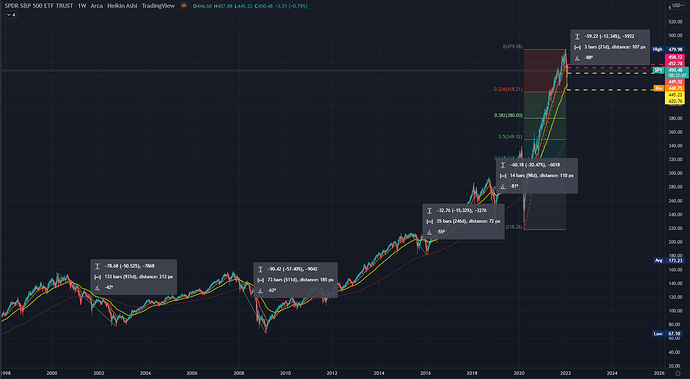

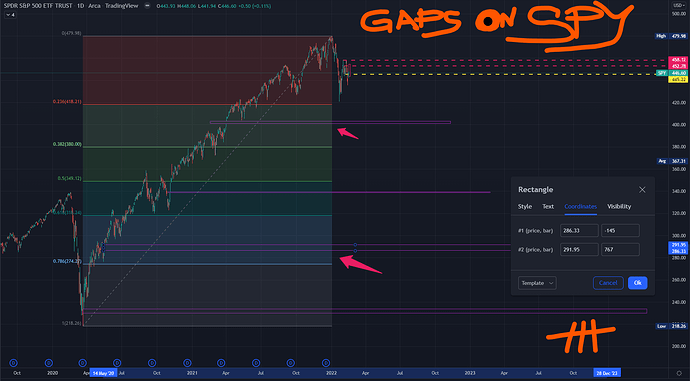

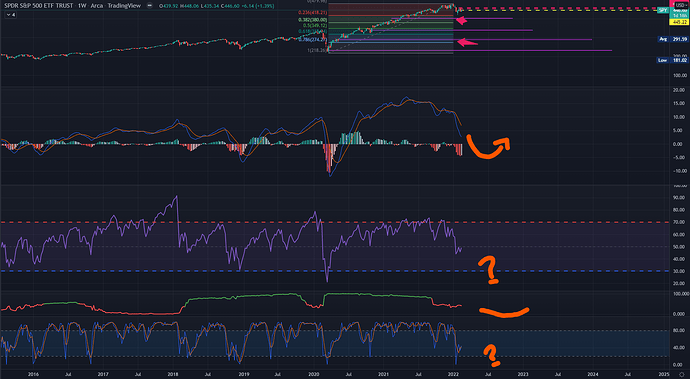

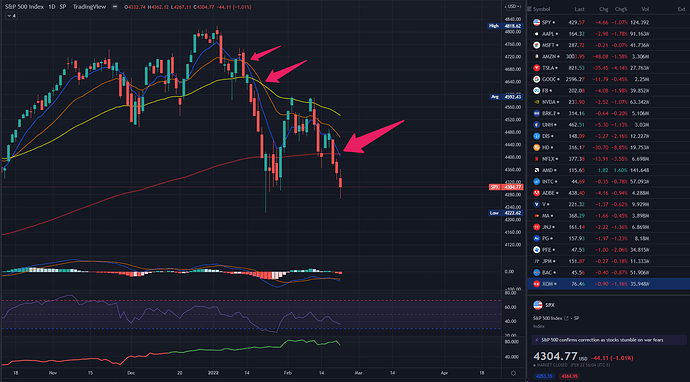

This is SPY Weekly from 1998 to present…

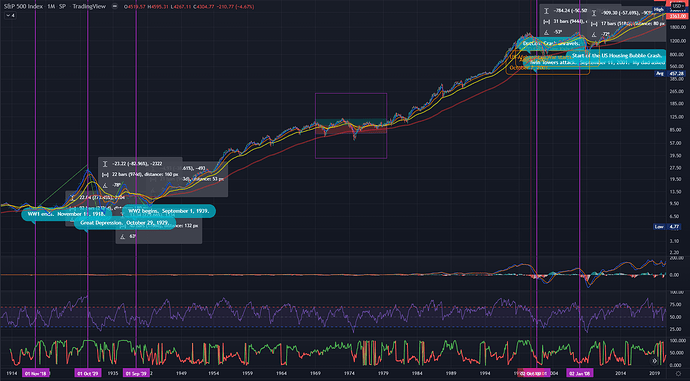

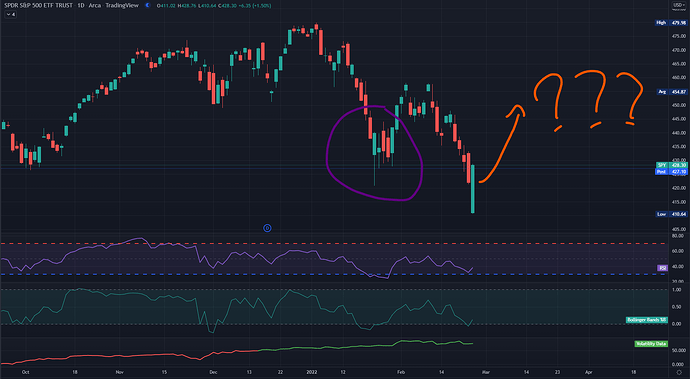

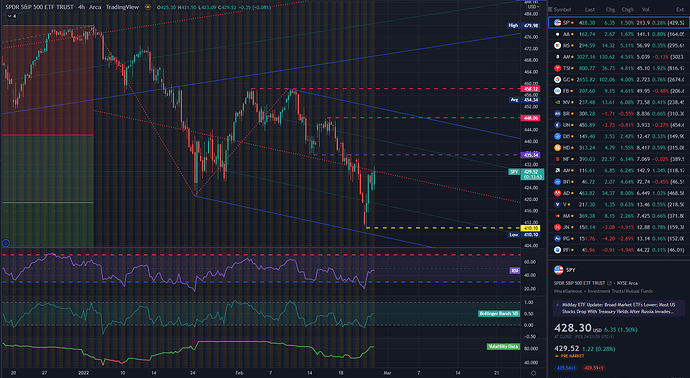

As you can see, the market is still a ways above the 200MA trend (red line).

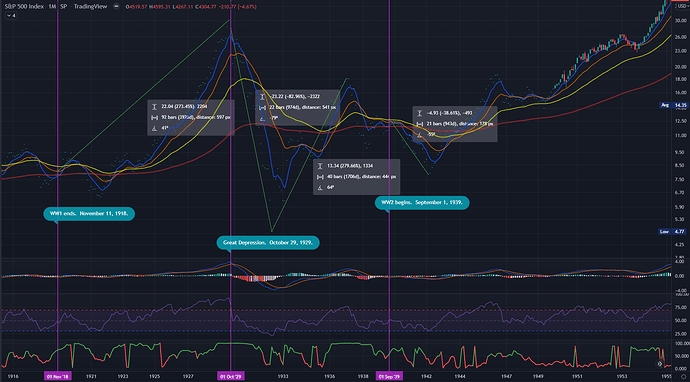

While I heed the warnings of senior analysts regarding a few more corrections, I think it will take a lot to effectively tank the market all of a sudden.

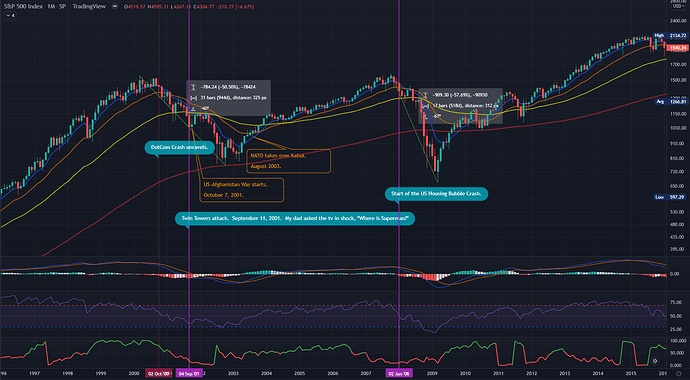

Some are looking to 2001 and 2008 for that -50% adjustment, but I am personally looking at 2015-2016 as my model.

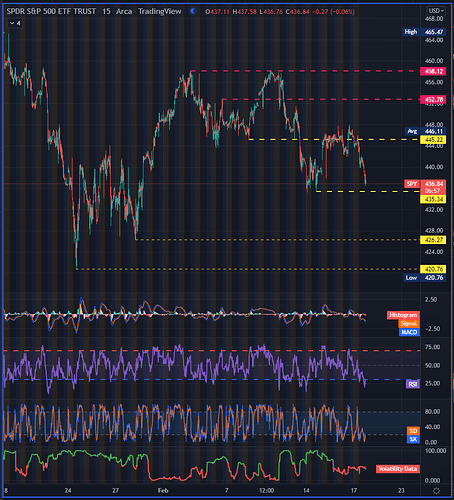

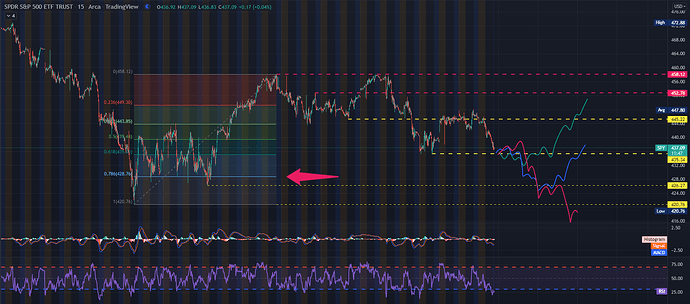

So far, we’ve only seen that -12.34% correction. With that rejection at 458, SPY should be picking a clearer direction next week.

I am anticipating SPY to touch that 200MA sooner than later, but I’m not extremely bearish.

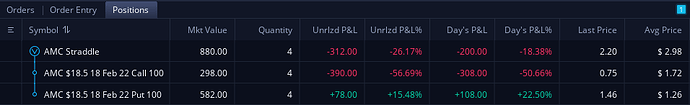

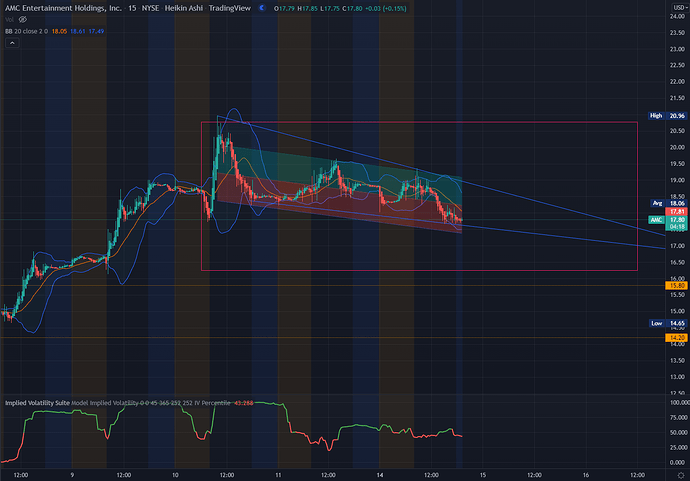

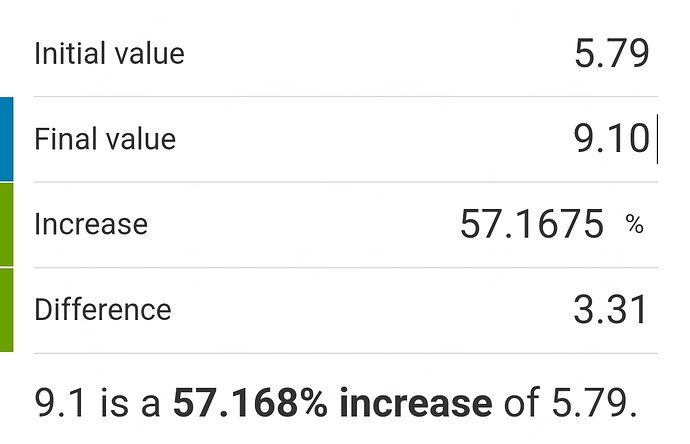

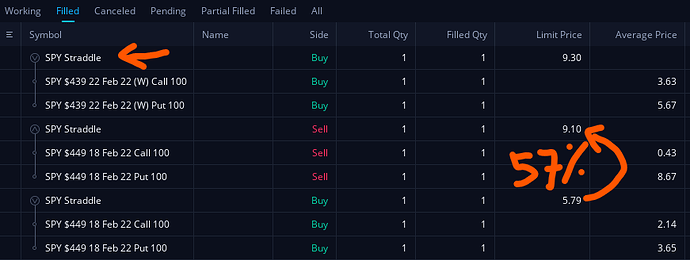

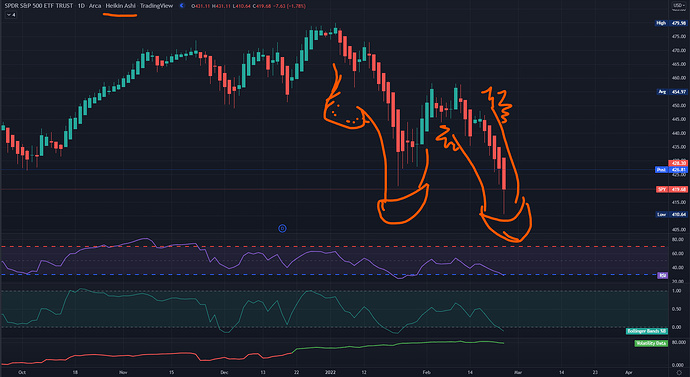

For now I choose spreads and take my gains every time I see them–5% is my average target daily.

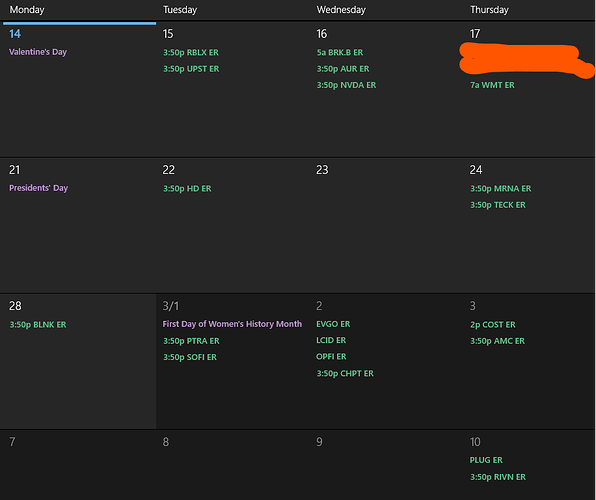

We’ve seen AAPL, MSFT, and DIS (to name a few), who beat their Earnings and helped the market trade sideways or fill gaps on the upside.

Thus I think it’s safer to not hold positions overnight, unless you have a tight spread with a conservative exit strategy.

I can tell you this, this is not the time to gamble with penny stocks. Smart money rules here.