Goodmorning

I was scrolling through reddit when I read a post about the infrastructure bill and what it might do for the steel tickers, since I’m deep into $NUE and $CLF calls it peaked my interest.

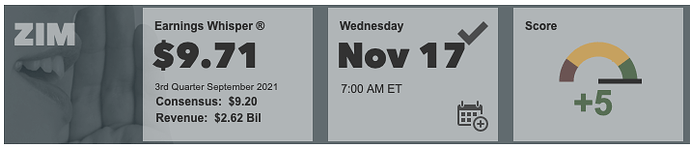

At the bottom of the post there was a section about a possible earnings play for $ZIM.

What made it especially interesting was this section:

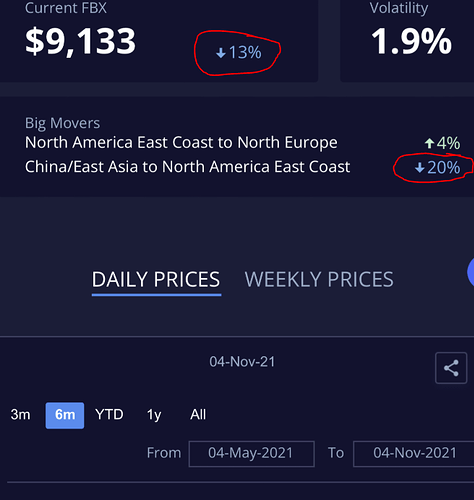

‘’$MATX reported an earnings beat on November 3rd after market and stated on their call they saw a strong shipping market at least through Q2 2022 (if not longer). On November 4th, they rose to a 52 week high while $ZIM fell. I figured this was a “fake flash dip” to get shares and bought heavily into options… which I them proceeded to sell for almost a $20k loss. Why? A comment on the daily mentioned how daily FBX rates showed a large decline. The kindness of this stranger saved me from a larger further loss of $ZIM dropping yet further (I’d link to this but it appears they have deleted their comment now so unsure if they want credit).

When the weekly rates updates, they showed a different story of a week over week increase. This appeared weird as a large sudden drop should have dragged the weekly average down to at least flat. Mintzmyer cleared up this discrepancy on twitter in what shows the large 20% daily drop that had completely disappeared on FBX today. It appears to have been some type of data error (as best anyone can tell). This didn’t stop the aggressive selling of $ZIM… and I bought my options again once the stock hit a bottom around $50. Mintzmyer has since done a post on this board with more details on $ZIM.’’

the drop:

So it appears that the sudden fall was because of faulty data about the shipping cost, the analyst that covers Shipping. Twitter: @mintzmyer Seeking Alpha: J Mintzmyer | Seeking Alpha

Had this to say about the whole ordeal:

’Well that was a wild couple days in Zim Integrated (ZIM) huh?!

Had a lot of people asking questions about freight rates and there was a Drewry report out yesterday saying Asia-US routes were softening. The Freightos FBX also showed China-US East Coast down 20% and had a 14% drop logged for the index. Okay…

Then today, we get the SCFI flattish (near all-time peaks), and Freightos FBX updated to be up w/w and d/d and yesterday’s dip was non-existent (i.e. they removed it from their data).

Anyways, bad day for shipping, but I added to ZIM in both November and January 2022 positions. Wanted to swing by to say “hello” and to share the notes on freight rates.

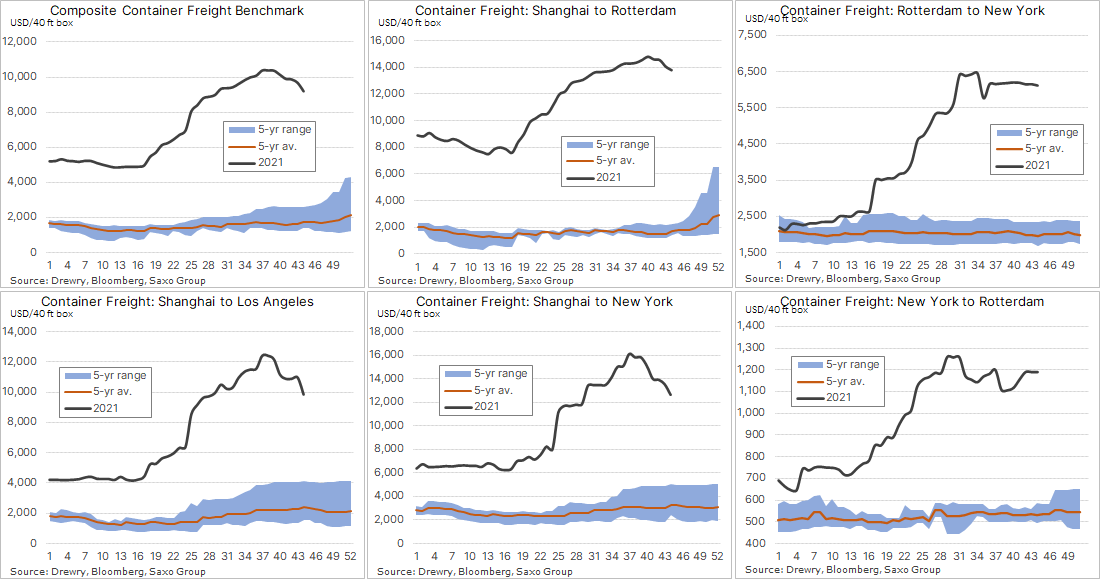

Big picture it’s kind of annoying and saddening that so many people are lazer focused on daily spot rates. Yeah they are amazing (!!) right now and I believe ZIM is doing $100-$150M in FCF per week at these rates, but these rates aren’t going to last up here forever. At some point they are going to come down. That should be expected by everyone… If we thought FBX $10k and Asia-US $20k/FEU was sustainable for many quarters/years, then ZIM would be valued $200-$300/sh.

Don’t lose sight of the big picture valuation of $30-$35 EPS in FY21, $20+ (my estimate) net cash currently on balance sheet, $1/sh+ in weekly FCF generation, and 30-50% dividend payment upcoming. Doesn’t mean you can’t trade it- I trade ZIM all the time! But the myopic obsession with the latest daily rate move or the latest political headline about “supply chain crisis” is self-defeating… and kinda weird.’’

this user: x.com showed a bit of a decline in rates.

the reddit poster further states:

So… we have confusion over whether rates have crashed leading to a selloff. (I can find mentions on twitter still of rates having crashed from today that most data sources currently don’t agree with). There is risk of power issues in China being worse than reported and that has caused some slight rate weakening… but recent drops in coal prices + aluminum prices (that take lots of energy to make) indicate that isn’t an ongoing problem for the moment. Outlook from a peer that just reported was very positive and they reached a new 52 week high after earnings and only had a slight pullback today to still record levels for the stock.

I think things look good for a strong earnings with good guidance. Lower P/E than $TX with a higher dividend. No bad guidance from peers that reported first thus far. Mintzmyer’s post goes into more about the stock as mentioned.

One thing to be careful about is that IV was spiking rapidly yesterday. November IV went from ~70% to ~99% (starting to reach meme stock territory on a stock with a 2021 P/E of under 2). Furthermore, the stock AH wasn’t strong which may mean it wants to go lower still. I have a little bit more I’m willing to allocate on another drop but may need to either do Call Spreads, CSPs or deep ITM calls if IV stays elevated at this new level.

Crazy how the stock moves +/-10% in two days frequently without much changing and more dip could still happen. Fingers crossed this will be an earnings move ala $CLF and $X and not a dumpster fire like $TX.

In my opinion things look promising, I’m currently working on a in depth DD on another ticker so I don’t have much time to look into this one, if anyone knows anything interesting to add please let me know.

links:

https://www.reddit.com/r/Vitards/comments/qnvac7/yolo_update_going_all_in_on_steel_update_30_tx/

https://www.reddit.com/r/Vitards/comments/qnk04k/brief_zim_update_mintzmyer/

https://twitter.com/Ole_S_Hansen/status/1456539188472451072/photo/1

EDIT: 17/11/2021: Sold FD’s at open for a good gain. got back in on Dec calls on the 50 bounce. Want it to stay above that.

EDIT: 18/11/2021: Dec calls of that 50 bounce already up nicely.

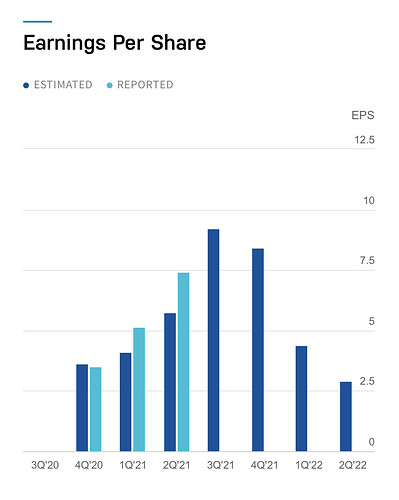

the earnings:

$12.16 EPS vs. $10.38 VIE / $9.25 analyst avg

-$2.50/qtr dividend (20% yield)

-FY21 EBITDA > market cap

-$18/sh net cash

-Generating over $1/sh in FCF per week

-Guidance implies Q4 > Q3

Raising our ‘fair value estimate’ to $80/sh ( this is a value from this analyst :x.com )

$55 stock with $18 cash and generating $1/sh in FCF per week.

The $18 was from 30 September, so it’s likely >$25 by now…

$2.76B cash has their cash/share at $23. They spent $2 on debt service, and $2 on dividend. they’ll have their entire market cap in cash by ~April if it continues like this.

This is all taken from the above analyst, take it as you please.

EDIT 19/11: Questions that were asked to the analysts that might be interesting.

“Hi JMintz would you mind briefly describing how you model the risk of freight indices plummeting in late 2022 or 2023? Does your model assign low probability to such event? Or you just model 2022 and what you call ‘residual value’ you assume low rates from 2023 onwards?”

Answer:

It’s a great question!

Generally, I expect 2021 to be peak earnings for ZIM- looks like easily $35+ at this point. If people thought $35 was normal earnings, this would be a $200-$300 stock!

I expect 2022 to be very good, but still a range. 2023 will be tighter and 2024 is really hard to tell. The way I look at ZIM is a residual business value based on a viewpoint of ‘normalized’ earnings of $5-$8 against a historic P/E multiple of 8-10x. The more earnings ZIM ends up retaining, the more stuff they can do to improve their cost structure, grow the business, and boost that $5-8 range.

In the interim, there is ‘excess’ earnings which add to that valuation. For instance $5-$8, call it $2/qtr would be the peak of ‘normalized’ earnings. So for Q3-21, ZIM’s excess earnings would be over $10/sh. I look at near-term excess earnings (really just Q3-21, Q4-21, Q1-22, maybe a bit of Q2-22) and add that to residual mid-22+ to drive that $80 fair value assessment.

An alternative way of looking at this is that I expect ZIM will have net/free cash of $50+/sh (before accounting for dividends) by mid-2022. So at current pricing the market is essentially valuing ZIM’s potential from mid-2022 through 2030+ as worth net $0. I think it should be closer to $40-$50. So $90-$100 then… maybe $80 now?

This would include dividends, so when I say ‘fair value estimate’ of $80. That’s $80 now, $77.50 after the payout, and probably $65 after the next big dividend.

EDIT 20/11:

Sold half yesterday for 120% profit. Will probably sell the rest on monday and look for a re-entry.

[event start=“2021-12-14 23:00” status=“public” name=“ZIM Ex-dividend date” end=“2021-12-14 23:00” allowedGroups=“trust_level_0”]

[/event]