Grabbed the following:

- Bunch of commons at market price for my longer term portfolio, about 1/3 the average position size

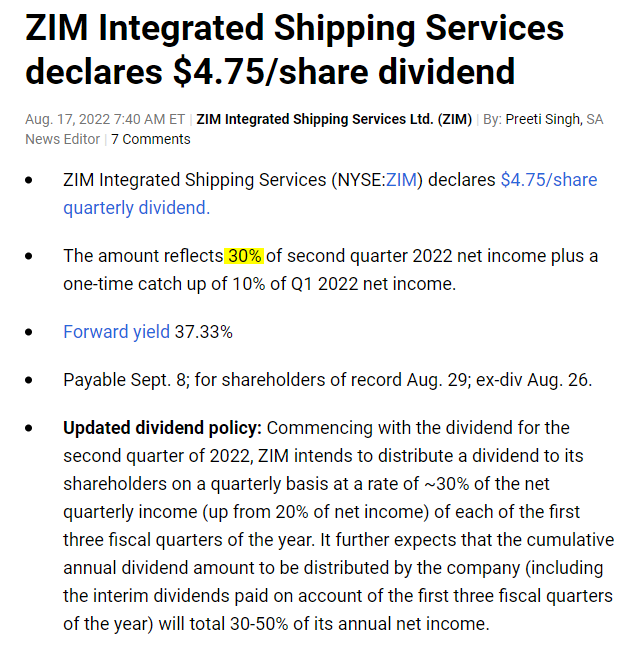

- JAN 19, 2024 35C (yes, 18-month expiration) @ $19.50.

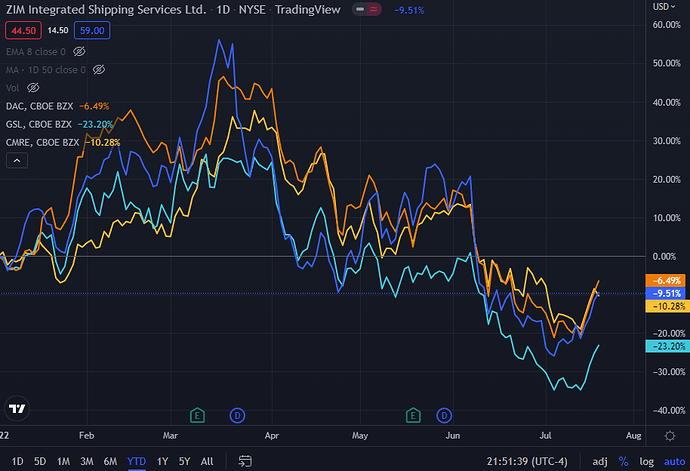

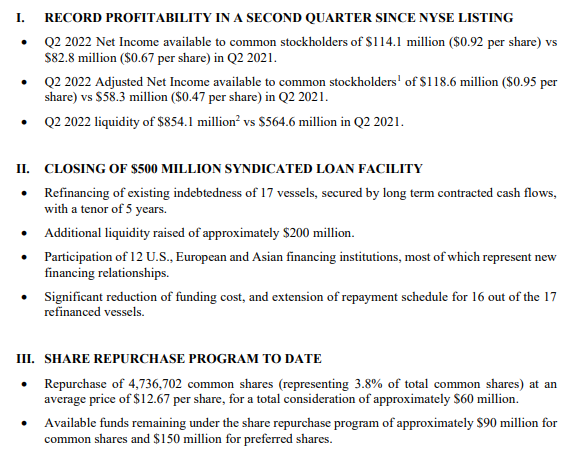

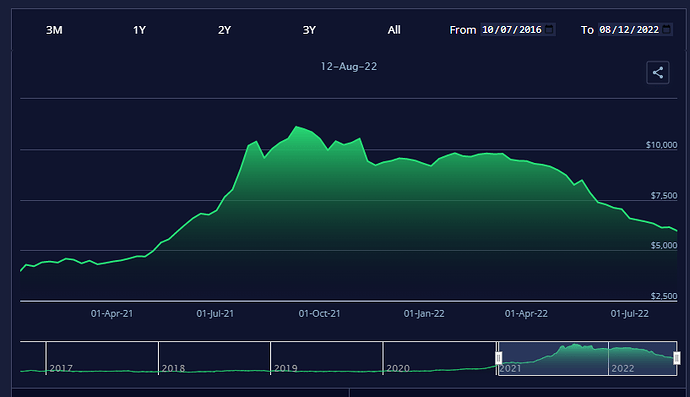

On the Leaps - Jan 2023 35C had IV of 92% while Jan 2024 35C had IV of 77%, making them almost the same price. No reason not to get that extra 12 months of runway for a about a dime’s worth premium. If ZIM doesn’t hit $55 again in the next 18 months, I should just quit trading.

Limit orders for:

- Another 1/3 of average position size at $45 - feel like we might actually hit this next week if market is red enough and analysts pile in

- And yet another 1/3 of average position size at $40 - this should really not hit, but if it does, it’s a gift. If it does not, I’ll just reprice it to whatever a reasonable price seems to be on the uptrend.

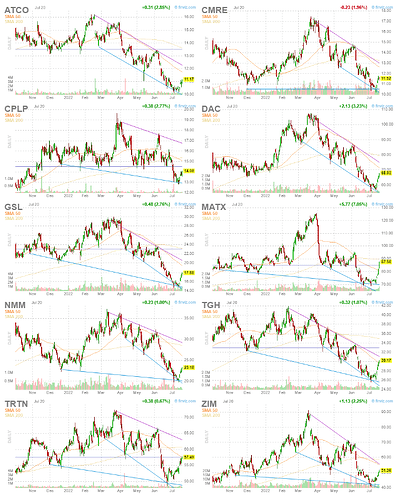

ZIM is a long term play, though it might take a while for the negative sentiment and relative supply chain slump to work out. Hence the longer term bet with commons and 18-month Leaps.