AN - AutoNation

This is my personal opinion, do your own research, yada yada yada.

Im going to keep this brief and continue to add more as the research continues. Im also going to update the post with current indicators as they move so it is easy to see any trends all in one place.

Ive been looking into the auto market for the last few weeks and I believe there are challenges that the market has not priced in yet.

My opinion is that the auto industry is due for a haircut due to macro conditions. (If you are still not completely up to speed on the current macro landscape, start with the inflation leading to stagflation post then head over to the stagflation leading to recession Kodiak Bear Thesis. I know you have to chew through them, but the analysis in the comments from many members in Valhalla is where the real value comes from IMO.)

There are a few statistics I want to share about the auto market that led me to AN.

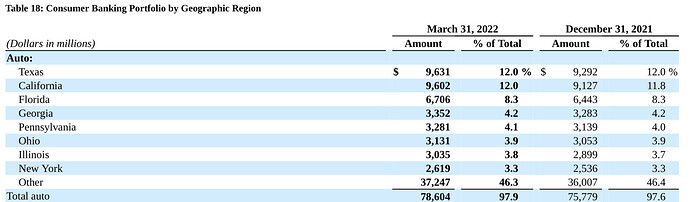

American’s currently hold over 1.4 trillion dollars in auto loan debt. This has continued to climb since the GFC in 08. For a comparison, this number in 2010 was 670 billion.

Of that 1.4 trillion in debt, 46% are underwater.

That surprised me, but even more so when you consider that used cars YoY have been up over 30%.

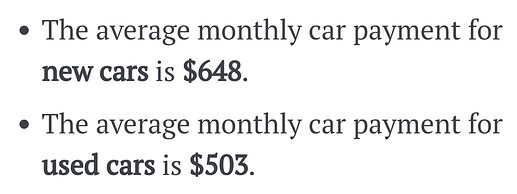

According to bankrate here is the breakdown of average car payments currently in the US.

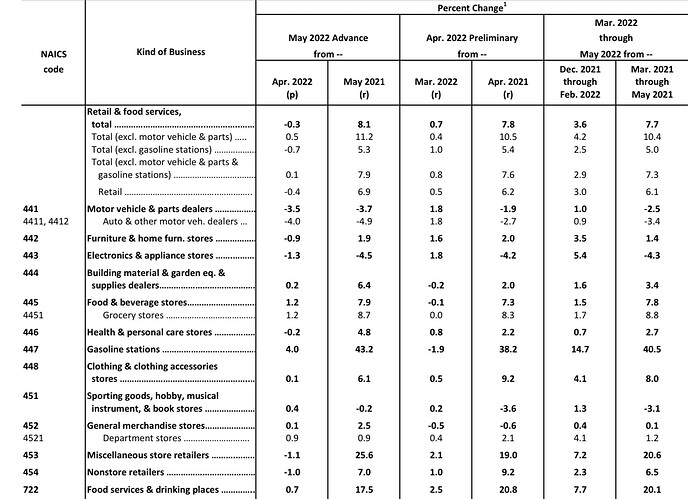

Both new and used monthly payments show double digit percentage increases YoY, this is obviously concerning because regardless of what heppens in the economy, Americans will have this payment for awhile. The average maturity on an auto loan right now is just shy of 6 years. While the average purchase price has climed to $37k, a new ATH.

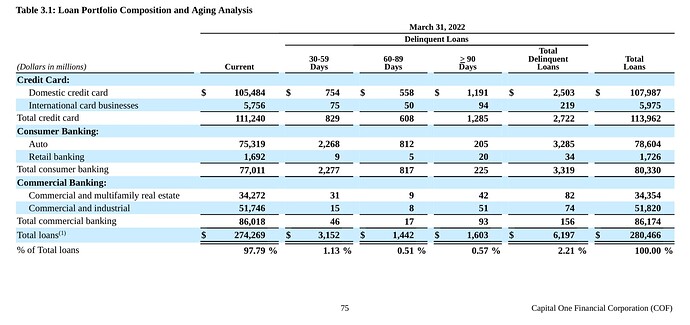

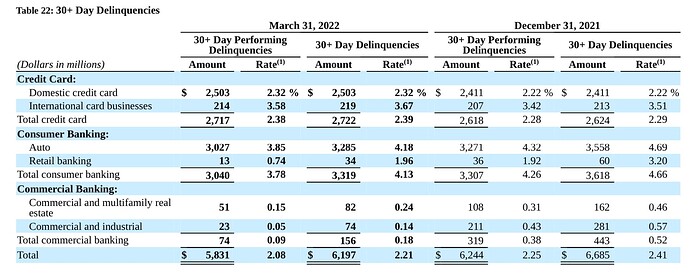

As we know, American’s personal finances have been getting squeezed from inflation. We now have the lowest saving rates in the US with the highest ever consumer debt. We can see this already impacting the auto lending world.

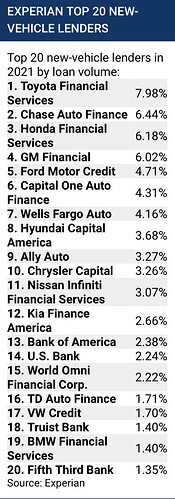

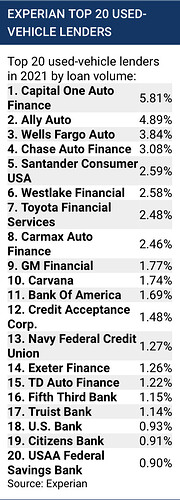

According to Experian as of last month, Sub prime auto defaults are at the highest levels since covid April 2020, while the broad auto lending market just saw its first increase in default rates since April 2020.

The federal reserve also plays a big role in the auto market. Everytime the fed raises the fed funds rate, auto interest rates obviously move up too. This is the main tool they use to lower demand and it instantly affects the auto market.

As I was trying to figure out how lenders could easily roll old loan balances into new loans on a car, usually one of the fastest depreciating assets, I came across something interesting in the Dodd Frank Act of 2009.

The Dodd-Frank Wall Street Reform and Consumer Protection Act was inacted in 2010. You can read about it here:

There are alot of pieces to Dodd Frank but the main purpose was to limit risk in our financial markets by inacting widspread regulations and opening up transparency for the consumer. One of the key pieces was to regulate the preditory lending practices we all saw in 2008, think “ninja loans”.

What I thought was interesting is these regulations hit nearly the entire financial market, except the auto industry. Its as if we cant help ourselves. The auto industry and lending practices are largely regulated on a state by state basis and leave most of the oversight to the lender.

I believe this has created a perfect storm due to the fact that most car dealerships in America are now also in house auto brokers. Meaning the dealership that needs to sell cars to survive is also the lender setting up the loans and is also supposed to be the one oversight body protecting the consumer. This is a pyromaniac fire chief scinerio.

Quite frankly it is the wild west out there in the auto lending world. I came across a number of ads looking for data like this one:

I think this has largely gone on due to obvious lack of regulation, fiscal stimulas, and easy money monetary policy, as well as the securitization of auto loans. Securitization is the process of packaging lots of small loans into a basket of that can be bought and sold on the open market.

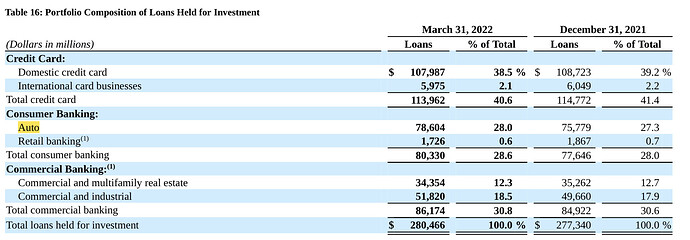

The main pain point with securitization is the lenders that are writing the loan typically dont keep them on their own balance sheet. They are sold quickly and the risk is transferred. This is a sweetheart deal for the lenders and dealerships. Auto backed securities issuance has been very popular lately. YTD is up 20% YoY

Volkswagen just today announced they are preparing a 1 Billion dollar issuance on 47k leased vehicle contracts. Leased, I didnt know that was something that would be put in a bond but here we are. Ofcourse this only works well until it doesnt, as defaults rise, these auto backed securities fall, and new issuance gets more difficult due to risk premium.

AutoNation - AN

AutoNation is a big player. 300 dealerships nationwide. When thinking about an auto market play I like AutoNation for a few key reasons.

#1 -

AutoNation’s bussiness has been booming due to inflated used vehicles prices. Throughout the industy margins have been very strong. However, I do not believe that is sustainable and I also dont believe any retail company should be beating the S&P 500 in 2022. AutoNation is -8% YTD, compared to the S&P 500 sitting at -15%.

#2 - AutoNation’s rental car exposure.

AutoNation owns Spirit Rent A Car, Value Rent A Car, and Snappy Car rental. I believe the rental car business will also continue to feel the effects of the macro landscape.

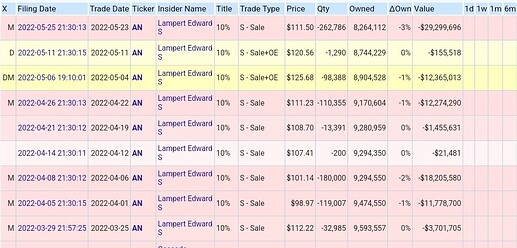

#3- Big insider selling.

One of AutoNations 10%+ equity owners has been selling pretty consistently these past few months. The most recent on 5/23 was worth 29 Million.

I believe the auto industry will not be immune to the economic challenges the country faces and should be priced accordingly.

There are couple main risks I see with this play. As mentioned above, used cars have been highly inflated, I believe US housholds start to become less enthusiastic about purchasing new vehicles based on affordability, leading to softer demand, but the supply side is harder to discern. Right now inventory is awful, and could potentially stay there as new vehicles feel the pain from material shortages. AutoNation has done well with this so something to watch.

There is also risk being bearish on a large relatively healthy company. The financials dont look to bad right now due to their recent windfall, and their P/E ratio sits at 5.72.

We also have a great bull case from @jjcox82

That can be found here AN the giant of what is Automotive retail

This is best case scinerio as we can fully understand both sides of this trade. I appreciate you bringing your experience and great perspective @jjcox82

I dont expect AN to go bankrupt, I just think given the challenges the country and auto industry faces, moving foward AN’s evaluation will change. Cars will continue to become less and less affordable as monthy budgets get squeezed and monthly auto payments continue to rise from the feds tightening cycle. If 46% of all auto loans are currently under water, that means a large number of Americans may not have access to the credit necessary to roll over negative equity, meaning they will be forced to stay in the vehicle, taking them out of the market completely. I also anticipate the thick margins they have enjoyed will start to decline from higher gas prices transporting vehicles and the COGS increasing as they continue to replace inventory.

Im playing long puts, very light position currently. Looking to continue to average into July / October strikes. This play may take time to develop, I think the strongest indicators will be fed funds rate, auto loan delinquencies, and used vehicle Inventories. I will be using these as a temperature gauge for position size and timing.

OI on the chain is weak, but as Ive learned from other plays this year, that can change quickly.

Looking forward to hearing and thoughts.