gonna start logging my trades, wins and losses, here. enjoy tards.

Some indicators I use:

Bollinger Bands

TTM squeeze

$TRIN

$TICK

Some rules I stick by:

- At least 3 of those indicators must confirm a direction before I enter

- Never fight the trend or time a reversal

- Only swing overnight if there’s a convincing daily trend.

- Average down around 20% loss, cash out if that turns into 30-40%.

- Unless clearly obvious daily trend, always wait to enter trades after the first hour of trading (when the market is picking a direction).

Current market thoughts:

SPX is extremely sensitive to the downside, in that anything can just guh it (see: SNAP 8-k). Right now it’s trying to move to the upside but there is hesitancy, as I think it would’ve closed above the 4000 level at close instead of cumming back down.

I was of the mindset that NVDA had to report strong earnings for this continued movement for the market, since it’s a large holding in SPY. While it did bring SPY down with it at first, SPY has since decoupled and recovered after hours, meaning buyers stepped in to correct algo sellofs.

My main thesis right now is an upside to the 4100 level (around 410-411 on SPY) and that’s what I’ll be playing. To the downside, I think 3950 has proven to be a strong level, and beyond that, 3850. I do think we’ve seen the near term bottom for now, and hope to see the markets trend higher tomorrow. My big thing to watch, still, is how AAPL performs, as it’s weighing down overall markets as it’s value area is still being sorted.

fucking finally <3 then you will be so rich and busy this journal will stall. el mayo <3

prove me rong ༼ʘ̚ل͜ʘ̚༽

Rode the trend for some calls before I had to deal with exit interviews. Everything looks bullish from a technical standpoint, so will be looking to scalp some more calls on Tuesday:

Not holding anything over the weekend. Considering the run-up we’ve had, I’ll be looking at the 4170-4200 zone as a place where sellers may step in.

While PCE data came in fine, I see oil futures continue to rise. You would also think DXY would’ve guh’d a lot harder with how much we’ve run but it’s holding it’s level relatively well too. Ideally want to see that well below 100 before going full retard on calls.

TSLA lottos were discussed in TF and shoutout to @cryptowhale101 for taking it and raking it in. Based on where we open on Tuesday I’ll throw out some more degen ideas for us to either lambo or bust on. have a great weekend everyone.

My upside for this week is 4250, with the downside around the 4130 area.

I do think we experience some chop this week, especially with CPI data around the corner on the 10th.

Some bearish points to note:

OIL has remained in an uptrend even with SPX and markets rising.

Put accumulation continued, and ramped up on Friday.

Volume was relatively low all of last week compared to what we’ve seen during the downtrend prior.

Some bullish points:

Momentum is on our side - with multiple gape ups, it’s hard to imagine this won’t continue for at least a day or two.

No high-impact events this week to alter trends.

As much as I think crypto is just play money at this point, it is a leading indicator in investor risk assessment, and with it trending upwards, shows retail is willing to throw money into markets.

I’m undecided if I’ll play 0dte or 1dte tomorrow. I’m of the mindset we’ll have a volatile first hour as traders will be taking profit as well as positioning themselves based on where commodities are at. From there I’ll most likely be playing calls .5-.75% to the upside.

We’re also nearing some key resistance points on big caps, such as AAPL and TSLA. If we fail to break through these on any daily close, I’ll position myself for some puts. Good luck all.

Taking today off as it’s just choppy at the moment. I was looking for upside but AAPL and other blue chips seem to be struggling at their resistance points. Unless we see some strengths I’ll be taking some put positions eod/tomorrow morning.

What a chop day - sat sidlines as I wasn’t really sure what to make of today’s action.

Tomorrow’s lottos:

SPY 409p

SPX 4100p

TSLA 720p

AAPL and other big players failed to find liquidity and momentum while above key resistance points. Unless we have some big moves overnight, I’m expecting us to carve out more downside tomorrow. Godspeed.

Grabbed 406p exp Friday. Let’s see what we carve out below.

Kinda went autistic and half ported that play cause my thesis indicators lined up almost perfectly. Oddly enough, my lotto plays posted yesterday have a huge possibility they run itm today. Congrats to those who played it!

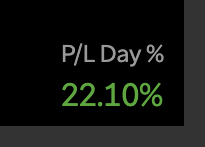

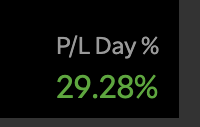

Up 29.28% for the day. Cashing out here cause I want to nap and shitpost with the homies. Good luck all.

If you took any of the lotto plays, I’d recommend cutting here.

Starting a qqq put position here. Lagging overall market and last domino to fall imo. 2dte 299 strike.

If you took the call you should be about 20% up right now. While I think there’s more downside today and this week, setting a limit sell here would be wise just in case some retarded shit happens.

and of course market decides to be retarded right as i typed that - stopped out for a good gain, good luck everyone. Will update tonight with some plays for tomorrow.

What a day!

The lotto plays listed from before went itm for a while, and the 406p I took ended up 3xing (while I exited around 50%). Congrats to those who played those and banked.

Some thoughts:

AAPL and other big tickers are struggling at the top of this channel we’ve been at. While they shot up at open, they failed to hold there and eventually gave in to the rest of the market.

Small caps shit the bed today. I always like to use these as a leading indicator of market sentiment, and it was clear from open investors are still shook on holding onto equities.

Unless something changes overnight, I’ll be looking to play puts, but this time, on QQQ. My theory right now is these growth stocks are seen as ‘safe havens’ but they’re just as privy and vulnerable to market selloffs. I’m thinking once they give in, it’ll be violent, not smooth, downwards.

Lotto plays for tomorrow:

300p QQQ

404p SPY

710 TSLA

All Friday expiration. I have a gay ass breakfast thing in the morning so won’t be here around open, but will update when I take my entries. Good luck all.

Leaving the cafe and looking at markets - way too choppy for me right now with no clear direction. I’m sitting out today.

Some things to keep note of tomorrow:

Unemployment rate, Non-farm payroll, and Manufacturing PMI.

The first two should give an idea of our economy, so expecting some large movements once those drop. These will most likely set the trend for the day PM.

After today’s action, there’s an obvious bias to the upside. While volume was low, big tickers made strong marches. Notably, AAPL burst through and finally closed above the 150 resistance. MSFT, even after it’s -3% sell off PM, made all of it back plus some. From a technical standpoint, this is a bullish engulfing on the daily, both for SPX and QQQ.

If the numbers come out good, and we hold today’s close for the first hour, or bid above, I’ll be grabbing calls. Specifically, 4210SPX. TSLA 800c if I’m absolutely confident and the indicators line up.

If we take out our close at open, I’ll be playing 4090p SPX.

Will update in the AM when numbers come out, as well as when I enter. good luck all.

Goes without saying but not playing the upside.

Jobs report came in hot, and as @Kevin pointed out in his community callouts thread, this gives the FED more ammo to be hawkish as they actually want unemployment to go higher to help control inflation.

Tech in general is already getting gaped and we’re well below the levels I had marked. Will call out my entries. Good luck all.

Way too choppy and I have 0 confidence in direction right now. Sitting today out as well.

Bidders/buy wall at 4130 couldn’t hold and now gone. Target area is 4090 for me on my puts.

Stopped out at that gay ass green candle right after my comment. Re-entered with a small amount 2dte 4070p.

Done for the day