With ER coming up on May 9, AMC is already trying to get out of the broader market’s influence…

Here’s the 1min chart, and SPY is the orange line…

It’s held up quite well on this $15 support line this week…

Latest News related to AMC:

With ER coming up on May 9, AMC is already trying to get out of the broader market’s influence…

Here’s the 1min chart, and SPY is the orange line…

It’s held up quite well on this $15 support line this week…

Latest News related to AMC:

They’re really going for the most passionate groupies now…

AMC, premiums have started ramping up again…

Hey dude…

HYMC had their earnings today and it’s mooning. This should be bullish for our AMC, ya?

https://twitter.com/realwillmeade/status/1521978310267486212?t=z_hcNKZJtYq0xadJjfSUMQ&s=19

Not necessarily.

Retardedly, yes.

HYMC up almost 30% AH. No doubt justified by the fact that they miraculously produced ~$10M worth of gold and $400K in silver from an inoperative mine.

Given the meme value of this MOASS-adjacent ticker, may gap up tomorrow even more, so should provide scalping opportunities it as it goes up more, and then ride it back down again. Especially if it hits $3.

Tf they found gold? Adam Aron going to be driving a CAT D12 dozer on next season of gold rush

Despite a few moments of excitement since the end-of-March spike, AMC has been on a steady downtrend, and almost back to prior support levels.

The option flow is bearish but not a lot of premium flowing.

Earnings are on Monday. Those 01/2023 deep ITM calls are looking kind of enticing. What do folks think? @rexxxar ? ![]()

I went with 15c 5/27. Only 5 of them for now.

This movement affirms my idea of Market Fatigue already weighing down on retail sentiment.

Just grabbing some positions now to collect premiums for their ER sometime in the next few days.

Thanks bud!

ER was apparently announced last April 29, as shared by @TheMadBeaker on TF…

AMC, the current 1hour pattern is moving like a fractal to your observation on March 10…

You’re letting your calls through the earnings or selling on Monday

I’ll most likely close the the May13 ones, and hold the May27 bag.

Mixed reviews starting to pile up on Dr. Strange: Multiverse of Madness.

Not a unanimous applause for this one.

Might reflect in the numbers in the coming weeks, and may even have a minor impact in AMC’s ER tone next week.

I got a bunch of strangles, just to collect premiums, but I don’t believe enthusiasm is high enough to expect a great bullish sentiment post ER.

Just my 2 cents.

IV move is over 20% for June.

So this either goes back to try 30 in the next few weeks, or finally completes its cooldown back to $1.

Amen to that. Prices have come back to the baseline levels (below), and difficult to see it stick around there. Frankly unless they now discover diamonds in the inoperative gold mine they acquired, I’d bet on the trek to $1. But we’ll know Monday.

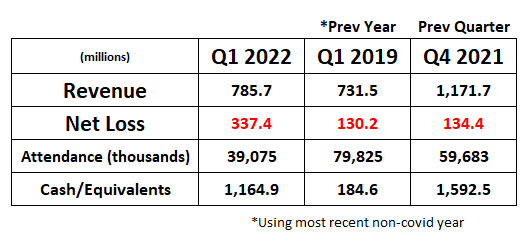

From their latest financials, compared to a quarter ago:

At least they have not increased absolute debt levels… still at 5.5B.

With quarterly net loss at 337M, they don’t really have a choice but to raise as debt markets are hella expensive now, and not like they have the cashflow to service more debt. Btw they already went from 400M outstanding shares to 515M outstanding shares in the course of a year.

Frankly, even though they have survived the pandemic, I don’t know how they will survive.

Prices were up 5% AH, which seems like a tepid response.

Feels like it should go down, now.

I posted this in TF AH when their numbers came out but also posting here.

As Ni said, their cash levels are decreasing. Obviously due to a good chunk being used in operating activities and also 20mil or something to that degree iirc for HYMC.

The biggest thing for me is this. The company continues to bleed money every quarter. They don’t have any more shares to sell (under 50k or something iirc) and to sell more it would need shareholder approval. AFAIK, they do not have a proposal to allow that for this year so I believe that option is off the table.

Their attendance levels are pretty bad.

Attendance (in thousands)

2021: 128,547

2020: 75,190

2019: 356,443

2018: 358,901

2017: 346,763

Just looking at 2019 Q1 (most recent pre-covid level) and their most recent thats 79.8mil vs 39.1mil. Essentially half of 2019.

Attendance (in thousands)

Q1 2022: 39,075

Q4 2021: 59,683

Q3 2021: 39,999

Q2 2021: 22,068

Q1 2021: 6,797

Attendance (in thousands)

Q1 2019: 79,825

Q2 2019: 96,955

Q3 2019: 87,100

Q4 2019: 92,563

For them to reach 2019 levels, they would need to have 3 straight quarters of their best performance ever. And even then it still be a maybe if they are profitable.

It’s honestly amazing that this stock has held its price in the double digits for this long. Barring a fundamental change to its business model, this has alot more room to fall imo.

Superb context, @Shadowstars - thanks!

Yesterday’s ER call was specifically a talk for the great retard shareholders.

*retail

It’s all meme power from this point forward until cash reserves start piling back up.

Be careful being too bearish on this one. Watch the price trend and ride whatever that is.

Better yet, just play another ticker that may be easier to read.

With most tutes on the fence at making big purchases in this current state of the market, don’t bet on a big bullish pump either.

It may just be retards on retards trading here.

*retail on retail

Damned typos.