The Company

Argosy Minerals Limited (ASX: AGY; OTC:ARYMF) is an Australian company with a current 77.5% (and ultimate 90%) interest in the Rincon Lithium Project in Salta Province, Argentina and a 100% interest in the Tonopah Lithium Project in Nevada, USA.

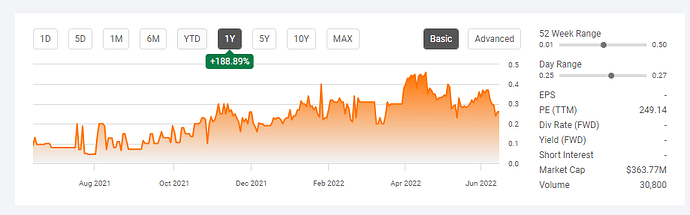

It’s a pre-production Li producer with ~$350M market cap with 1.3B shares outstanding. Daily volume is tiny, .

This bullish article gets most of the basics right, so please check it out for details. Summary of current situation.

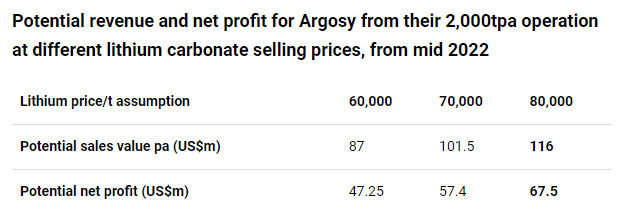

- Argosy Minerals’ Rincon Lithium Project is on budget and schedule for a mid-2022 production start of 2,000tpa lithium carbonate.

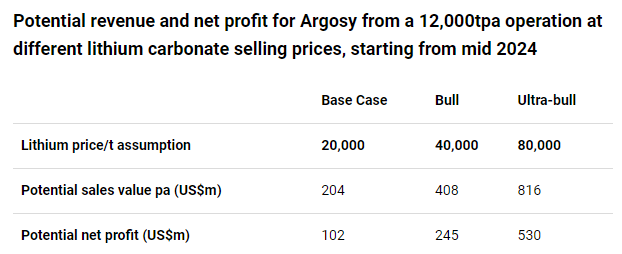

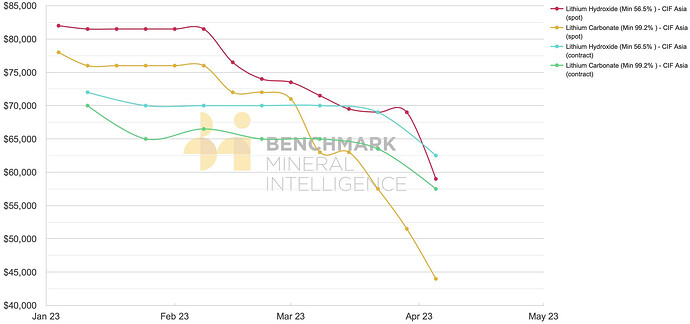

- Strong lithium prices means Argosy can now potentially self-fund their expansion from 2,000tpa to 12,000tpa at their Rincon Lithium Project.

- A look at potential revenue and net profit outcomes at different lithium price scenarios. Valuation remains exceptional.

- With lithium demand surging and supply battling to catch up there is no better positioned lithium miner today than Argosy Minerals.

They are also somewhat active on their Twitter account.

The Play

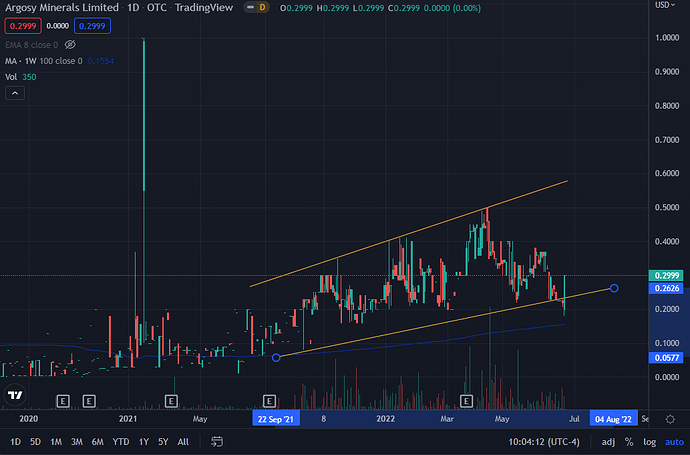

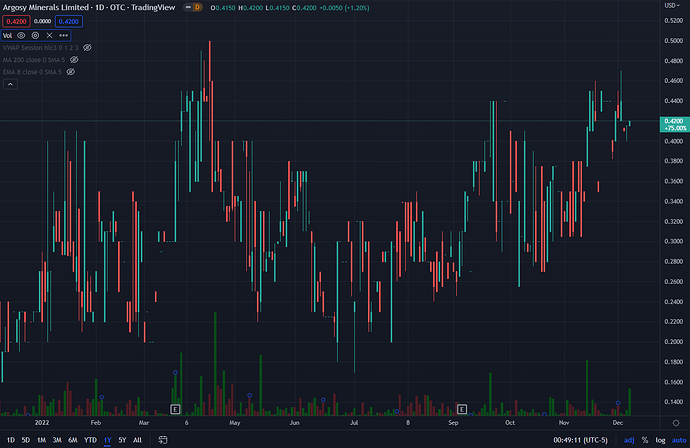

I see this as a long term swing. This is the market action over the last year and a half - the period I have been paying attention to it:

I’d swung this twice in the past:

3/16 - Buy @ 0.04

9/22 - Sell @ 0.152/19/22 Buy @ 0.22

2/28/22 Sell @ 0.35

Had almost given up getting back in again because this moved quite well with lithium prices, but then recently started to fall as all kinds of smaller companies got punished. Can’t find any materially negative news - nothing more than what one would expect from a speculative miner, anyway. So when this got filled today, was quite happy:

6/14/22 Buy @ 0.245

I feel pretty bullish for this stock for a couple of reasons:

- They seem to be plodding along with the 2,000 tpa production schedule, in which case they may not need to go to market anymore for funds

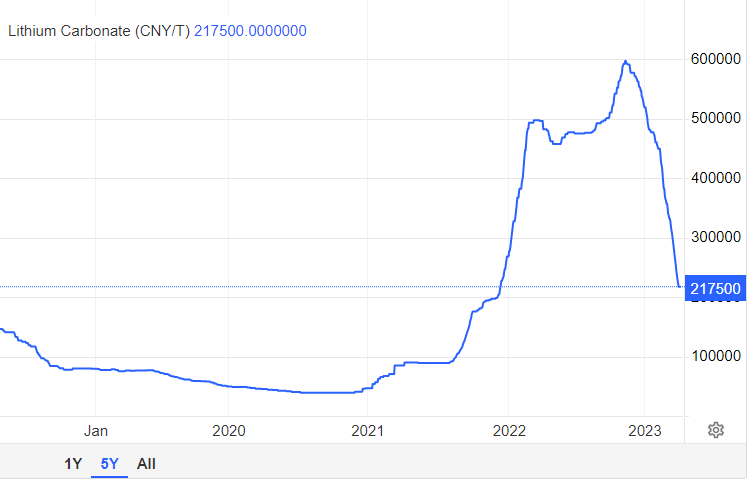

- Secular increase in demand for lithium, as discussed in the Lithium thread

- Higher highs and higher lows (in chart above)

- Read somewhere there might be buyout interest in the Nevada mine

- If nothing else, this should run up on the next lithium rally. And we know lithium fever isn’t going anywhere

Having said that, it could fall some more, for some more months, in case the market stays sour. We won’t have definitive good news till Q3 2022. Hence, have another limit buy set @ 0.20.

Warnings (apart from the fact that it’s a pre-production miner, which comes with its own set of risks):

- This is another OTC (like SIRC) so all bets are off - might just go poof one day.

- Extremely low liquidity - one of the two buy orders have taken more than a day to fill. If you have access to Aussie markets, liquidity there is 100x better.