This play isnt as much where the auto market is currently but where I believe it will be in a few months, although it does look like things are moving rather quickly. I see similarities to the airline industry earlier this year.

In feb the CEO of Delta paraded around saying demand had never looked better. The problem was higher crude prices were being passed to the front end consumer while macro conditions affecting things like real wages and discretionary income. I see the same headwinds here. This is really a play that the windfall the auto industry has enjoyed these last few years is not sustainable and should be reflected in their evaluations.

People wont stop buying cars, but they will buy less and will buy less expensive options. AN will undoubtedly feel the pain from both IMO.

Took profits on this round of AN puts at 53%

Will look for another entry most likely next week

I agree there will definitely be a slow down in the industry which personal sucks for me. But have been strategically watching my inventory and cost so stay ahead of it. However I do not believe there will be a huge decline in profits until supply level catches up. Which is more a when not if. However I do not think it’s gonna be reflected in this quarters earnings as market is hot.

AN has been beaten down pretty bad by the market with really no bearish news. Currently not real far from their 52 week low which in my opinion is undervalued based on their continual profitability. Coupled with the fact they are the fastest growing dealer group in regards to add rooftops.

That being said august chain came available. I took a August 120c near the bottom. I highly doubt I hold til august as my ADHD and boredom. And if it has any kind of bounce back will cut and look for reentrys.

Also most importantly you played this really well nice work @TheHouse

I think you are right, a slowdown for sure, but used cars should remain money makers so long as inventory remains soft. I also want to mention I work in an industry at my main gig that is highly sensitive to economic slowdowns, so by no means taking any shots.

I also think you are right about their financials. They do look strong and will weather the storm, I just think they may look a little weaker before the end of the year. I did see the Aug strikes today, looking to see what the recent price action will do to the chain.

As always, very much appreciated. I have traded AN way more cautiously due to your valuable insight and experience.

No worries. I didn’t take it as a shot. I’ve known since last year that all started that it wouldn’t last forever. I’ve told all my employees to be prepared save and. It expect to have continued like it is. I’ve been in the business for 16 years now and have never seen anything like it. However I have been through some major downturns specifically 08 and similar catalysts high gas prices low inventory at that point due to GM and Chrysler bankruptcy. And most good dealers will be ahead of the game.

Also side note keep an eye on KMX. Earnings on 6/24. Not near as profitable as AN and strictly only used cars which new cars have consistently had highest GPU now a days. So their profits should stay consistent with Q1. But might be a sign of any kind of slowdown on used side. Although they have been burying themselves in inventory for the last year so they may actually see a steady volume but much lower GPU.

AN seemed to rebound from that 104 range with pretty steady rise. Seemed to buck SPY and the market on the down swings. Could be a point to watch on the next inevitable downswing. Up at one point 50% on the august 120cs really was hard to not unload. Wil look to take profit next week on bullish day. If not plenty of things can happen in next couple months. But seems that range could be a sell point for puts in my opinion.

I grabbed a 125c august 19th LAD posts their 2 quarter ER on the 20th and AN 21st of July. LAD should give us a gauge of where AN is going to come in. I think both beat as months April may and June were solid months and showed very little slow down.

I do think a slowdown is coming Q3. Will watch AN and LAD for a bounce from Q2 for our entry for Q4

Pretty decent article highlighting some of the same data points in this thread and how they are progressing. AN has earnings in a few weeks, I would like to have another entry soon.

Any thoughts on best option strategy here? OI on the chain still hasnt moved much, if there isnt much OI and a drawdown isnt broadly anticipated, would it be worth holding through earnings? Thanks in advanced!

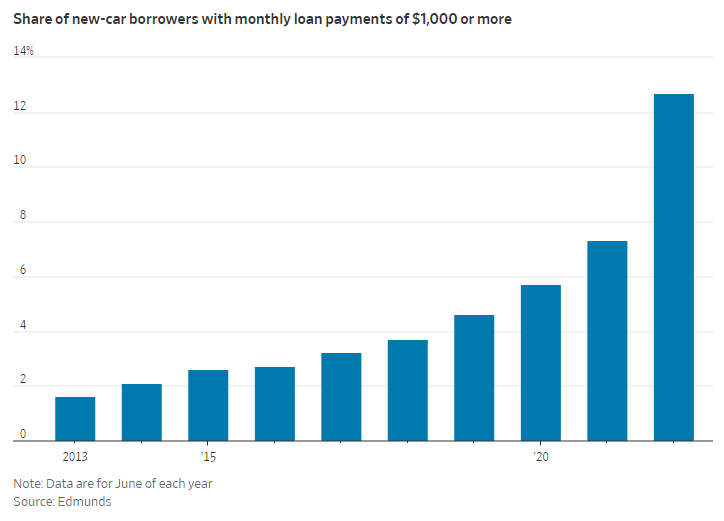

To go along with your article, this also appears to be a red flag:

In my opinion both of these are good points but are more bearish to the lenders we discussed above. COF ALLY etc. The dealer is off the hook once loans are funded by the lender. People signing up for 1000 dollar a month loans is actually bullish for dealer groups. Means GPU (gross per unit) is still up the higher the selling price larger the gross typically. Also means demand is still there. Currently to get a car at slowly increasing rates leads to higher payments and consumers are still doing it that means dealer groups are still pumping rides out.

I think to your point if there are strong ER I’m coming weeks there would be an opportunity to the downside after I’d fully expect a decline in automotive for last half of this year. Especially if rates continue to climb. When lenders start to see repo rates rise which happened a lot in 08-09 they tighten lending guidelines this tends to hurt dealers and retailers.

With LTVs (loan to values) being so out of it in regards to reality of where they should be ie used cars being given loans for more than the cars cost new and rise of default puts the banks in a tough position because if the elevated value market crashes the losses on the repos increases. All things to watch for in months ahead.

Circling back on this AN and LAD have relatively little OI still on their chain being August strikes and plenty of time til expiry. With relatively little IV I am currently sitting on an LAD 320c with premarket Print tomorrow. And a AN 120c that I have had for about a week it is deep ITM now I grabbed it at about 110 underlying. It’s currently up 90 percent if LAD has solid print I will hold the AN call through their Thursday ER. If LAD is soft will cut the AN.

I’d expect fairly solid numbers from them both for Q2 and more likely a drop off on Q3 but I’ll continue to keep y’all posted on how the car market is progressing. Currently July has shown no signs of letting up across our dealer group as a whole. Volume is still accelerated and GPU is only slightly down.

AN showed a pretty big decline yesterday and is now on my strike list for a position again. Im looking at the broader market direction first.

Wanted to update on this as you posted you are watching AN. Firstly you probably know this chart way better than me. I don’t really watch it al that often becuase the volume is so slow. However since I consider you one of my boys. I wanted to take sometime to contribute my insight here. I am limp dick here with no skin in the game this time ![]() . However I always enjoy the knowledge and discussion you provide. I’m not bull or bear here. I’m just going to post the actual numbers I have at my disposal. And if they shake out like your thesis I’ll bear the shit out of these guys too.

. However I always enjoy the knowledge and discussion you provide. I’m not bull or bear here. I’m just going to post the actual numbers I have at my disposal. And if they shake out like your thesis I’ll bear the shit out of these guys too.

CVNA and KMX obviously took a beating this week as most of us have saw. However I largely seperate those two from the AN LAD type tickers. Mostly because LAD and AN post profits and the other two do not. Secondly because the CVNA and KMX only sell used cars. And frankly the large profit center of any dealer right now is the new car department.

So I like to consider the group I work for as a mini type of AN we have 9 rooftops and 8 brands. So what I did was looked at our quarter new /used and gross profits. Granted geographical circumstances come into play here as dealers in different parts of the country experience different economic climates. If you’ve ever heard the saying” if it plays in the Midwest “ it plays anywhere. So I’d say the middle of the country is a good gauge on most stuff.

But wanted to share the data either way bullish/bearish no matter what because I have it and if I can help anyone profit one way or the other I’m happy to do so.

So what I looked at was my groups quarter new car sales used car sales and total gross profit YOY so comparing July/August/September of 2021 to the same 2022. 2021 was literally the roaring years of auto biz since I’ve been doing it since 2006. It’s largely continued for most of 2022 until…. September. Was our first non record profit month in last 2 years. Volume softened as inventory grew used mostly. New is still largely non existent. This is what makes me hesitant on the likes of AN and LAD to be overly bearish compared to KMX and CVNA. If supply is still stagnant on New then the profiteering will still exist.

Here are the numbers. These are sales numbers only do not reflect parts or service.

July 2021

New- 419 units

Used- 525 units

Gross profit-5.3 million.

August 2021

New- 353

Used-400

Gross-4.4 million

September 2021

New- 358

Used-513

Gross-4.8 million

July 2022

New- 347

Used- 592

Gross-4.9 million

August 2022

New- 391

Used-579

Gross-4.8 millions

September 2022 these are as of this morning. So today could have some variance here.

New- 335

Used-497

Gross- 4.2 million

So here’s the totals for those who don’t math that reads this.

2021

New-1130

Used- 1438

Gross-14.5 million

2022

New-1096

Used- 1684

Gross-13.9 million

So as we look here the volume is actually up overall however the gross is down excluded today. Which is rough til 250k

So for Q3 we are looking at 14+ million.

Largely pretty stinking close to 2021. Interesting as this is first time I’ve ever looked at these numbers by the quarter that used is up fairly decent over new. New cars are out of dealers control and reliant on manufacturer. However the GPU on new is huge compared to used currently.

Largely my conclusion is I’m not sure about AN they could beat again and still be running strong. Being as they are all new car stores.

Going to be watching this with you. From curiosity standpoint. I also wholly think AN is largely undervalued based upon their EPS and history of profiting and well run machine in comparison to other auto tickers. And if it does drop more from

Here I’d add them in my IRA for sure.

As they say in the casino. The house always wins.

This is amazing info, I would love to see how these trends evolve. I appreciate as always your industry insight and perspective.

Im going to give an update on where my current thoughts are and why I jumped in a position today after leaving it alone for a few months. AN is now on my strike list, meaning if the market is trending red ill be looking to catch longer legs down with swings and on steep broad market decline days Ill be looking for scalps. I anticipate in both cases AN will follow the market but decline with steeper declines.

Ive had them on my watchlist everyday since I wrote this thesis. But as mentioned in this thread I have only played a few times this year. There has been minimal stock movement and little OI. AN actually hit an ATH last month.

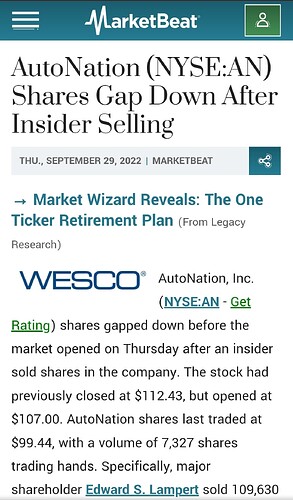

But then this happened 2 days ago

So what caused the -10.56% drop on Sep 28th? The largest single day drop in AN since March 18th, 2020, Covid hell week?

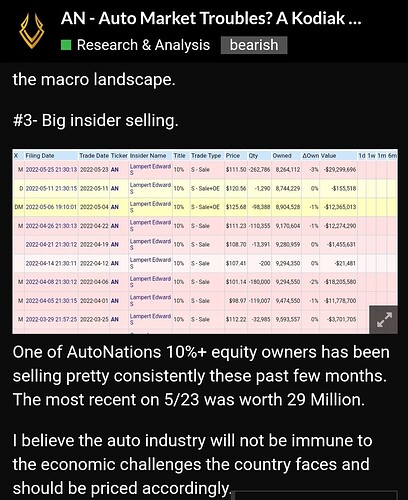

Big time insider selling.

Hmmmm where have we seen this before?

Oh thats right, he has been selling shares all year and I wrote about it in June

Outside of indexes I have been playing swing and scalp puts on CCL, ARKK, DAL, PTON, and HYG off and on nearly all year. I watch them daily to get familiar with how they move and interact with other indicators as well as key levels and potential entries. I believe AN will be another great long term bear opportunity to take advantage of what I belive is a unbelievable overpricing.

There are 2 main fundamental angles im thinking about AN, but first, lets look at a weekly AN chart.

We are looking at 3 years here. Unbelievable growth fuled by euphoric demand, booming revenue, and fat margins leading to higher and higher profits.

But the last 2 year performance of the auto industry has largely been artifically stumulated by fiscal and monetary policy.

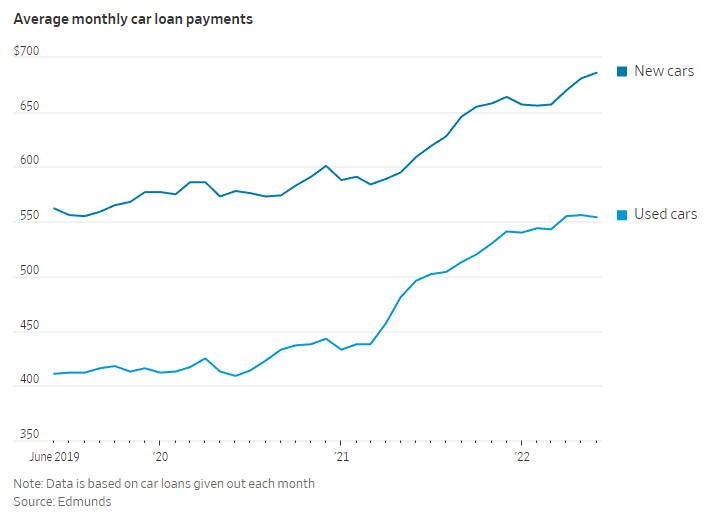

The auto industry is extreamly sensitive to higher interest rates. American’s shop monthly payments not prices, every time the fed raises rates it makes the vast majority of monthly auto payments go up with them, just like the housing market and how is that going?

We already know from credit data I posted in the Stag thread that consumer financing fell off a cliff last month, this is including auto loans.

This screams of less demand and a consumer that is tapped out. How did we think this was going end? Avg auto loans are currently over $700/month with inflation squeezing housholds and wages falling behind. Less demand is what we are seeing all over the economy, again the auto industry is not immune to this even with supply issues.

One more important chart. This is what happens to an industry that allows everyone to have access to cheap credit for 14 years highly unregulated, while selling auto loan backed securities back to the poor fucks in their “diversified” mutual funds all while they are currently underwater on those said loans, which have become increasingly less affordable.

I would assume rolling negative equity from a previous loan to a new loan on a quickly depreciating asset in a sustained low intrest environment over a long period of time isnt a good thing.

Am I saying they are going out of business? nope.

Im I saying this is timing a imminent crash?

nope.

Am I saying Im playing it every day?

nope.

My belief is, AN is currently priced like the recent fiscal policy tailwinds as well as long term monetary policy / credit tailwinds in strong economic conditions will go on forever, this obviously is not the case, AN needs to be priced accordingly.

I think a 2019 demand / balance sheet forcast is a more than reasonable place to start, that puts AN about -40% from here. I think it is more likely it goes lower than that but ill ultimately just play as much downside it will give me

Im going to be trading AN only when its moving, swings for slower bleeds, scalps on big decline event days. when its not moving I just watch and wait for the next leg down. Move to my trades that are moving. These are the plays that I love because the risk reward is as good as I have found.

Heres how im playing it with risk management/ capital preservation strategies that have been working well for me.

All entries into legs are further DTE, closer strikes, and smaller position sizing. Giving few day window for trade to form. If it doesnt form or broad market is rallying, cut position, play the upside to broad market rally. This gives us a realistic shot at being net positive on a consistent basis

Just like earlier this year Ill be waiting as long as it takes and have strike money ready to buy into the next leg down, again, with smaller position size, closer strike, and further DTE at first. Ill be paying attention to broad market moves and developments, outside of company/sector news or earnings the broader market will be guiding the direction of AN. If/when the trade goes my way I will change positions to maximize profits.

Rinse and repeat paying attention to technicals.

If im dead wrong that means I had a few starter positions that didnt pan out and AN sat on my watch list too long. If im right, it will be highly profitable over a long period of time.

I have no doubts you will come out profitable. Was closing out September today and looking back at my stores performance versus objective and planning goal and forecast for upcoming month. I was thinking historically and when I say historically I try to base all of my forecasts based upon not the last two years of craziness.

August and September are perennially two of the tougher Auto months of the year. Along with January and February. Then year end is typically go out with a bang end of year push. So I should have expected a slight September swoon. Why I largely don’t expect AN to fail as badly as CVNA and KMX is inventory acquisition costs. So for example most used car purchases take junk trades in CVNA KMX only used. So they have to be almost creative to acquire inventory in other ways. Such as auction or from consumers. Let’s face consumers aren’t dumb. We all know our cars are worth a lot right now. So they pay up. However there are ways for AN having new cars to sufficiently acquire cars to succeed. We have had tremendous success keeping our volume and profit numbers up by purchasing cars from the closed OEM auctions. This means only dealers that have that brand can buy cars from this sale. Used car dealers can’t even bid on them. We typically carry about 60 percent of our inventory of these late model cars. So acquisition cost is lower. Less bidders equals lower costs.

They also sell new cars. There are creative ways for dealers to shift dollars around on a new car purchase to effectively take in the trade.

Second thing I started thinking of was are we going to see a car bubble burst. This is obviously of utmost importance to me as I am not overly concerned about myself however my staff of 20 plus and their families I think about and to effectively prepare them for this scenario. I am fortunate enough to have been through this in 08-09.

So I want to touch on what happened then. It was really a doomsday scenario for automotive to the point that two major US manufacturers General Motors and Chrysler had to enter bankruptcy. This essentially just created and even worse scenario as when the OEMs are in bankruptcy factories are shuttered and no cars are produced. Then the brilliance of political policy took affect and the government decided to pour billions into a stimulus program perse called cash for clunkers. Incentived people to get rid of their junk for 4500 dollar rebates from the federal government to get a better fuel efficient car.

Well…. As we know our federal govnerments timing is always impeccable. This was an absolute disaster for US automakers. They didn’t build fuel efficient vehicles to meet requirements of the rebate etc. it effectively pumped the Asia brands. Banks stopped lending unless loan to values were 80 percent or less rates were elevated and I ate spaghettos and ramen for a bit everyday.

However this scenario only lasted for about a 3 month period. It was tough tough. This is why I think the Auto sector is largely recession proof sort of. A car is a need a house is a need. But, Houses you can stay in. Soemteimes cars you can’t they break down get wrecked etc. so as it may not be fruitful with demand out pacing supply like it is currently it’s a very tough bubble to burst. Takes several major events to pop it. Since I’ve been in the business I’ve seen best rates anywhere from 8 percent being the best out there to 1.75 range. And it has essentially not changed the auto market much. It may take a light downturn. But the demand is still largely out pacing supply. Could be one of the more resilient sectors to this whole circus we are living. Especially in the new car segment keep in mind there are also other sources of revenue for dealers that carry new cars. Such as service parts body shop etc.

A lot of rambling there but wanted to share my insight and thoughts. Will continue to update this to keep all ahead of the game and any signs I see on my sector.

Always always appreciate your perspective, and any future updates would be wonderful. I always like your expanded thoughts so no worries on the rambling, Im also pretty sure I take that to the absolute extreme ![]()

Not really following this market outside of macro numbers but this person indicates a change in leasing behaviour?

https://twitter.com/GuyDealership/status/1581681032264552454?s=20&t=9n-jWlEq_u51PEBwMm8rWg

Lots of quotes from Ally as they’re a major financier of auto loans? Their stock price certainly reflected this headline: