I am starting my 25% gain challenge.

The challenge here is Discipline, not just the gains.

Threads I contribute to:

SPY - SPY - Broad Market Analysis - #157 by rexxxar

AMC - AMC - Watching out for 1 final Bounce / Double Bottom

Ford Leaps - Leaps on Ford Motor Company

CHPT Leaps - Leaps on Charge Point

UPST Leaps - Leaps on UPST - Post ER

RBLX Leaps - Roblox Leaps and ER Strategy

Update:

This strategy has been consistently profitable–for as long as I stick with my process.

So far, I only have 3 trades (current) that are losing me money (read update below for April 22).

The returns may be lower in percentage, but are very good in value.

Winners outweigh the losers, since I don’t risk more than 2% of my port in single leg overnight positions anymore.

Learning from this, I will aim to cut down single leg positions further to only 0.5% max of my capital.

Update: So far so good. So for the curious ones, here’s my short checklist…

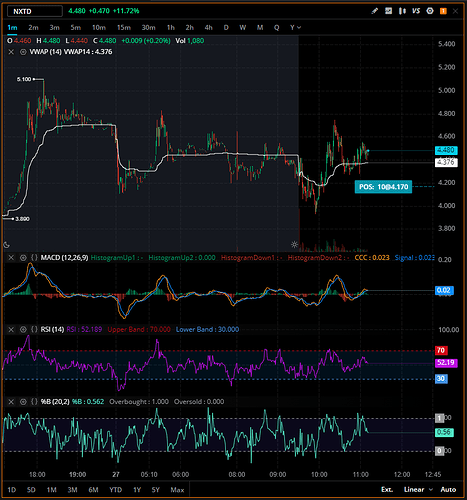

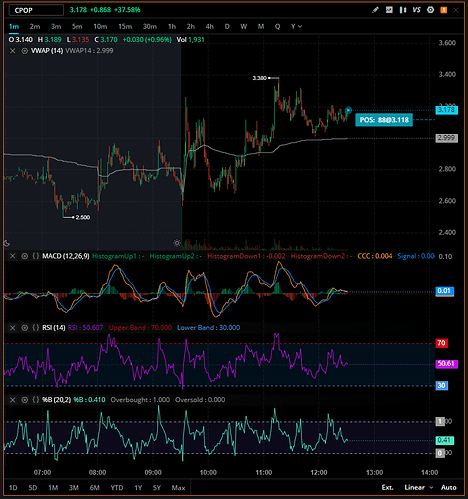

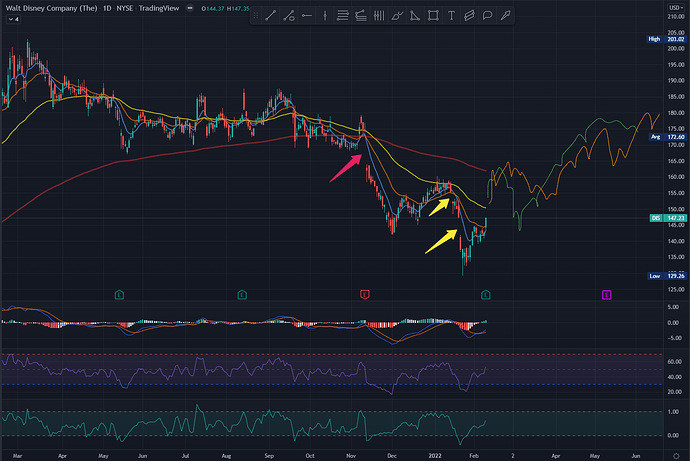

- Check the chart, what kind of pattern is it developing, I prefer an entry under $5 or $10, below vwap.

- News, what’s making it move, is it enough to attract new institutional buyers and retail fomo?

- Sentiment, reddit subs, twitter, stocktwits, discord servers, and if i have time then also youtube.

Update: Setting my own rules…

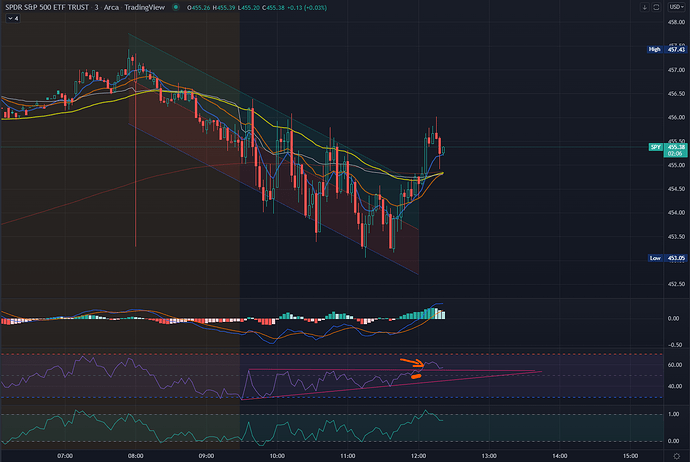

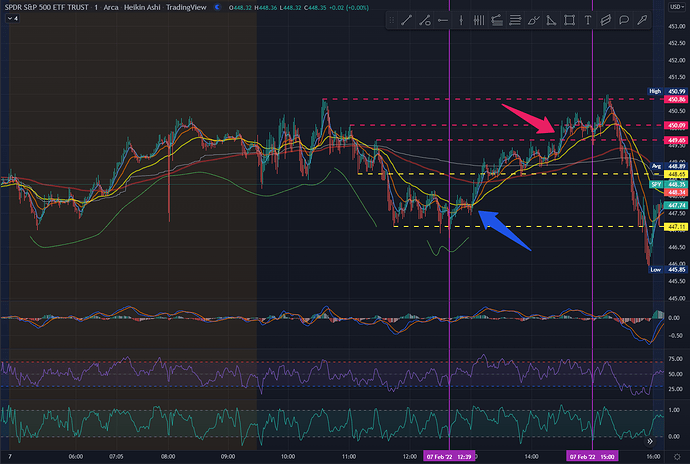

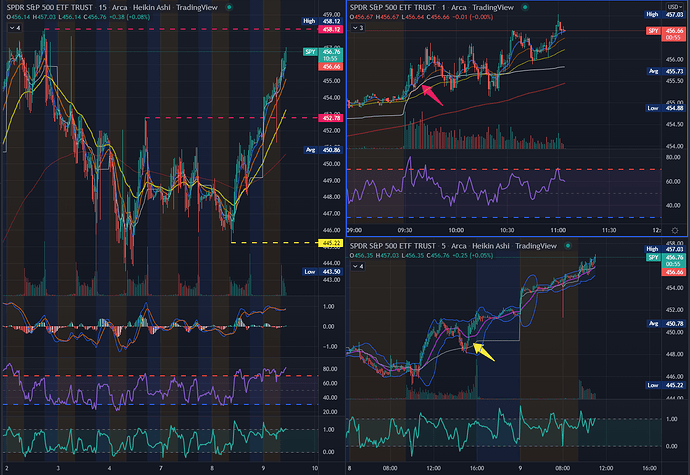

1a) I will only be playing Options on SPY and no other ticker.

1b) SPY will always/mostly be a Day Trade.1

1c) Overnight SPY positions will only be considered IF there’s a clear/expected market news/trend, and will never exceed $100 exposure.

2a) Shares will be played on other tickers.

2b) Positions will mostly be traded overnight.

2c) Larger positions may be considered for quick Day Trade scalps, if bullish momentum is great.

3a) SPAC/deSPAC positions will be minor–never more than 3-5% of the portfolio.

3b) SPAC/deSPAC positions must always be close to the NAV.

4a) ER plays are not counted–those are always gambles.

4b) Post ER-result trends may be considered.

5a) Crypto-currencies are not included.

5b) Leaps are also excluded.

Twice every week, I’ll be trading SPY. It will either be Monday and Thursday, or Tuesday and Friday.

In between, I will also be swinging momentum stocks overnight.

The challenge is to always cash out profits as soon as I see 25% gains, give or take.

On bullish days/seasons, the gains might be greater with expected volatility on the upside.

During choppy weeks, I will either be satisfied at 3-5% gains or just sit them out entirely.

My goal is to help myself grow on the conservative side.

The gambling side is already mature and full of losses, I assure you.

While I do enjoy my gains and growth on high-risk setups, longevity in the market is more desirable.

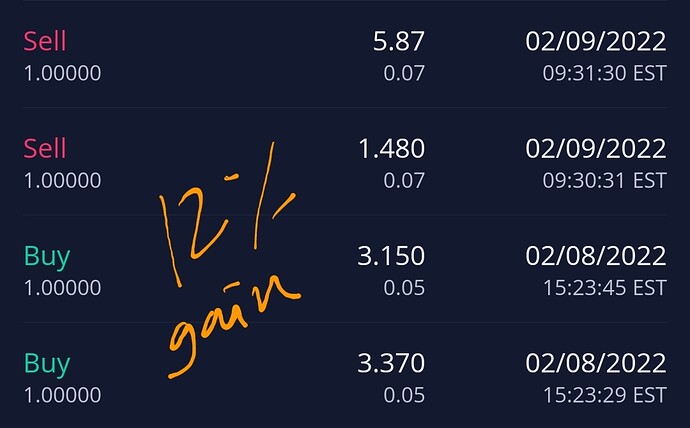

I started this challenge this week already with quite a pleasant outcome:

12/15 - SPY 2.95 call contract, sold at 5.37, 82% gain.

12/16 - SPY 0.6 put contract, sold at 1.42, 136% gain.

Obviously these gains are way off the 25% mark, but as mentioned above, some days are expected to gain more than others.

This week moved around the FOMC and QWD events and news.

Let’s see how things work out next week.