As am I

CPI numbers next week, probably not a bad idea.

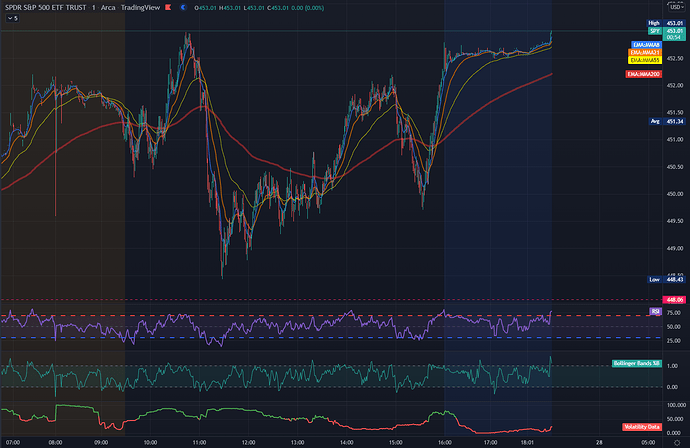

Just to be clear, market is still bullish on the shorter time frame.

Volatility is high, so higher gains to possibly secure–lower your risk capital.

But if I see a sell signal, I’ll probably take it right away.

Today is just a good start for me to measure things again.

Thanks for the CPI reminder, @thots_and_prayers !

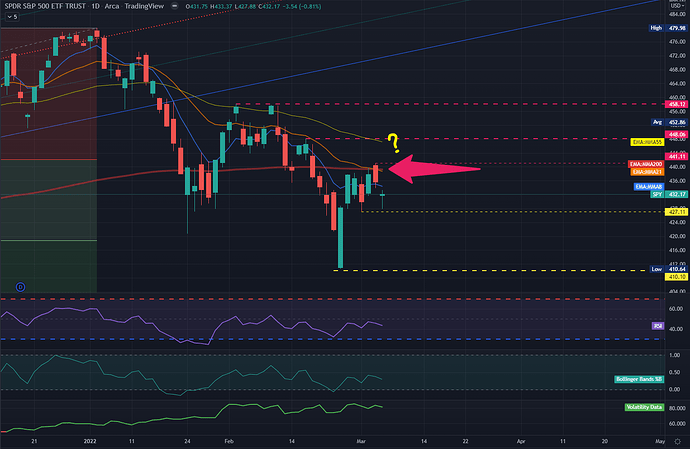

You told me 447 is the number you’re looking at, and I think that’s really good since the 55MMA lines up with that.

If the 55mma line breaks downward, that’s your genius right there, bud.

If it breaks upward, we can blame @Yongsooyuk6 for saving the market.

Quick view on SPY…

21 MMA line has started crossing down under the 200 MMA line.

It’s only a matter of time for the 55 line to cross down as well.

I’d wager this will be sooner now than later.

With the demand on electronics and batteries, I’m looking at gold, palladium, and copper.

Still have Chips and EV stocks as my top watchlists (since I don’t really know much about others).

Still choosing mostly cash at end of day, and only keeping a very small trading account–I withdraw every time I hit $5k.

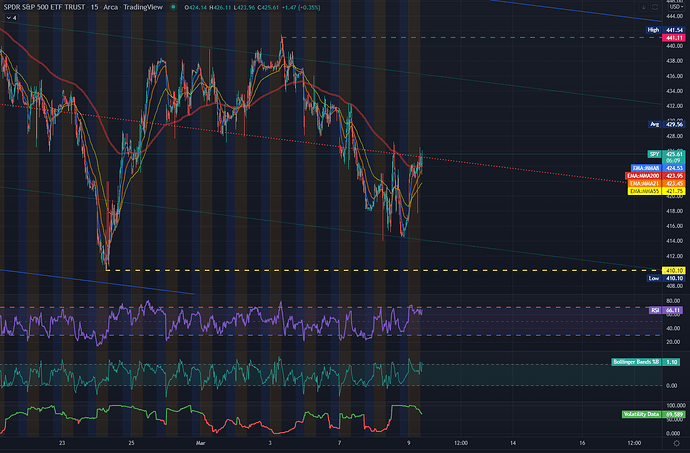

Green Market so far…

I’m watching out for Volume on SPY before 11AM to confirm a direction for the rest of the week.

Upside will push towards 432,

Downside will push it back to 410.

Without big volume today, it will just trade sideways ~1% until next week.

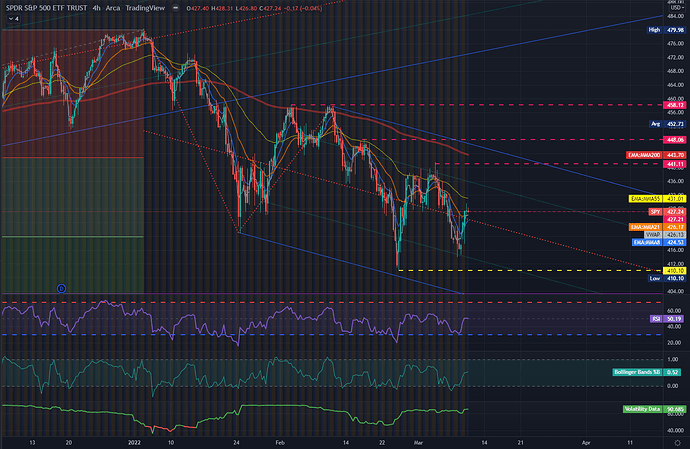

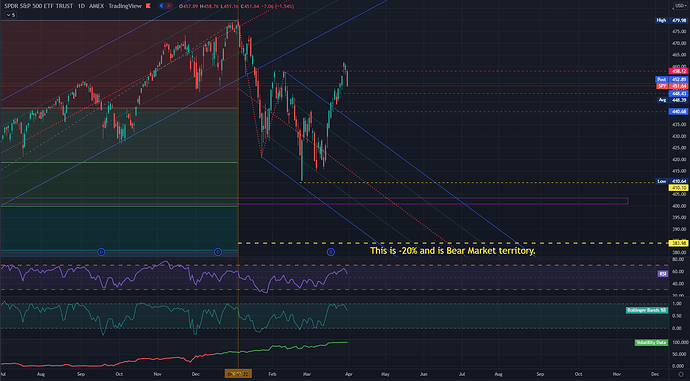

SPY confirmed that bounce on 414, right in line with the Schiff Pitchfork tool…

I expect this ETF to continue tracking within these lines for at least a few more weeks.

Can SPY drop out suddenly and lower than this current range? Probably, but that will be a flash crash.

Corrections are usually just up to 20%, but one of our major indices, the NASDAQ, has fallen way below that.

Any lower and further than 20% is official Bearmarket range–and that is usually confirmed by some folks in charge.

So for as long as SPY stays within this -20% from that peak of 479.98, I expect to see a bullish reversal soon enough.

That’s the time I’ll see SPY break out and upwards away from this pitchfork.

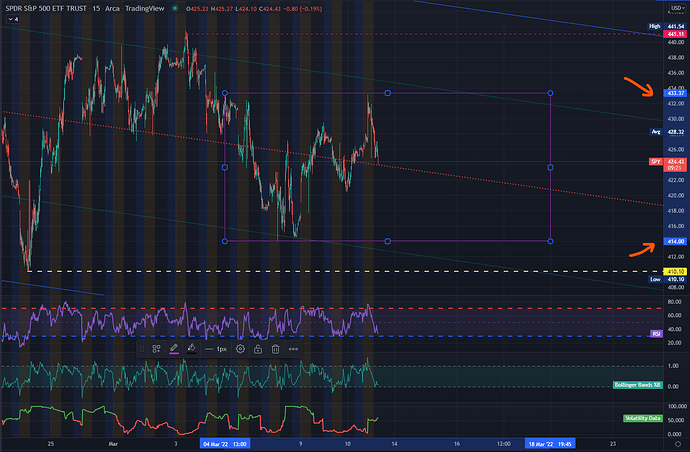

This is most likely SPY’s range for next week…

High Resistances of 430-433,

Low Supports of 410-414.

Got a spread at 428, and just hoping for a 5% return on Monday.

I’m out not and will enjoy the rest of the day.

Happy Weekend everyone! <3

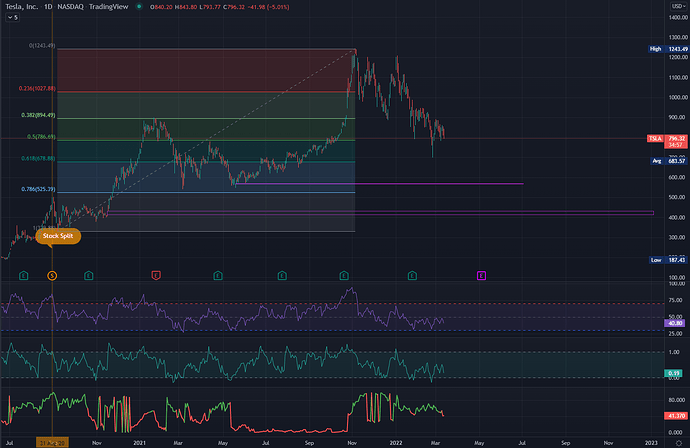

TSLA, these gaps are what I’m excited for…

Being the almost-perfect Data Acquisition and Modeling Company that they are atm, Tesla has a lot of room for potential growth in the decades to come.

But not until they give back enough of this stupid speculative gains.

The purple sections are gaps after they split the stock in August of 2020.

Time for puts

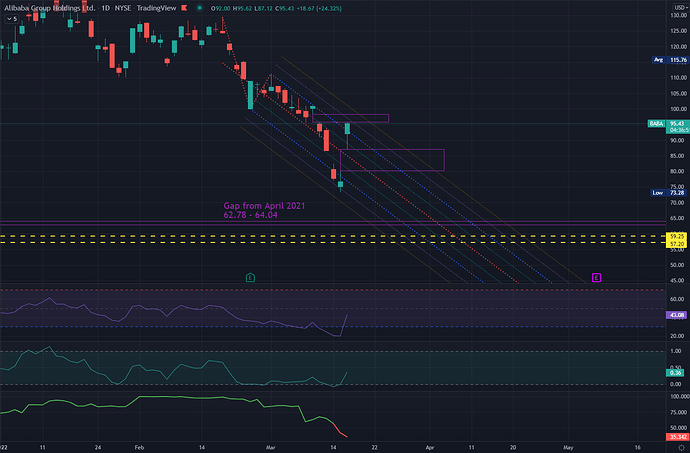

My wife is following a youtube channel that’s crazy about BABA, so I’m following this too…

Gaps are marked with purple rectangles.

April 2021 gap is still waiting down below.

Published my idea on TV:

I took several positions this week, with AMC being the biggest (2 legged strat)…

While I’m aggressive with AMC, I’m not betting on a one-way movement.

My bitch swings when she wants to, and she swings wild. Just the way I like it.

I checked CHPT’s options chain and I think there’s a good chance it will break the resistance of 18.96 and 19.98 soon.

I also have a dedicated thread for CHPT (leaps) that explain why I’m following it.

Adobe usually takes a few days post ER before making further big moves either way.

My put remains.

NIO and ATVI positions are explained in the Community Callouts thread.

As the server grows, we’ll slowly find better ways to document positions.

*I limit my single legged positions to under 1% of my capital.

My $452 calls better be paying next week ![]() Hopefully no bad news over the weekend

Hopefully no bad news over the weekend

Just want to remind myself this question:

When others are fearful, what do I do?

You probably look at the TA

Draw penis’ on your charts?

Why this is highly accurate, is best interpreted as a fap signal.

My SPY strangles 2days ago, paid today, and right at market close…

Now if today’s candle isn’t clear to you yet, let me spell it out–we are going down for a bit.

Support lines for next week will be 448.43 and 440.68.

You want to see SPY recover from those lines for it to remain stable and bullish.

Should SPY bounce hard, we might just see this cup keep running upwards.

Should SPY decide it’s time for it to rest along with the rest of the market, that gap to 400 will get filled.

The broader market is in a Rolling Crash like that of 2018, so secure profits when you see them.