Hello, I am Tuanathans. I am a long-time lurker of the server and often talk in chat.

This is going to be my first DD ever. So please any guidance or such would be great!.

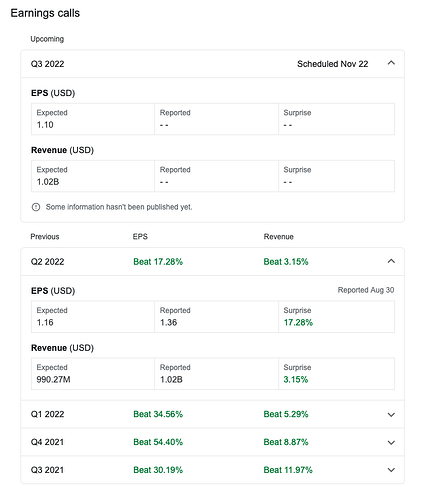

ZM is a pretty common household name due to Covid and there is no doubt about that. However, I believe their name is going to die down slowly. Their earnings are 11/22 and I believe it is going to be a knife down.

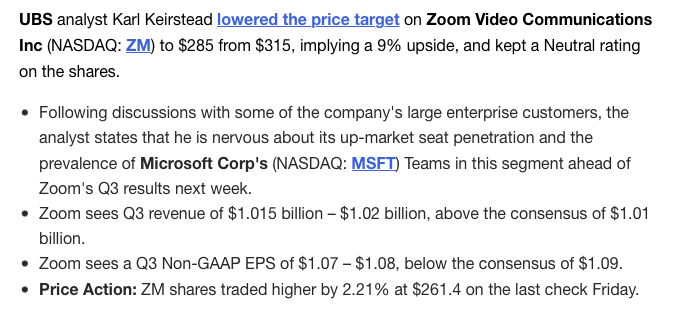

Their overall stats:

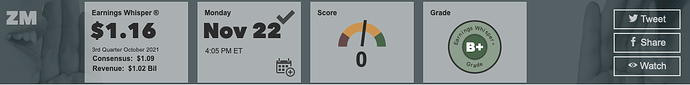

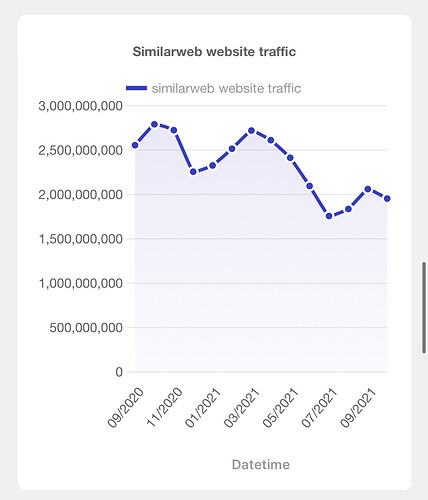

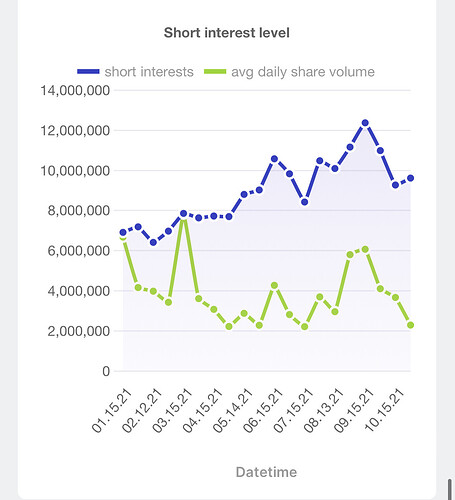

It has been overall decreasing slowly and it might not be a lot but they are waning

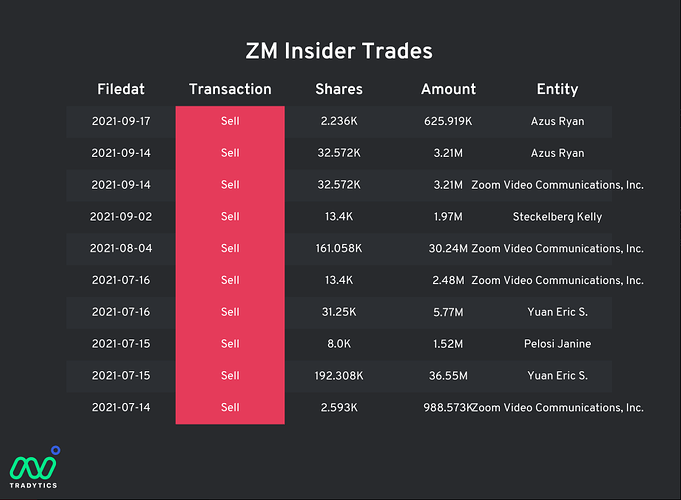

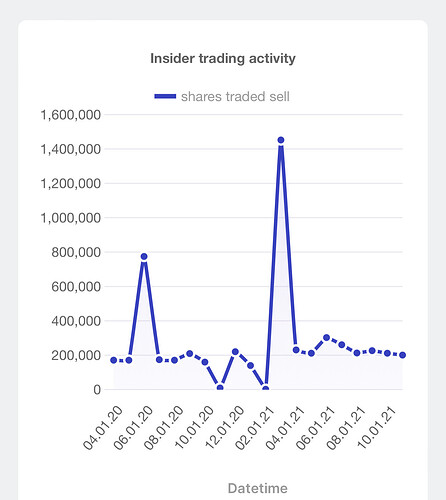

The insider trades are all sells and no recent buys. They themselves know ZM is indeed overvalued and are just selling away.

This is the most recent SEC filing and their CEO is selling. It’s actually pretty common how often they are selling.

It’s actually pretty regular for them to sell to.

There is reason and sentiment that ZM is going down.

If you would to have a look at the filings here it is.

https://www.nasdaq.com/market-activity/stocks/zm/sec-filings

This is from the google app store and its downtrending these are somewhat recent

Apple is also downtrending however these are also somewhat recent.

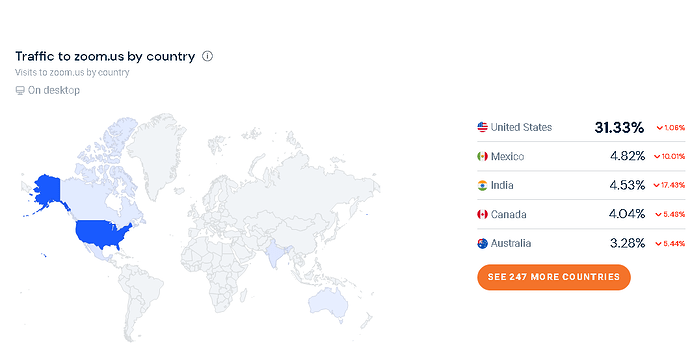

Zoom usage in countries is slowly also dying down as well.

Zoom has a lot of potential securities and still has a long way to go to be the top communicating service and premiere app for big corporations. They have so-called fixed most of them however there are still possibilities of a security leak. They lost a lot of people because of the leaks and such last year. People are still skeptical and rather have something solid like Teams which is going to be integrated with Windows 11 which is a free upgrade and will be easy for any Windows 10 user to switch up too.

A lot of less interest in the overall google search of zoom as well.

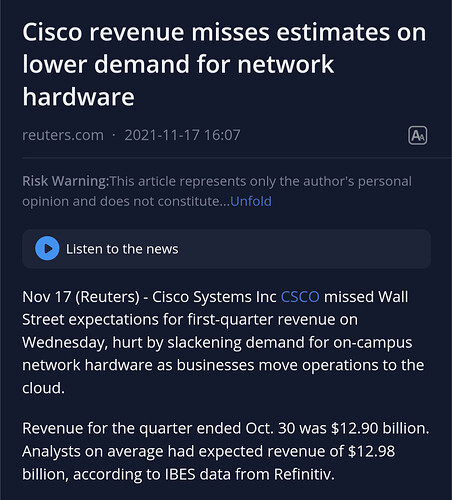

There are also other things you can think about like the competitors such as Microsoft teams who are a tech giant and provide communication with security easily and easily has a better integration on workflow and such.

Now there are Cons and we do have to see if there is a bull case:

Zoom is already priced in

Zoom’s revenue is a subscription-based (monthly and annual) so revenue could have been locked in. Their usage is also not always based on volume or or usage from the web. Contracts can be set with them for a while and they are a household name.

The sentiment was already known that Zoom was going to be trash so they aren’t expecting that much (analyst)

Zoom knows their fame is based on Covid and is trying to go into other markets/ways to increase revenue and maintain their market value.

Zoom has also already downtrend a lot from their ATH. They could see bounceback even from the smallest glimpse of good news.

Conclusion: Overall I believe ZM will falter this Quarter and knife down. I am not a financial advisor and you should take what I think with a grain of salt. I will be taking put positions for ZM soon. I suggest just playing IV for ZM earnings if you’re skeptical as you will make money either way. If you have conviction with my post stay in. You can easily make money from the IV during earnings day. Remember nothing is a guarantee and stay skeptical at all times. Also ZM is 11/22 AH for anyone who doesn’t know. Godspeed.