Mentions for starting the conversation about Zoom puts:

@Joshuke @Iloveyou @choebro @Days20

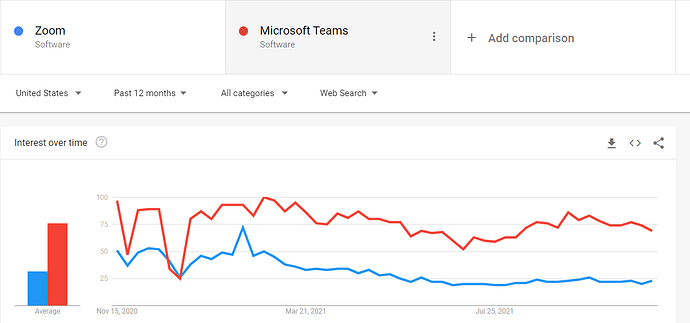

So with Covid-19 starting to show signs that the end may be in sight, a lot of those that had to go to school, work, and stay connected with people got very familiar with a little company called Zoom. Now that life is returning to normal, kids are going back to in person school, and businesses have figured out more developed ways of working remotely; will Zoom have life ahead of the return to a “normal” everyday life? And will their stock survive this change?

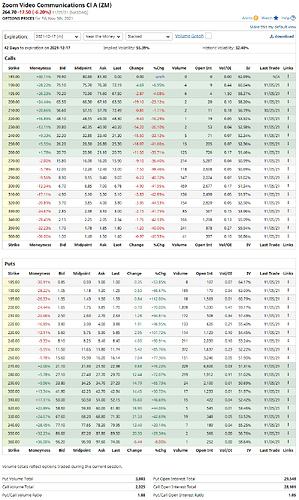

THIS IS NOT A SHORT TERM PLAY OF ME SAYING GO BUY PUTS RIGHT THIS SECOND THIS COULD BE A LONG TERM PLAY WHERE IF YOU WANNA PLAY PUTS YOU ARE BUYING LEAPS (OPTIONS THAT EXPIRE IN 6 MONTHS+

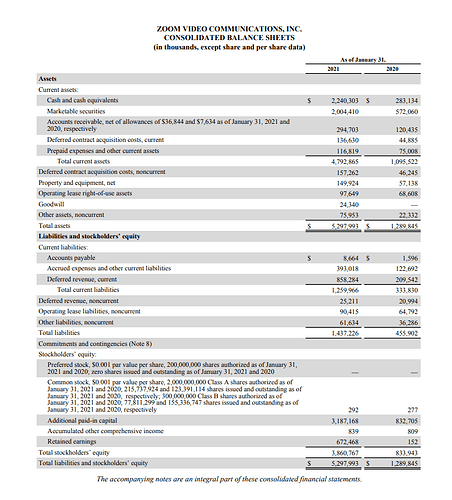

Lets take a quick gander at where Zoom is sitting from their most recent 2021 annual report where KPMG audited their books and talk about a few basic accounting measures:

Dang this guy is talking about shorting a stock with a quick ratio of 1.56.

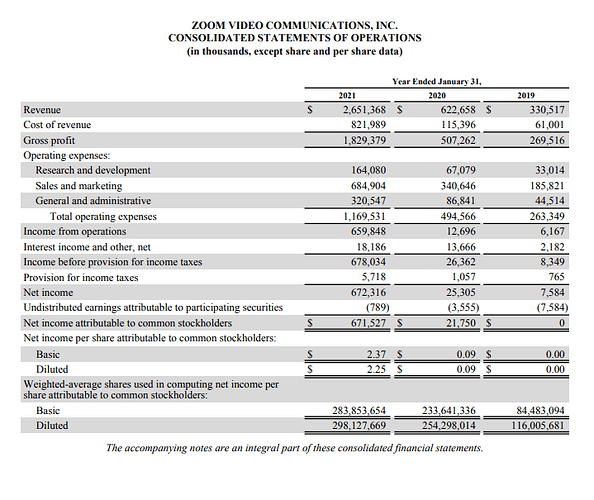

A P/E that is currently around 79.98.

A company that increased revenues from ~600m to ~2.6b in a single year and this guy wants to buy puts on it. Someone dunce this man and his friends.

So lets talk about the year ending 2021 since that is technically when they made most of their money (I know march last year feels like forever ago and thats cause it was).

Now out of that 2.6b Zoom had a gross profit around 1.8b after all the C-suites and executives got their cut for how well the company did (commonly referred to as Cost of Revenue)

That increase of revenue from 2020 to 2019 was around a 425% increase in revenue. But it didn’t come without growing pains

https://www.reuters.com/technology/zoom-reaches-85-mln-settlement-lawsuit-over-user-privacy-zoombombing-2021-08-01/

Zoom had one settlement of $85m for the whole Zoombombing fiasco. This is probably one of those types of things you don’t want happening on like your first big year of bringing in the big bucks and basically having society forced into your product. Long term no one wants to be apart of hack of infosec issue and it tends to cost companies a good amount of goodwill in the future.

Now what I can say is with the crazy increase for Zoom in revenues their net income also increased extremely well… Like 30x’s better in 2020 than 2019.

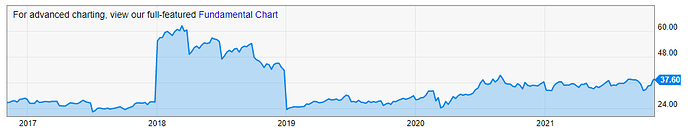

Here is Zoom’s P/E ratio trend:

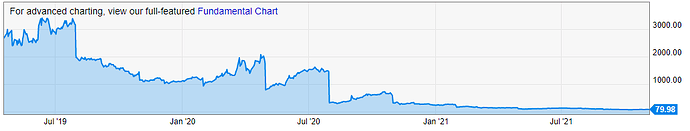

Now Google’s P/E ratio trend:

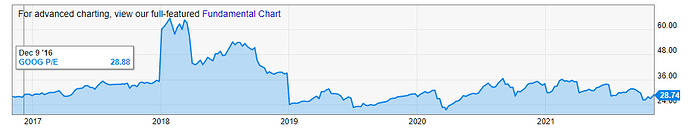

And the last competitor, Microsoft P/E ratio trend:

You’re probably thinking, “wow wtf ZOOM had a crazy P/E ratio awhile ago and it just kept going down wtf does that mean Stonk guy?”

Mainly a lot of nothing besides the fact that Zoom went from being a $50 stock to being a an ATH of around $589. So of course P/e is gonna get lower as the stock price catches up with however much they are earning (which it looks like they were negative for 2017 and 2018 and broke even in 2019)

But the Price to Earning chart does show how when a company isn’t making a lot and is trading at certain levels it can be incredibly confusing… Lets just show you TSLA for the fuck of it:

Even TESLA has a reasonable chart compared to ZOOM’s P/E trend in the early days. and considering

Zoom raked in a cool 25m the year before Covid it doesn’t leave me with the idea that this company is going places and their product is so good that its going to disrupt markets.

Lets talk about what they actually list for their products actually this part is great:

Zoom Meetings: Provide HD video, Voice, Chat and content sharing across multiple devices (laptops, phones, etc)

Zoom Phone: An enterprise cloud phone system that provides powerful private branch exchange features, such as secure call routing, call queuing, call detail reports, call recording, call quality monitoring, voicemail, and “much more”

Zoom Chat: It’s included in the Zoom client and I never touched the damn thing. It’s AOL messaging for the soon to be Zoomers.

Zoom Rooms: Where you get locked in a virtual hell hole where you have to try and brainstorm with Sherry from accounting about how to fix this fucking company.

Zoom Conference Room Connector: Basically for whatever reason if you bought a Poly or Cisco conference room system and for some stupid fucking reason wanted to use Zoom on it instead than thats a possibility!

Zoom video webinars: Now this is somewhat legitimate use case that I foresee having some staying power for external facing types of presentations.

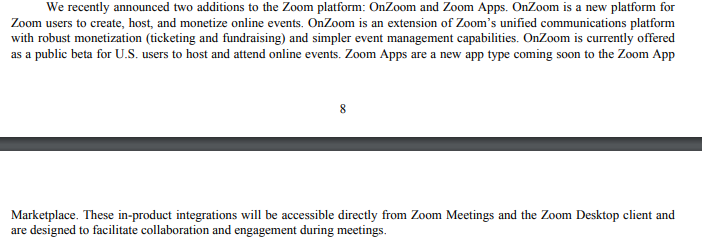

Now the recent two they just announced this year are OnZoom and Zoom Apps so lets dig into that and see if its somehow going to take market share from Google and Microsoft…

Now the OnZoom product essentially is like paying to sit at home and go to an event that you can pay for but a lot are free as well:

Now I can see some validity to the use case of this if people wanna put information and talks behind a paywall. But if you’re one of the few people that hasn’t figured out how the internet works and that literally everything you could ever need to learn is out there than yeah this may interest you.

Zoom Apps, the landing page just well… makes me laugh:

The apps they used as the headline of this page included Kahoot! and a couple note taking apps, followed by Lucid Spark (Which I’ve used its like a funky whiteboard app that you can collaborate on with sticky notes and a bunch of other very Silicon valley like functionality).

But my main point if for any reason one of the big product develppments of your company has anything to do with Kahoot! then there needs to be some serious pivoting…

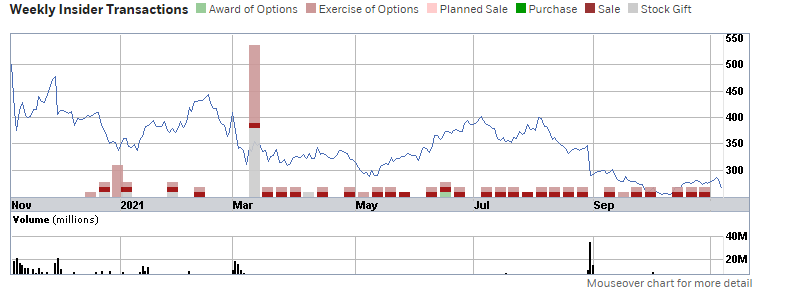

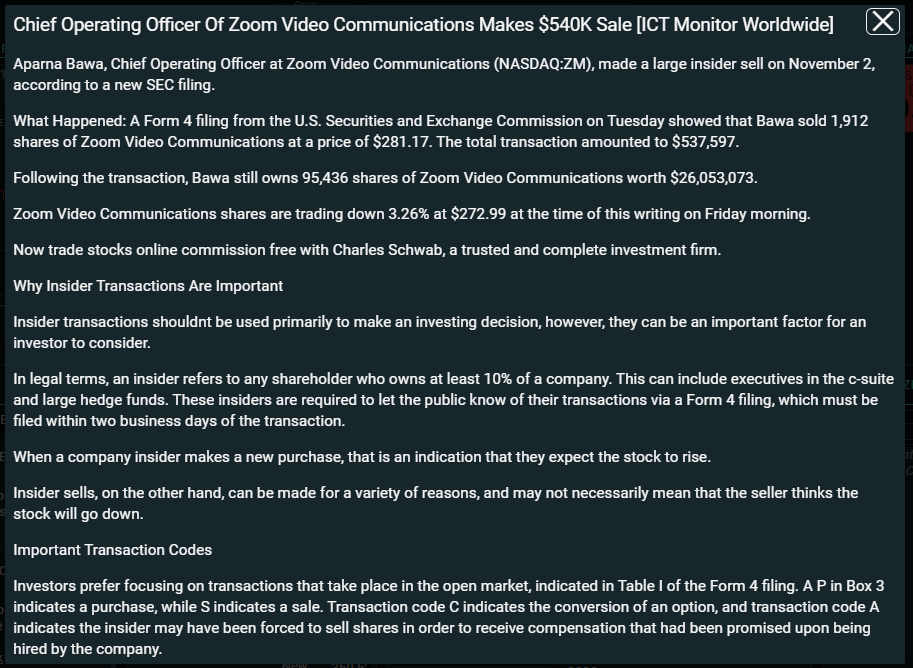

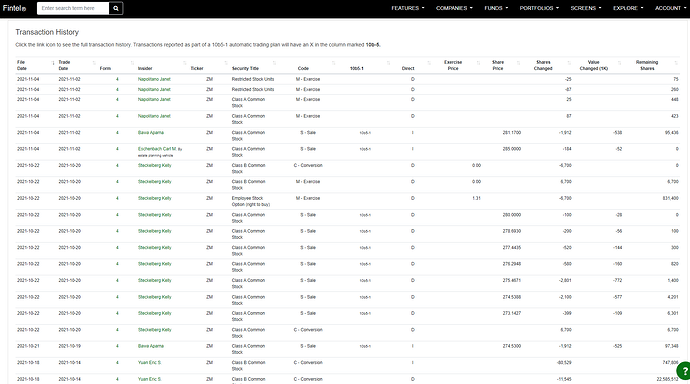

Lets check to see what Zoom insiders think of the company as well:

They selling their stock! The CEO has sold shares in 2021 15 times. He’s probably largely paid in stock but my god the one buy they had on the damn chart was an award for 80 shares which definitely ain’t a buyback.

I wonder why their selling a lot of their stocks? Surely earnings must be growing right?

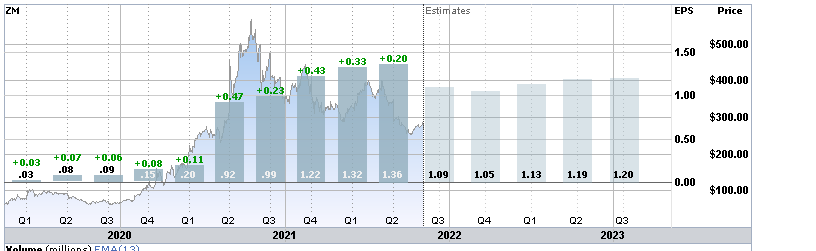

The general consensus is for Zoom’s EPS to be at around 1.09 for Q3.

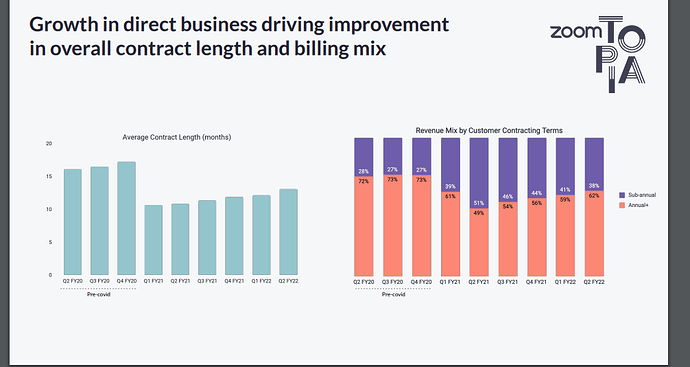

Now lets talk about one thing that is very important is how Zoom gets paid. 50% of their revenues are generated from subscription contracts with companies. Interestingly enough we saw a weird drop in their average contract length in Q1 this year

It could almost be said that when we got to around Q1 when things started to open back up and vaccines had begun hitting the veins we saw a drastic reduction in contract length by almost 30%. Thats a little wild for a company where most of their revenues come from these contracts. That would also imply that most of the companies that got locked into their Zoom contacts from when Covid started in March are already done with that contract. They may have resigned who knows, but as more of these contracts end so does the possibility of lost customers as the world transitions back to regular life where video conferencing like Zoom is no longer needed persay.

Noting the shift of revenue mix being more leaning recently towards the annual+ customers could also show that maybe some of the returning companies are having a tough time deciding whether they want to lock in Zoom as their service provider for the virtual workplace.

I tried to find some user number increases for their platform as a whole and this was the only slide that even mentioned their customer base numbers (and it doesn’t call out the change in those numbers at all its just vague)

This would leave me to believe that if you’re doing your annual report for Analyst Day you may wanna have a slide on what your customer retention numbers are? Nope didn’t get a single slide on it…

Well you’ve made it this far you must like personal punishment,

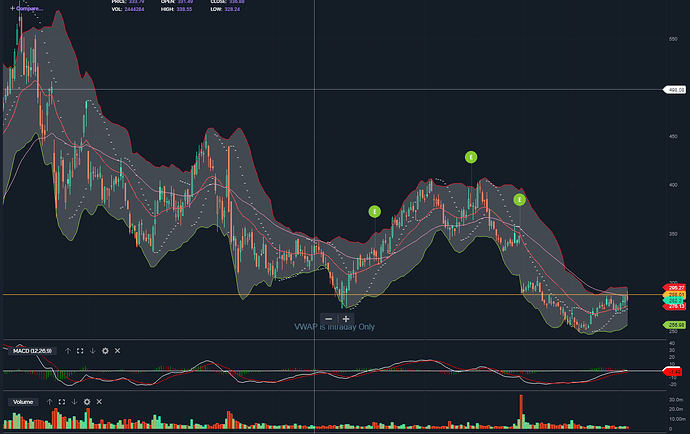

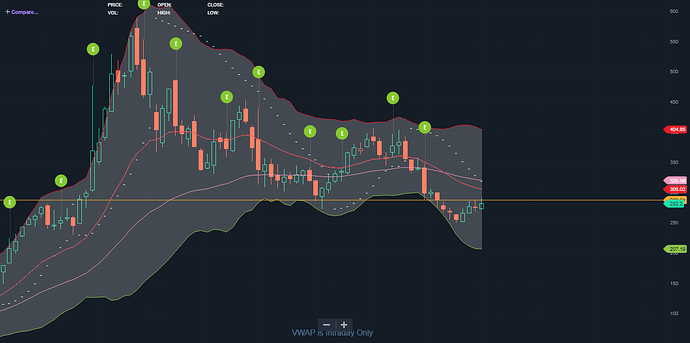

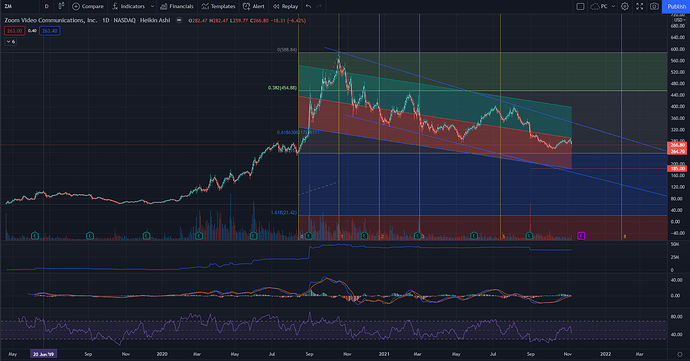

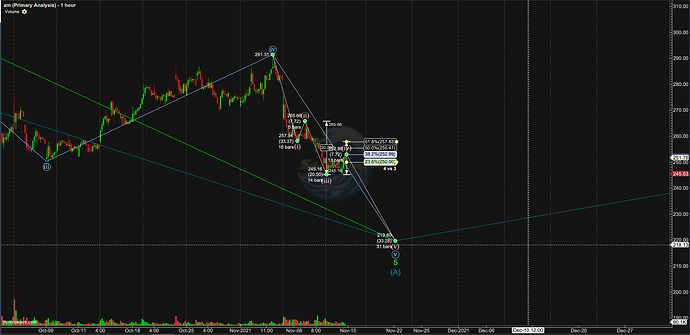

Here’s some TA to help your smooth brain:

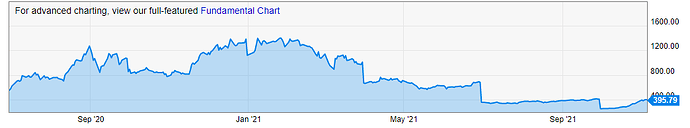

Of note here is the 08/31 date when the Five9 deal was terminated after hours on 8/30 the stock fell from around 350 to 300. This is where we find Zoom now. The Five9 deal also led to them deciding they were going to develop the new VEC product that was essentially supposed to be what Five9 was going to fill the spot in the company for. The deal — based on Zoom’s price of $362 a share — was worth $14.7 billion. Since then, Zoom stock has fallen 28% — costing Five9 shareholders $4.1 billion were the deal to have gone through (from a news article on Oct 1st) So the prospect of Five9 was also a way of Zoom pivoting and finding a new market, which a vote by Five9 voted against.Since then we can see an almost wonderous quadruple top set up on the daily chart. The first touch sent the stock to around 250 and the recent 2 were wicks but I’ll count it since it shows clear resistance of around the 290 level. Friday we the stock slid most of the day. We can see that typically Zoom has almost consistently droppe dinto earning after reaching its ATH:

I think this move Friday was confirming the downtrend that Zoom is currently on and that if the stock drops the 200 level we may not know how much further it could go…

Depending on how next week plays out I’d love to see some confirmation of a continuing downtrend and then I might grab some puts looking forward to what everyone else has to say on this as well!

[event start=“2021-11-22 21:00” status=“public” name=“Zoom Earnings” end=“2021-11-23 00:44” allowedGroups=“trust_level_0”]

[/event]