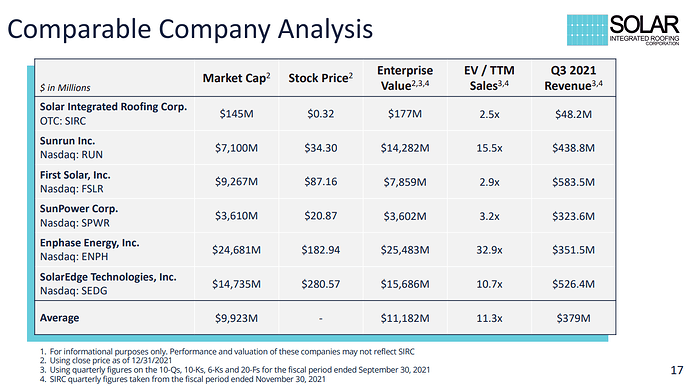

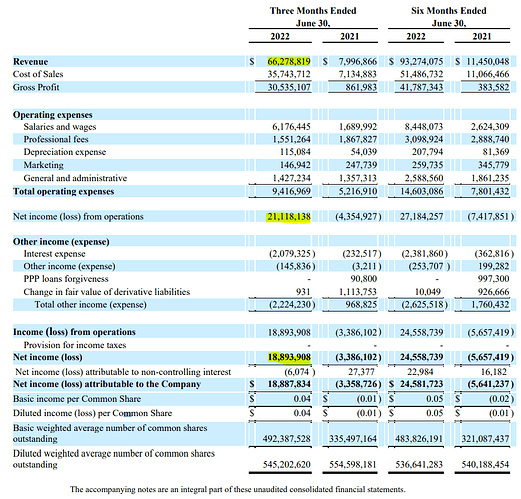

SIRC released Q3 results on Friday: revenue was $48.2M (964%+ YoY), gross profit was $25.2 (2,372%+YoY), net income was $18.4M (was a loss last year). Company valuation is $193M. Sounds undervalued, doesn’t it?

Solar Integrated Roofing Corp (SIRC) installs solar things (roofing systems, charging stations, HVAC etc.). They’ve had a tough few years, and are turning their fortunes around. This is a penny stock, they are in a very competitive industry, and their track record is just this quarter, so the risks are very high. Wanted to share why I like this stock, bought into a small position two months ago in Nov, and will now double down on Tuesday.

Considerations:

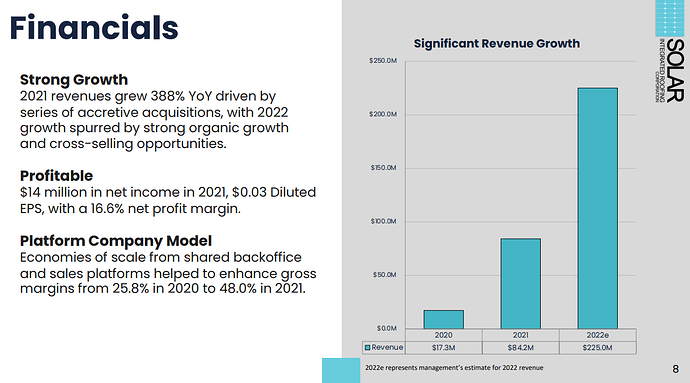

- They expect to “substantially exceed” their 12 month revenue guidance of $100M

- They see annual run rate approaching 200M (same PR as above)

- Growth is both organic and through acquisitions.

- Leadership has solid experience in the sector. SIRC came on my radar when I saw the press release for their President joining in Nov. I remember reading this sentence, looking at their market cap, and thinking, this could be a multibagger. Now, this is a company press release and pipeline is not quite revenue by far, so buying at this time was a leap of faith for sure.

“In his initial four months since joining SIRC as CEO of our USA Solar Networks subsidiary, Pablo has developed a nationwide dealer and contractor network while concurrently securing $280 million in commercial projects for our development pipeline”

- They have submitted their application to the OTCQB market; while this is not as cool as making it into the S&P or even the Russel, it’s another positive signal.

- Word is if they keep doing well, they will apply for NASDAQ in a year or two.

- The CEO has engaged on Reddit (link to AMA) and Discord; again, not material financial info, but positive signalling - I like management that keeps up with the times.

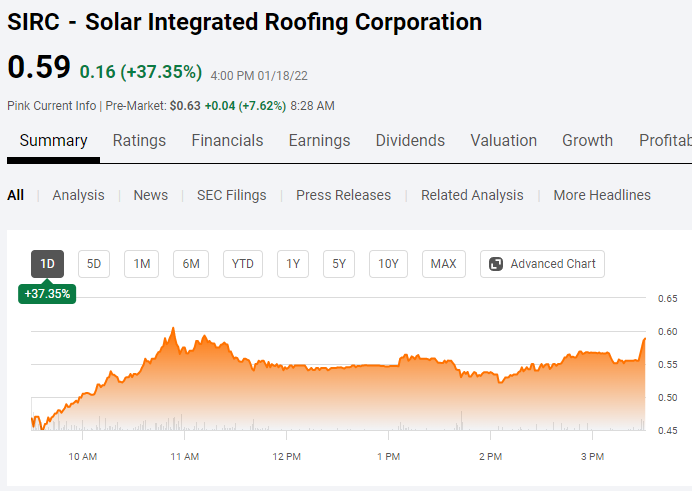

- Stock price jumped 55%+ on Friday before ending the day up 24%, so market is reacting positively.

- Even if one does not see the long term potential for the company, Q3 results could make for a nice swing trade:

My bull thesis is mostly based on the notion that a company approaching $200M annual run rate should not be valued at $193M, and a general gut feeling that management is doing the right things. I don’t think $1 is unreasonable in 2022 vs $0.42 now.

However, I want to reiterate that penny stocks are very risky and all kinds of things can go wrong. Dilution, convertible debt nonsense, key person risk, wonky financials, etc. Super important to do your own DD.