Not sure how reliable this source is but this YouTuber says the commercial paper in auto loans has essentially dried up and explained it terms my dumbass could understand. If true, this is terrifying, as we’ve already started to see weakness is the industry.

Keeping an eye on AN this week testing key support. Maybe we get a little sympathy movement from KMX ER on Thursday?

AN sitting around -3% this morning.

Looks like we did get some movement from KMX, might be a multi day play if the broader market stays weak, keeping an eye on it.

Currently sitting on Jan 100p’s & Feb 95p’s

Wanted to put this up because I saw some tweets in the tweet feed from this guy.

For one this guy is always doom and gloom the sky is falling etc. and I think it’s imperative to not always be looking at the world or the segment in this aspect. Or vice versa through some lens of perfection.

Yes Q4 has provided a decline in automotive demand much the same as housing. This was to be expected as prices elevated and rates get higher makes smart consumers just wait it out. But it’s certainly not at 2019 levels or 2018 or 2017 or 08-09. There is still an astronomical backlog in new car orders. For example in 2019 I had roughly 250 new cars on the ground and 150 cars. For a total of 400 total. I’d absolutely love to have this today. As of today I was sitting at roughly 30 new and 125 used. Not because I don’t want them. Simply because I can’t get them.

Below I will post my actual stores numbers for a real world showing. Same store same location nothing has changed not even so much as a repaved parking lot. One disclaimer I will say is we acquired the store in 2016 so we’re growing it in 2019. I’ve been there from the day we opened to the present.

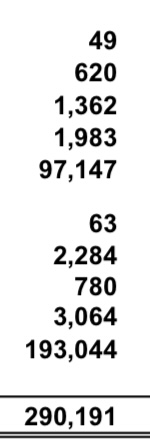

This chart reflects December whole month numbers from 2019. Top number is in order like this New cars sold the second number from the bottom reflects total GPU (Gross per unit) the bottom number is total gross on new cars sold.

So to break it down simply

49 new cars generated 97147 dollars in gross profit.

63 used cars generated 193044 in gross profit.

These numbers reflect the entire month. So a total of roughly 290k

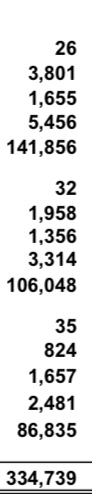

This reflects this month December 2022 through today It’s a bit more confusing since our used car sales are seperated by trades and program or purchase units.

26 new cars at total of 141856 in total profit

67 used at a total of 192883

So essentially with four days remaining which also is our biggest week of the year. We have already surpassed total used car units and total gross for the month.

In summary there is still a long ways to go before we go full on doom and gloom on the car market. Yes it’s taken an affect. But it’s nowhere close to where it was when it was what I’d call normal for my whole life.

I fucked it up cuz I’m retarded on charts but it’s correct now.

I appreciate this and glad to see you guys are doing well.

I think that market conditions will continue to get worse before they start getting better and thus AN’s future earnings.

Imo the auto industry has had extremely favorable market conditions since the GFC. Their evaluations have reflected this nicely.

I think the changing economic conditions we see today continue to decline and in a few key areas that directly impacts the auto industry, but put simply, I just think AN is overpriced and I am planning on trading it if its moving

I’d agree here that their Q4 earnings will come in subpar especially compared to 2022 numbers. One thing to note on AN valuations though is their growth. They have added numerous rooftops which in turn leads to more revenue. Possibly warranting a higher valuation.

If you’re interested in this thread, this twitter seems to be the best resource for news in this world.

KMX continues to look like the most prime target given the options chain

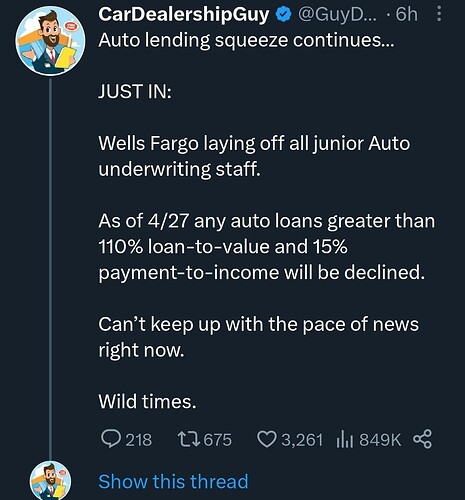

It appears we have started the process of only lending to people that can afford it. Imagine that

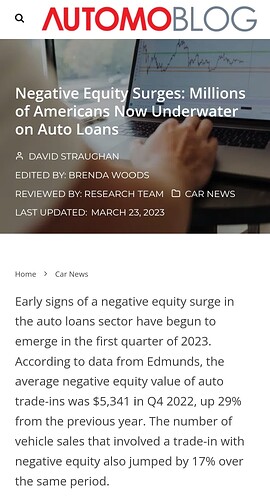

I think its a good time to pay closer attention to the auto world. As mentioned in the original post, Americans owe over 1.4 Trillion in debt, over 46% + underwater.

My main bear case has been a consumer that is being financially squeezed by inflation, higher rates making new loans less affordable, and tighter credit conditions or less access to credit for the average American.

Things appear to have continued to move in this direction.

Came across this article from a few weeks ago, i think its a great read and touches on many points we have discussed on this thread.

Wells fargo says as of 4/27/23 all loans with a LTV of +10%, or a payment to income of +15% will be declined.

These were avg payments back in June 2022

And now

So what do those numbers look like from a recently changed wells fargo risk perspective?

An avg used car payment is $526/Month

Which means that now the minimum income required is $3,500/month

While an avg new car payment at $716/Month

Would require a minimum $4,750/month

Less people that can qualify for credit on any purchase they cant pay cash for means less demand.

It also makes it tricky for people that are overextended to get out of a current loan if they want to trade in for something less expensive.

Remember, we need to pay off the old loan (trade in) + finance the new car = New loan

This total is the amount that is measured against the actual value of the new car and the income of the potential barrower. Yikes.

The loan to value change means they are waking up to the fact that rolling trade in deficits into new long duration loans on a quickly depreciating asset isnt sustainable forever.

Most people will be stuck in a vehicle they most likely are spending too much money on monthly and will be there a while, which also means less demand.

I say this referencing still elevated expenses, historically low saving rates and historically high barrowing rates.

I think we are beginning to see why auto lending should have been included in dodd frank.

KMX seems to be the most viable today but has already been beat up quite a bit. AN on the other hand is still trading near ATH.

This weekly chart is something else. Do we really think AN’s nearly 7x growth in the last 3 years is sustainable? Earnings are on Thursday, see if we get some movement or new information