As of making this post XSPA is at $1.65

XpresSpa Group is a leading global health and wellness holding company operating three distinct brands:Treat™, XpresCheck®, and XpresSpa®. XpresSpa is a leading airport retailer of spa services and related health and wellness products, with 43 locations in 21 airports globally. I will be focusing on XpresCheck which is their Covid testing brand, currently, they have 14 locations which are all located in airports throughout the United States.

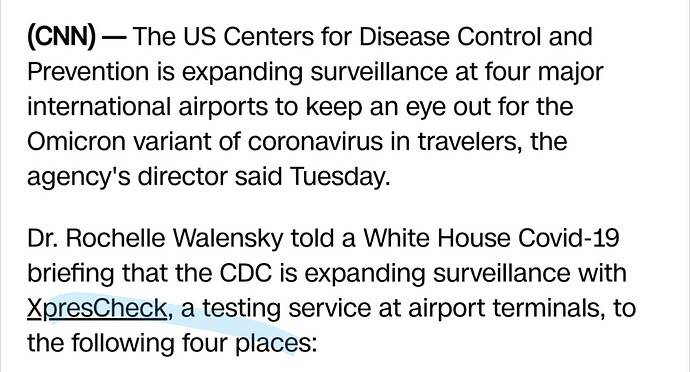

As everyone knows The World Health Organization last week classified omicron as a “variant of concern,” meaning it is more contagious, more virulent or more skilled at evading public health measures, vaccines, and therapeutics. The new covid variant is the perfect storm for $XSPA as Fauci has said this Sunday Americans need to be prepared to do “anything and everything” to fight the omicron Covid variant. THIS MEANS MORE TESTING. Currently, XSPA has a 2 million dollar pilot program with the CDC for biosurveillance.

August 13th 2021

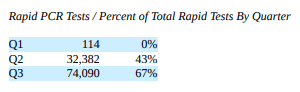

Currently, the media + countries are going crazy over the new variant many countries have shut their borders and tightened covid testing procedures. This means $$$ for XSPA as they are testing more and more as evident by their recent earnings report.

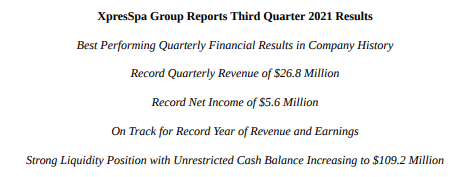

Incredible Financials: On November 15th 2021 XSPA reported RECORD results.

Earnings blowout

The company is valued at 171.2 Million, XpresSpa Group has US$5.65m in debt but US$109.2m in cash offsetting this, leading to net cash of US$103.5m. That means the companies whole business operations are only valued at 67.7 Million.

XSPA reported $0.09 Earnings per share. That’s a return of %3.2 of the companies market cap in one QUARTER since earnings. If you don’t include the actual Cash value of the company and just look at the return of the value of the business that’s a %8.2 RETURN IN ONE QUARTER. THE BEST PART IS THEY ARE JUST GETTING STARTED.

They SMASH REVENUE EXPECTATIONS. The expected revenue of $9.97 this quarter, They report $26.8 Million in REVENUE. THAT’S A %168.8 REVENUE BEAT. THEY smashed revenue expectations by 16.73 MILLION.

More and more testing = $$$

They are growing like crazy, and they will continue to grow as they are opening more and more locations.

Upcoming Catalysts: 1. CDC CONTRACT EXTENSION. With the new variant, Biosurveillance is gonna be increased significantly in the US just like it has begun in the UK. XSPA is poised to make an insane amount of money of this with an extension in their CDC program which they are confident they will get as shown in their latest earnings report.

CDC Covid extension expectation from earnings report on November 15 2021

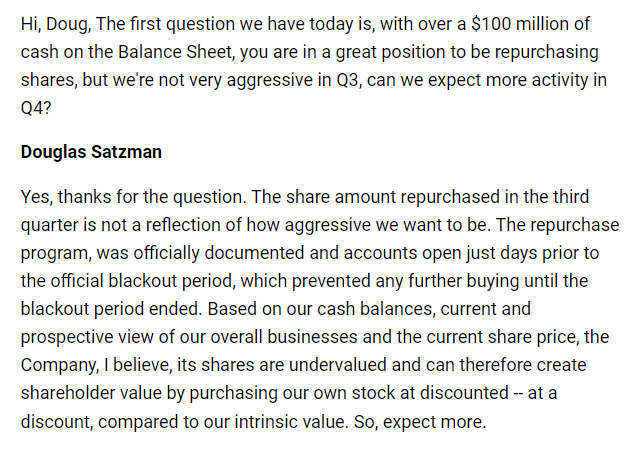

2. SHARE BUY-BACK TIME. They have a plan to buy back $14.75 Millon shares of shares in their share buyback program. This is from November 15th’s earning call.

- New locations are OPENING UP, Their First XSPA treats location is opening up in DECEMBER.

In their latest earnings report they said :

The first Treat In-Airport Wellness Center is now set to launch at JFK International Airport in December and will be followed by Phoenix Sky Harbor International Airport in the first quarter 2022. The Company is in negotiations for several additional locations, including some XpresSpa conversions, at major airports across the U.S. for 2022 and 2023.

What does XSPA treats do?

Treat In-airport Wellness Centers will offer services such as, travel vaccines, anxiety care, emergency prescriptions, vitamin IV therapies, as well as private virtual wellness services including fitness, yoga and guided meditation sessions. Treat Wellness Centers will also include a highly curated assortment of premium health and wellness travel items in their onsite retail collection.

$XSPA projects $500 million in revenue in 2025, as the CEO said in their latest earnings call:

Mr. Satzman concluded, “Ultimately, we believe that the Company has significant opportunities utilizing three sustainable growth brands that can collectively generate annualized revenue of $500 million by 2025. We believe each can have healthy unit level economics and can operate adjacent to the others while leveraging an efficient corporate structure, coupled with our relationships and experience operating in global airports. In realizing our growth target, we intend to elevate these brands and remain nimble, but also further expanding our services and products, resulting in increased market share and attendant shareholder value.”

Covid testing is here to stay, The future looks incredibly bright for XSPA. I believe they are incredibly undervalued as of right now. Please let me know your thoughts.

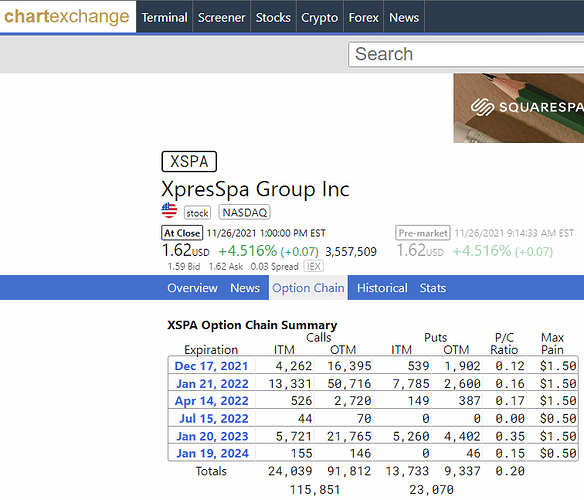

If the price stays at its current price I will be buying 10,000 shares on Monday as I truly believe they are undervalued. I also have 500 Calls at 2.0 for DEC AND JAN

Here is a link to seeking alpha article about this earnings report : XpresSpa Group, Inc. (XSPA) CEO Douglas Satzman on Q3 2021 Result - Earnings Call Transcript | Seeking Alpha

Here is a link to investor relations so you can read the earnings report if you’d like: https://investors.xpresspa.com/overview