Daily Comments

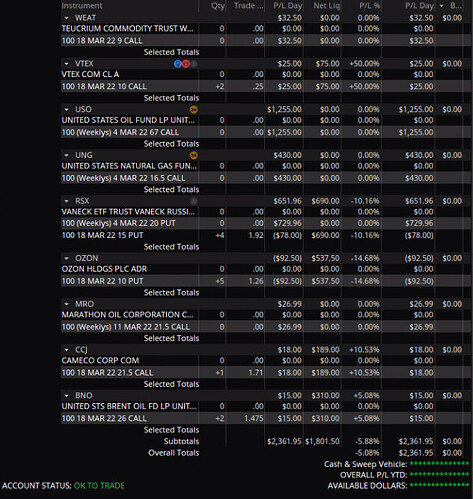

I wanted to offer a sincere “thank you” to everyone for sticking it out with me while I dealt with with some personal issues last week that then rolled into a bout with the flu. I’m finally back and feeling better and more with it and thus we’re back to these updates ![]() – Today was the payoff on a weeks worth of work in testing the waters on various plays and seeing what would be the most profitable given the unfortunate event that Russia invaded Ukraine. This is also the payoff for my “hover” strategy. Remember when I said being able to keep “around the same” balance is one of the best skills you can learn in trading? Well, this is why.

– Today was the payoff on a weeks worth of work in testing the waters on various plays and seeing what would be the most profitable given the unfortunate event that Russia invaded Ukraine. This is also the payoff for my “hover” strategy. Remember when I said being able to keep “around the same” balance is one of the best skills you can learn in trading? Well, this is why.

Play Breakdowns

WEAT

Took this play based off the DD in the following thread: Ukraine Invasion Plays: XOM, USO, LMT, RSX, CRWD, PANW, IRNT, etc

We learned that wheat is a primary export of Russia and that incoming sanctions could potentially spike the price of it. I was already averaged in pretty heavily to “Ukraine plays” so I only had $30 to take a call on this with. I noticed it was trading sideways and resisting downward SPY momentum so I invested what I had left in this since the call was cheap enough for my measly $25. Sold for +140% this AM.

VTEX

This was another attempt at showing people how to take these “earnings gambles” in a way that makes them either profitable or “free”. In this case I took 4x calls yesterday for an average of .20. I then rode the IV and momentum today and cut 2x calls for .40 each, essentially making my 2 remaining calls free.

Now the earnings report seems to have no effect on the stock, that could change, but I’m not betting on it one way or another. The point is that I’m not really “risking” anything should the trade go sideways now. If you’re addicted to gambling, this is how would should be playing these because they are absolutely gambles. We’ve done a lot of work on this front and people pretty consistently choose to ignore it and burn their money in the process and the end of the day, that’s their choice.

This will probably be one of the last “holding through earnings” plays that I take on. I’m just not interested in them to be honest unless the research is extremely concrete and that is super rare. These plays are a waste of money and hit to profitability and almost always nothing more. I’m in this to make money, I’m not in this to gamble. More on this in a second though.

USO

Sweet, sweet crude. Oil was the front-runner for a FOMO pop based on action in Ukraine. We spent a solid week trying to get a feel for the way the tickers moved off news, initially playing XOM. Half way through the week, we discovered that XOM had a tendency to sell off majorly intraday after AH spikes. Considering this, we looked for other options that could potentially be more stable and found USO which is an index for crude oil itself.

This paid off handsomely as not only the USO jump more off the news, it also remained more stable throughout the process, allowing for prime entries. We closed yesterday near our cost basis and today sold for $1,255.00, +141% profit.

UNG

Natural gas is another Russian export that could’ve potentially seen sanctions. I liked how cheap the options were on this play given that we were anticipating a gap upward. Similar to USO, we saw exactly that and my options were unloaded for $430.00, +76% profit.

RSX

@Droburt I believe had been playing this a lot of success. I wanted a play that would also take advantage of the downward momentum on Russia’s economy if they chose to invade as a way of sorta hedging my bets that the above resources would increase in price. This ETF didn’t disappoint. Sold this AM for $1,109, +191% profit.

Considering the full on invasion hasn’t happened yet, we’ve taken more puts on this play betting on continued sanctioning of Russia and more downward momentum in AH tonight.

OZON

After the success of the RSX play, @BBarna had the idea of trying to see which tickers in the ETF itself responded the most. After weeding through the others, I settled on OZON “Russia’s Amazon”. They undoubtedly are going to feel some pain from logistics hiccups and continued sanctions related to the conflict but hadn’t quite dropped as much as YNDX so I added puts on what looked to be a cliff it was going to fall over. However, later in the day very unexpected buy volume came in and pushed this one a bit higher. I took the opportunity to average down damn near the peak and I’m sitting pretty comfortably only slightly down on the position. After some analysis, its reasonable to assume that the later day volume was short profit taking and if that’s the case, we should be handsomely rewarded tomorrow if it continues its downward momentum.

MRO

I took this call after seeing TD call out that MRO was moving “the most” out of the oil companies. I didn’t want to place a large bet so I only held one call. It turns out my concerns with the companies themselves were warranted as MRO didn’t move nearly as much and ended up falling off an absolute cliff at open.

CCJ

Based of some information from @TheMadBeaker, I took a call on CCJ playing Uranium. Russia apparently exports a great deal of it to other countries and considering the issues with other energy sources, we may see supplies get further constrained and the prices continue to rise. In addition to this, CCJ themselves have noted that uranium is already facing a supply crisis that they don’t see letting up any time soon. I have only one of these and wish I would’ve bought more, but its better to have one than none.

BNO

After todays sanctions predictably didn’t include anything related to oil, it underwent the selloff we predicted, coming back to earth and hitting it’s trading prices on the previous day. However, I think this is probably and overreaction to the US stating that they’ll be controlling the price of oil. The conflict has not ended and further sanctions may be required as a result. Given then, the market will likely still spike oil as the conflict in Ukraine progresses. Since we’re still under the impression that things are going to further escalate, we made a perfect buy in at that support level and we’re prepared for another round of potential profit. We switched from USO to BNO as BNO simply moves somewhat better.

Closing Thoughts

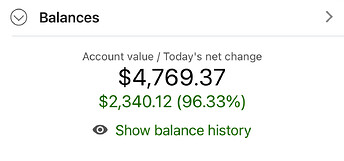

I again want to thank everyone that assisted with all the research for these plays. While it came during an event that is extremely unfortunate and sad, I am proud that our community was positioned properly. A lot of people lost a lot of money in the market today, but those people weren’t us. We played every part of this directionally correct and walked away with an incredible +96% profit on the day.

Trade like you have no heart, live like you have a massive one.

I mostly took it easy today, staying out of things that were potentially super volatile and was careful to keep a substantial cash balance instead of going right back in and trying to squeeze more profit out. This is something that is very important and something that has gotten me personally time and time again. You have to learn to take your wins and chill. My cash balance right now is $3,000 out of a total balance of $4,769. I kept my gains safe from my idiocy and as a result, I finished this day incredibly up and incredibly proud.

The other point that needs made is that when you are in a play, you need to be willing to cut when it’s met its end. 9 times out of 10 this means that when you get a gap from close, you must sell at open. This is a golden rule. If I had waited to offload these positions, I would’ve probably been closer to 50% up on the day, a substantial loss over my near 100% gains I have now. This lesson pairs perfectly with my blog post which I think you should read if you haven’t:

All in all, I’m mentally getting more with it again and I’m excited to continue to grow this account. I’m overjoyed to see so many people doing well and learning from the stream. Hopefully I haven’t disappointed too much. ![]()

Stats

Today: +96%

Week: +126%

Challenge Overall: +376%

Side note: I’m running on 0 sleep and I think that made this post a little ranty. My apologies lol.