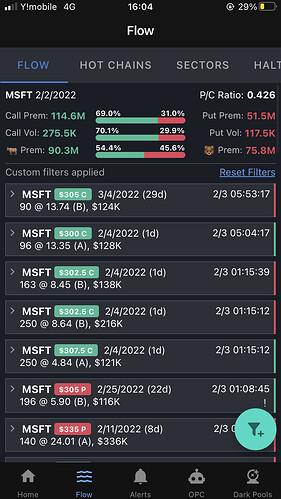

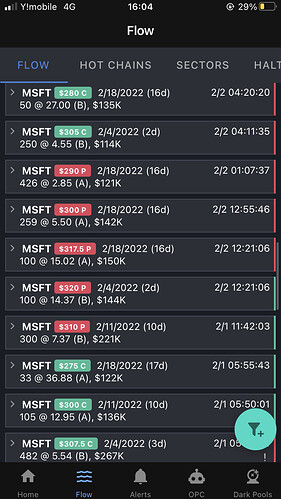

Msft. Microsoft posted earnings two weeks ago and where quite bullish I have an article below here but will try to give some highlights. 1.) added 9 billion in sales 2.) operating income jumped from 18 to 22 billion. 3.) increased return to investors by 9%. As you can see Microsoft continues to be Microsoft. Microsoft acquired activision which is bearish short term as investors know it’ll make a hole on the balance sheet and are scared of “deworseification.”

Msft chart.

Microsoft had a similar pattern Monday where it started off by dipping below the 20 day sma but rejecting a downward move before closing green. On Tuesday we saw a similar pattern by again dipping below the 20 day sma but rejecting to the upside before closing out the day lower compared to Monday. I think this double rejection below the 20 day sma is a strong indicator it wants to push up.

Riskier tech. Roblox a meta verse player that has been trapped in the rotation outside of growth saw a turn around yesterday which I think is a strong indicator market fears a fading for a bit.

Rblx had rejected off the yellow line intraday I thought for sure it would continue the trend downwards but actually ended up mirroring the xlk chart where it attempted a bounce off the 10 day sma but got rejected to the upside.

Risky meme stock ps gme asts astr and pltr all show similar patterns of rejecting further moves downwards.

Spy showing the same pattern as well of the rejected pullback I feel that the writing is all over the market everywhere I look that we are due for a bull run in the coming days in tech and in turn the s&p as well as tech is the biggest category in spy.

Obviously there are some big reports coming this week including adp employment change that could come out bearish but as it stands I’m full bull mode on xlk and spy.

I tried to be as thorough as possible so let me know if I missed anything.

All opinions are purposely stated as “I believe” or “I think” as it’s just my opinion and would love to hear other opinions.

Edit: forgot to put a spread warning, xlk has a wide spread don’t use market orders you will get burned on them.