Just FYI, 4090 target is not for today, but in the next day or two.

Out of the rest of mine here for tens of dollars. ![]() I do think there’s more downside to carve out, but will be stuck in orientation for the rest of the day. Good luck all!

I do think there’s more downside to carve out, but will be stuck in orientation for the rest of the day. Good luck all!

Congrats on the gains, boss!

WhereTF yall at??! Why am I the only one commenting on this thread?!?

Looks like 4090 downside target will be achieved by open. Congrats to those who held puts overnight.

Keeping an eye on AAPL 144 during the first hour of trading. If we fail to break back above I’ll be playing SPX puts to the downside again with a 4040 target.

Good luck all.

Taking a lotto put position here. Super risky.

I’m out here. Sitting sidelines rest of the day good luck all.

Looks choppy at best, with a bias to downside. I think the morning was people ‘buying the dip’ and now they’re selling off intraday. While I don’t think there’s any reason to be bearish, I don’t see any reason to be bullish either. Market is playing itself out today so be careful.

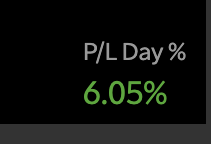

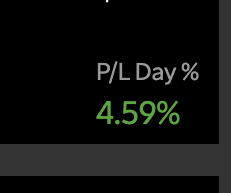

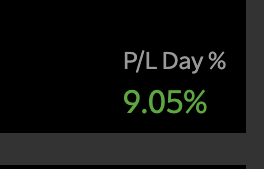

P/L for the day

Much like TF has pointed out, we’re still range-trading since last week. Without any catalysts before CPI, it’d be a safe bet for it to continue tomorrow and Thursday. With OPEX tomorrow, I do expect some wild swings to happen and will call out where and what I’m entering when I see an opportunity. As we’re near the top of our channel, I’ll grab puts if we settle near the 4170 mark after the first hour. Will keep y’all updated.

Riding a Tesla put right now 85/ the only big cap that’s green while everything is shitting the bed. Banking in it catching up. 700p Friday exp.

Added more when it was around the 2% green area, trimmed those out and letting my original position ride.

out here with the rest of them. Gonna re-enter puts if we close in this area. Good luck everyone!

Using house money to purchase some 4080p here, 2dte.

Jobless claims + EU rate changes has seemed to shift the market. EU and Asia are bloody red and I would think the USA would follow. I plan on cutting half of my puts at open and letting some ride. Good luck all.

cutting all here, this is too good profits to take. good luck all.

Played some of the rip n dips after open thanks to big dick sucky, officially done for the day.

Wtih CPI tomorrow things should get interesting as we’re still in our channel. While I lean bearish on sentiment based on WH and Yellen statemens, how the market will react is another story. Good luck y’all.

CPI not only came in hotter than expected, but came in with a gaping asshole and HIV dipped dildo in it’s ass.

Expecting huge downside today, and will be playing 0DTE TSLA lottos. 680 strike. Good luck all.

woke up late and didn’t take any positions - feeling a bit late right now so sitting sidlines. Most likely will swing a play over the weekend. Will call out if I enter something else before then. Good luck all.

Good evening sex havers.

Today’s post will be more about current sentiment and catalysts, along with some levels.

TL;DR - I have my upside capped at 4000, with a downside target of 3750.

First let’s talk about last week.

CPI not only came in above expectations, it came in absolutely fucked. MoM numbers were more than double, WITHOUT including energy and rent.

We’re seeing other countries, especially those in EU, combat inflation with aggressively raising rates. While the USA may not sing the same song, it’s hard to ignore macroeconomic conditions just because our FED is taking a different approach.

This week, there really isn’t any bull catalyst. PPI numbers cum out Tuesday, along with FOMC Wednesday. ON TOP of that, we have an enormous opex this Friday, where 4 different types of securities have options expiring. With these bearish catalysts in mind, I really do think this is the start of when things to get sour. An added catalyst happening already is BTC trading well under 2850, a super strong support that has held until a few hours ago.

Here’s a few tickers and strikes to play for me:

SPX 3750 Friday exp

MSTR 180 Friday exp

TSLA 620 Friday exp

AAPL 131-132 Friday exp

For those wondering, “why tesla? didn’t they just announce a stock split?”. Under normal circumstances, this would be a bullish catalyst. The last time they announced it, it rose 80% from AH to the next day. This time, they rose a meager 1.6%.

Take a look at AMZN and GOOG when they announced their splits - they immediately sold down the day after.

TSLA’s split to me is a sign of desperation. Keep in mind, Elon is dealing with a ton of shit with TWTR and isn’t focused fully on TSLA. Another key thing to note, TSLA has 1.5-2 BILLION in BTC. Algos trading crypto-related tickers also include TSLA in their swings as they have a significant amount.

This week should be pretty damn volatile, with some softness to start off on Monday. I’ll for sure be playing puts and calling out what I see as possible good entries. Keep in mind, while I see bearish catalysts and conditions, the market has a mind of it’s own, so position carefully.

Good luck all.

TSLA 620 Friday exp

AAPL 131-132 Friday expFor those wondering, “why tesla? didn’t they just announce a stock split?”. Under normal circumstances, this would be a bullish catalyst. The last time they announced it, it rose 80% from AH to the next day. This time, they rose a meager 1.6%.

all the dd i need. doubling down on 550p

Cry about it