Daily Comments

Well, that went well. I’m getting more and more used to streaming as the days go on and I’m getting more and more comfortable calling out plays as well.

Play Breakdowns

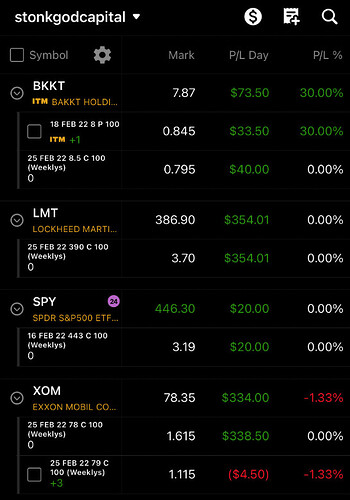

BKKT

Last night it was brought to my attention that BKKT was a candidate for a short squeeze. While it absolutely was, I wasn’t really sure that the stocks sentiment itself would really make that happen. After reviewing our forum DD on the earnings:

and

I concluded that this would probably get a sentiment bump in the AM. We cut calls near peak, pocketed some profit and moved on while it did its thing. However, later in the day it became clear that the sentiment was turning bearish ahead of earnings so we entered a put position of 2x puts. We rode them down and then cut one for a 26% gain and let the other one ride based on the earnings DD. While optimally, I would’ve held a slightly larger position and pocketed profit into the account and let a small amount of house money ride (let’s say having taken 4 puts, cut 3 of them for 26% and then had 1 free put and some pocketed profit), I’m still happy with having captured profit in the position which makes my singular put that I paid $78 for only cost about $55.

While it needs some further optimization, this was a proper example of playing an earnings report you’re confident in. However, there is a significant likelihood that I’ll wind up -$55 on this play when I would’ve been +$33. 9 times out of 10 its better to cut everything, but if you’re hell bent on gambling earnings, you need to get better at this strategy.

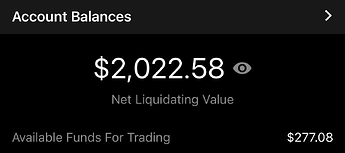

LMT

From Russia with love. While Russia didn’t end up invading Ukraine last night, tensions have continued to escalate creating more FOMO into LMT and giving us our beautiful crazy vertical run today of which we were perfectly positioned for:

This trade showcases how to combine news sentiment, technicals and proper trading strategy to catch extremely profitable plays. We averaged down between an end of day low and an intraday pullback, we identified early and inverse head and shoulders and bought the head (the low of the day) and had the confidence to buy both those times because we knew the news was still showing tensions escalating. Then we let our winner run and cut the almost absolute peak intraday by watching SPY and judging when it was done with its FOMC induced pop-off.

Slow, meticulously planned, precision trades are how you generate wealth.

I opted not to reenter LMT this evening because I didn’t want to risk the high amount of capital on the overnight hold when the stock is already so elevated. Instead we opted to make a better entry on XOM which is a stock that could see some correlated upward momentum should tensions continue to escalate.

SPY

FOMC minutes were today so I took a call earlier in the day at what I correctly read to be near the intraday bottom (SPY loves to essentially trade sideways into FOMC minutes releases). This was somewhat misplayed as theta chipped away at the call price itself throughout the day leaving me somewhat negative into the release. Had I waited until just before the release (roughly 1:45ish) I probably would’ve gotten a far better entry and made some more profit.

My home internet went out in the middle of the release so I cut this from my phone. Ended up turning a quick 20% profit on one FD call so I can’t complain.

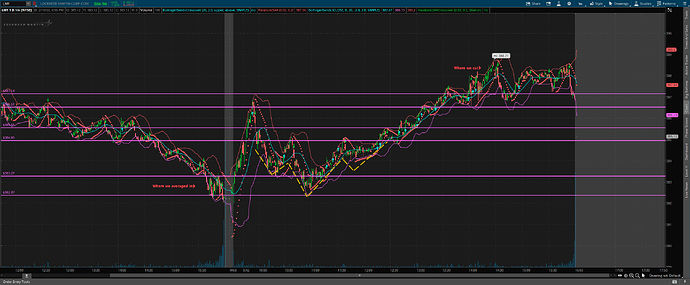

XOM

Alongside LMT, we had calls on XOM which experienced a similar run-up this morning based off of escalating Russia tensions. We cut the peak and basically left the stock alone for the rest of the day. A lot of times we feel like we need to keep playing the same ticker over and over again immediately but this is often a mistake:

We sold that early open peak and as you can see, if we had tried to take a reentry at almost any point today, we would’ve ended down. So because we moved on and concentrated on our more bullish prospects, we were then provided with an opportunity (and the capital to be able to make use of) a bounce off support just heading into close.

Closing Thoughts

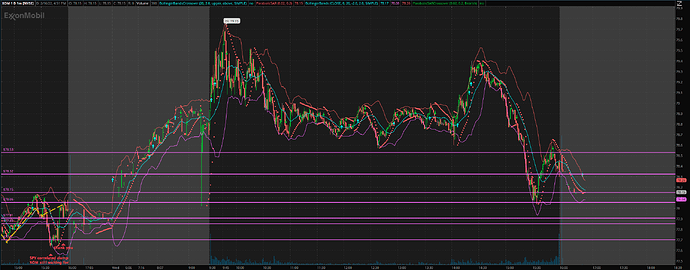

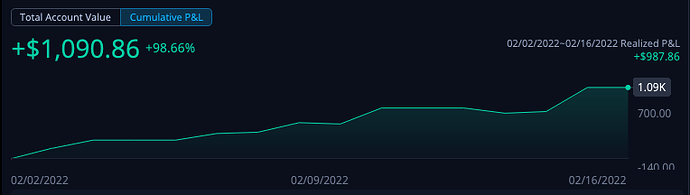

Its hilarious how proud I get of these small account gains. Crossing 100% today was pretty big for me, I’m not going to lie. The idea of streaming while trading has always put me off, so many things that can go wrong and the added pressure of knowing there are 100 something people focused on what I’m doing can easily distract from making profitable trades. But I think a balance has been achieved. I’m so proud of this community in this moment. I’ve got to watch the trading in the server get objectively better over the last week and a half. I’m seeing people trade more responsibly, regularly cash out gains and become more profitable traders as a result.

This is what we do this for. For all the negative that people have said about this place recently, at the end of the day this has always been what our community has been about; genuinely helping people to better their lives through trading. I’m proud of you guys, all of you and thank you for your support when things may have not looked so bright. Your belief in me is not something that is lost on me at all, in fact its something that I think about very often.

The best retail trading community in existence.

Stats

Today: +69%

Week: +68%

Challenge Overall: +102%