@swoleappa wanted me to mention COIN might sympathy dive tomorrow based on the celsius network news since they appear to be a coinbase-type exchange. https://twitter.com/CelsiusNetwork/status/1536169010877739009

Got a sweet sell order filled on that tsla p for a 80% gain, thank you @squishy27 ![]()

Watching for now - will call out if/when i enter something. Leaning towards eod since we’ve already gapped down so hard.

starting a call position here as it’s nearing my downside level. Please keep in mind this is both a small position and super risky as there’s a clear overall downtrend. If this doesn’t work out just blame Phil.

I’m out here for a solid gain on the account:

Good luck to everyone. Will update eod with some thoughts and upcoming catalysts.

Short version: playing puts at the 3800 level with a target to 3700. Thinking we stay there before FOMC decision.

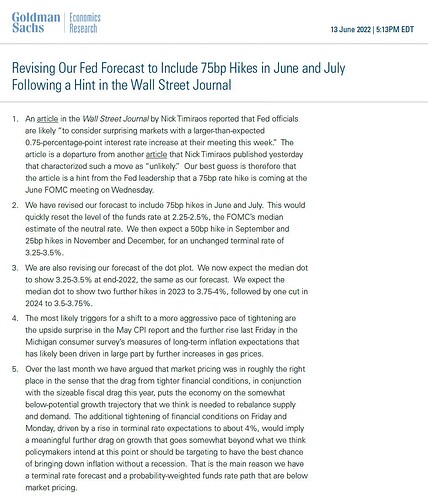

My thoughts on FOMC:

The entire world is expecting surprise hikes - 75bps June and 75bps July, with 50bps rates in September.

The FED is having their credibility tested again. Do they stick with their current plan laid out a couple months ago? Or do they surprise us with the new data they’ve presented.

After re-watching previous speeches, JPOW always noted “for now” when answering questions about forecast. Many people focused on the first part of the sentence and assumed he’d absolutely stay on track with 50bps, but he has been subtly giving himself an out every time by tacking on that phrase when answering questions about rate hikes. This way, in instances like Wednesday, he’s able to surprise us with rate hikes while also maintaining his credibility, cause it wasn’t completely ruled out.

The bull case here is obvious - considering we officially closed in bear market territory today, announcing a surprise hike on Wednesday would absolutely decimate markets and send it into a free fall.

Millions of people will be affected negatively even harder, and he’ll receive the full force of the blame. It’s in his best personal interest to not do a surprise rate hike. That sounds like a stretch, but policymakers, just like every other human, has their own best interests in mind when making decisions, not that of others.

The bear case is also obvious - how much further can we ignore macroeconomic conditions before something is done? Gas prices are skyrocketing, and rent and food costs are continuning to rise with no end in sight. Retail is now getting fucked cause they oversupplied and are having to slash prices to fill the gap between supply and demand. If he doesn’t take action now, what’s the point of even having a FED?

With these notes in mind, I’m of the camp he’s going to satisfy both camps: stick to the current rate of hikes while announcing future hikes. This way he preserves some of his credibility while also showing he’s actively doing something to help those that are struggling.

I know there’s a lot of doom and gloom being spewed in the media, but looking at things objectively, a 75bps raise honestly won’t do shit at this point. The cons (crashing the market) far outweigh the pros (getting a slightly better hold on inflation). It’s with this in mind, I think we’re going to get a surprise on Wednesday when he announces he won’t be raising immediate rates.

In the end, I’m using information in front of me and speculating what’s to come based on what we know from the past. I have been wrong and could be wrong (in a super, fucked in the face, major way). The only thing that’s for certain is I’ll be waiting until his speech before deciding to take a position. Until then, I’ll be playing my levels tomorrow of 3700-3800.

Still sitting cash, waiting for 3800’s to start a put. Will be grabbing a 3600 strike for Friday exp. Fully expecting a fade eod if we’re still green - we’ll see.

I don’t think levels will really mean much today with FOMC. Staying cash and riding whatever trend presents itself after news breaks. Good luck all.

adding a lotto put, single, just for funsies.

I’m out here for tens of dollars. Will be back for fomc. Good luck friends.

Theory was incorrect, womp womp.

Market still figuring itself out - most likely waiting on jpow’s speech to pick a direction. Careful out there.

starting a small puts position here

I’m out here

adding qqq’s puts here

Ended the day green off some small momo plays + the positions I’m swinging overnight:

SPY, QQQ, and TSLA P.

JPOW said just enough to keep markets from guh-ing but not enough to shake off fears. Unlike past FOMC runups, the market trended downwards after his speech, indicating to me there still isn’t confidence in any of his dovish talks he gave. Re-watching it now, it sounds the same as other speeches where he kept adding on “for now” when answering questions about future rates.

With market sentiment, the surprise hike, as well as options expiry friday, I’m expecting we re-test 3700 by eow. Have plenty of BP left to average down tomorrow and I’ll try my best to call it out if I enter new positions. Good luck all.

Unless something changes, my QQQ position will be ITM, and my TSLA and SPY positions will be close to the money. Will be dropping the TSLA and SPY legs and riding the QQQ one out. Good luck all.

completely out of all my positions as I didn’t want to risk anything:

Good luck all.

Will start a tsla call position, next week exp if:

- we get to the 620 area

and - we hold above it by close

Sitting completely out right now just watching. Clearly there’s downwards pressure due to opex, and I expect it to linger come Tuesday. Mid or EOD Tuesday is when I’ll most likely be looking to start a larger call position.

Expecting sell off for profit taking right now. Key level I’m watching is the 3650 mark - we close above there I’ll scale into calls.

Deciding against the swing play idea. Three attempts were made at 3700 and failed thus far. Unless we close above there I’m feeling a retest of todays lows come Monday, even 3600. Will position myself there most likely. Good luck everyone.

Opening an AAPL put position here. 130p next week expiry.