[center]DEGEN MILLION % GAINZ SON, Well sort of…[/center]

I’m sure you’ve all heard about the 1,000,000% APY’s in yield farming and have considered getting a piece of the action. Yes those APY’s are real and i have farmed them at times making good money and at times Losing even with sky high APY.

Like with everything there is no such thing as a free lunch and you are being rewarded for excessive risk with excessive APY.

So how does it work?

Well firstly you need a wallet I use metamask https://metamask.io/

You will need the token used as gas on whatever network you are on for ethereum mainnet and layer 2s like arbitrum its ethereum, Polygon its MATIC, Avalanche is AVAX, Solana would be SOL and so on. This will need to be on the wallet you intend to use

How tokens get distributed on launch:

When new token launches it has various options of how to raise money and distribute its initial tokens.

So Bitcoin does this through proof of work mining where by contributing to the Hash power of the network you get a chance of mining a bitcoin. This is how they distributed coins in a fair fully decentralised manner with the exception of the 1 million btc in statoshi nakamotos wallet (never been moved or used).

The next way is an ICO (initial coin offering) where through various methods of bidding tokens are sold in one go or batches and the token creator can decide how many are initially sold who has access etc.Ethereum did this initially with some tokens kept some back to fund the not for profit foundation and the rest have been minted through mining which will soon change to staking rewards when it moves to proof of stake in 2.0

Yield farming token seeding model:

Thanks to the innovations of the decentralized exchange (dex) like uniswap and the second ever dex, sushiswap tokens can be placed into pairs in pools which allow automated swapping. When you first set the ratio of a token pair you set its starting price (this is usually eth and one other token as the first pool) so the starting price is really whatever the pool creator sets it as. Obviously this is open to manipulation which is how people do rugpulls and make token prices shoot up as they can pull liquidity or add liquidity as they choose.

Along comes yield farming its essentially an new way for token creators to give their new token (and by extension their project) value. As soon as the token is paired in a pool (usually in uniswap or sushiswap pools) its tradable on the exchange and the ratio of eth-new token determines price. Purchasers simply are adding more eth to the pool and removing the token and sellers are adding the new token to the pool and removing eth. That’s how the price moves away from its starting price.

So effectively you are lending them money on a somewhat flexible basis in return for their token. Imagine a company launching where you could lend them money and in return they paid you stock instead of money for interest.

So how does this fund the team?:

Providing people buy the token, they push up the price and assuming the team hold some of the tokens they also increase in value. The team can now either trade this in or pay people directly in their token. This allows them to pay themselves a wage hirte devs do marketing etc or if its a bad project rugpull you.

How to:

So how do you “farm” a token. You Provide liquidity to a Dex (this differs depending on the farm) Get an LP token in return then stake it on the farm which matches the token pair. Done your now yielding tokens.

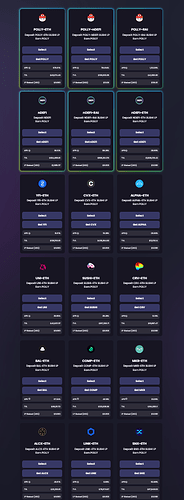

First you need to look at the farm to see what LP token it takes (I.E uniswap LP or sushi LP or whatever dex) if you use the wrong dex it wont work you won’t lose your money it just won’t be addable to the farm. You also need to pick a token pair such as below (we will look at why this matters later)

They will often list the token pairs with the native token (that protocols token) at the top with the fattest APY for dem big GAINZ. Well No this is a bad idea because Impermanent loss will take you to the cleaners I’ll cover this later.

So to add liquidity go the the dex website this may be sushi swap, uniswap or a dex of the token. Once on the page which looks like below go to the liquidity tab. Simply choose the two tokens you want to pair (it’s always a pair) and add liquidity.

As you can see you get a share of all the fees for the trades from the Dex as well as the yield you will pull from the farm. I’ve had mixed results with this. If it’s a really hotly traded pair it can earn a decent return but if it’s too much selling of one pair and buying of the other you will suffer something called impermanent loss. I will cover this later. Once you hit confirm you will have to give permission to the dex to access your token (both) then finally confirm the liquidity add. Once this is done you will automatically get an LP token in your wallet. It won’t have a proper logo and will simply have a string of numbers.

Once you have the token you can head over to the farm and add the lp token.

They all more or less look like this. Picture one is what you will first see again you need to give the DApp permission to use the LP token, then press the plus button to add the LP token and confirm. From there you can unstake the LP (often subject to fees for rapid withdrawals after deposit but not always) and harvest when you click harvest that will take the newly farmed coins into your wallet.

Impermanent loss:

When you add liquidity to a pool you get a LP token (certificate of deposit) so you can go back and remove your tokens anytime you want. BUT the tokens you get back will differ to what you put in as you will get a share of the trade fees from traders trading that pair (which is good) and you will lose money the more the price of the 2 assets divert from each other from the point of the liquidity add. So if you had a stable coin and a farmed token for example as the farmed token dumps to 0 (this happens 99% of the time due to the constant sell pressure from farmers and no incentive to buy when it can be farmed) you would get hammered because as the price goes down that means traders are putting the farmed token in and taking the stable coin out. Eventually this leaves a pool full of the shitty farm token and as there’s nothing else on the other side of the pair that means no swaps so no value so $0…

This is why i said earlier DO NOT FARM NATIVE TOKEN PAIRS even will a squillion APY. You are the sucker as you gave the farmed token value and as other farmers dump they are taking your money and you won’t outfarm the Impermanent loss!

Heres a link to binance they go into more detail if you want https://academy.binance.com/en/articles/impermanent-loss-explained

Farm weighting and block timing:

Another thing to consider is farm weighting. When a project has different farms (usually eth and some other token) each farm will be rewarded differently.

The numbers are entirely arbitrary but basically add them all up divide by 100 to get the value of 1%. So the total number of all that above is 73,566 divided by 100 is 735.66. So 1% for every 735.66. Lets take Polly/Ndefi as its the biggest number so 15,000/735.66 = 20.39% (I rounded up). Ok so thats the yield… NO. That is the percentage share of each block reward. What the fuck are you talking about you boring bastard. WOAH no need for that bear with me…

So you may have heard of block timing this is how often a new block is produced by the block chain its simply a record of transactions within a set timeframe checked saved then recorded. As we are looking at polly finance on Polygon MATIC lets stick to that. Polygon is fairly quick and makes a block every 1-3 seconds. Polly finance gives out 312.5 tokens every block. So the yield for the Polly/Ndefi is 20.39% of 312.5 or 63.72 (rounded). So thats how many tokens i get every 1-3 seconds… NO. Oh fuck you how much more complicated is this?! Look stay calm we are nearly there.

So thats the amount of tokens given to that ONE FARM every 1-3 seconds and the amount of those token YOU get is determined by the percentage share you have on that farm. If you are the ONLY one staking LP on that farm you get all the tokens. If someone matched your exact value of LP it would drop to 50% (31.851). Now it get more complex as other people will add more or less LP than you so how do you calculate your nominal share in tokens. Well you just get the current LP value on that farm and figure out the value you want to add and what the % of that is.

Heres me autistically trying to optimise my yield on polly day 1 it got more complex as nDEFI farms were added on day 3. As you can see the Adress is the LP pool address of the token pair farm if you copy and past that into ether scan or in this case polyscan https://polygonscan.com/ it will show you how much is in that pool at any one time. If you want info like this the docs of the protocol should list all that unless its utter shit Bao Finance | Bao Finance Docs

Now luckily you don’t need to do this unless like me you want to squeeze every penny out of day one farming. Once the farming is set up and has been running a week or so the APY shown on the farm page on each farm will have some degree of accuracy so you can just go off that.

Picking a pair:

A few things to consider:

- How much LP is already in the farm the more there is the more YOU yield gets diluted thats why people get cagey when you ask what they are farming. I’m showing you Polly because its crap now.

- NEVER EVER PAIR WITH THE NATIVE TOKEN!!!

- How in sync is the price action of the two coins. The more the better so stable coins can be bad pairs if you’re expecting volatility (this is crypto)

- The underlying matter don’t pick crap pairs either one side will be eth (solid) so make sure the other token in the pair isnt something that will crash and wreck your face with IL (impermanent loss)

Race to the bottom and native token pairs:

I’ve already covered this but I want to make sure this is crystal clear. The native farmed token will almost always dump to 0. Farmers are sellers with endless supply to sell the buyers don’t exist other than the liquidity pair providers (AKA suckers) who added liquidity to the pool initially or who were drawn in by the super high APY’s. Did you notice even Polly had all the Highest weights on the Polly pairs? The aim of the game is simple steal the suckers eth sorry but unless its an actual good (and i mean seriously good) project its going to 0. This means farm EARLY day 1 as theres more eth to get and less farmers so better APY plus they usually taper the amount of tokens that are farmable and dump regularly like daily.

Check out how many tokens on polly were farmed in week one compared to later weeks and that’s not even that steep!

GAS GAS GAS!:

Gas fees are killer on mainnet so i suggest not bothering. Stick to layer 2’s like arbitrum and DyDx or side chains like Polygon MATIC and Xdai for your farms even AVAX anywhere where gas is cheap cos you gonna use a lot.

- Swapping tokens to the right pair GAS FEE

- Briding from main net to side chain or layer 2? GAS FEE

- Enabling permission to use tokens on the dex GAS FEE

- Enabling tokens for liquidity providing GAS FEE

- Adding tokens to liquidity pair GAS FEE

- Confirming LP use on farm GAS FEE

- Adding LP tokens to farm GAS FEE

- Harvesting yield GAS FEE

- Dumping farmed coin on DEX GAS FEE

- Unstaking GAS FEE

- Pulling out LP GAS FEE

Yep main net even at $30 a pop is cheap now so thats a no go. Xdai and matic are fractions of a penny and layer 2 is around $2-5 a pop depending on network congestion.

Other issues:

- Rugpulls are common faire here for shitcoin farms so watch out for that

- Slashing fees for early withdrawals. To prevent exploits usually there’s a BIG withdrawal fee for pulling out of a farm within seconds which diminishes with time

- Don’t be late. All the good gains are first few weeks and often really first few days get in DAY 1 better yet MINUTE 1 seriously this makes a massive difference.

So as you can see that headline APY isn’t as good as it looks and remember its paid it their shitty dump to 0 coins so its not proper yield. Still if you play your cards right and get in early there money to be made.

Using meta mask:

So you will need to add the right RPC depending on what network you are on its basically like asn address for the network so you would need one for BSC and one for MATIC etc. You can run multiple RPC’s from one wallet and use a dropdown bar to change between them its not too difficult. here s a guide https://metamask.zendesk.com/hc/en-us/articles/360043227612-How-to-add-a-custom-network-RPC

You may also need to edit the gas if you’re on main net to make sure you don’t overpay and get ripped off or underpay and never get transacted. https://metamask.zendesk.com/hc/en-us/articles/360015488771-How-to-adjust-Gas-Price-and-Gas-Limit

You can check the gas here https://etherscan.io/gastracker

Bridges:

Theres no way around it you will start on main net as your on ramp as thats what the CEX’s will send to. Binance will send to BSC and MATIC i think which is better but i know some of you don’t have access to that. Either way you need to bridge to get to the farm usually. I cant add a guide here as there different bridges for different networks but if you get this far there’s guides they’re not that complex But guess what GAS!

Here’s what I’ll be farming next (today is 29/10/2021 for reference)

Its a fork of olympus doa on main net (backed by Mark Cuban ooooooooooo) and they are not a shitty rip off fork they are on AVAX and the OHM team are supporting them. There more too this but if you’ve ever seen people post 3,3 its referring to this OlympusDAO see 3,3 together on the left.

None of this works or could exist without Chainlink Grindalythe out.