Stop loss about to hit on INVZ. Volume really died… <@&895135662867619930>

Sucks seeing but INVZ had great support at 4.50 and been climbing up all day. I hit my stop loss at 4.46 so I should have kept that 4.40 stop loss, as low for the day was 4.44, but I would close out around here. Good play but bad timing and stop loss. Hope some made some money on this. <@&895135662867619930>

By way of update:

- Closed DAC 8/19 70C/75C - Bought for $1.20, sold for $2.11 (+76%) - 1% quarterly dividend yield for holders on record 2 weeks for now. Not sure that’s enough to sustain prices, .

- Closed GSL 9/16 17.5C/22.5C - Bought for $1.25, sold for $2.45 (+96%). Earnings is tomorrow, and don’t want a knife down like MATX. GSL is less well-regarded in the industry.

- Holding MATX 8/19 90C/95C - MATX crashed 10% today post-earnings, even though results were good. Bought $1.20, currently $0.825. Price seems to be returning so hopeful of exiting at least at break even.

- Holding ZIM 8/19 55C/60C. Bought at $0.815 average, currently $0.975. Earnings on 8/18, so bit of a runway still.

Watching that 17 break for AMC on continued earnings volatility. Recent high was 18.37. Safer buy will be if it dips to 16.50 or 16.75 but only grabbed a few weekly cheaper calls for now.Also playing with profit from it earlier. <@&895135662867619930>

Out of SPY puts there after that tweet on layoffs etc. on the drop below 410. Dropped my AMC calls as they hit my stop loss <@&895135662867619930>

AMC 16.50 support on calls gave about 15% to 20% just now. Remember let’s help each other with plays, ideas (on forums) and callouts vs just reacting and attacking @here<@&895135662867619930>

Ok as mentioned in chat. SPY- There is the 409.50 support for now. Recapture 410 on SPY and calls looking ok then. Take profit when you are happy. If it gets rejected by 410 then may be ready for more red. <@&895135662867619930>

taking a put here

added a shorter exp call hedge

cut my call leg there

still holding my put leg, debating cutting soon as there’s a lot of support showing up in this area surprisingly

out here, up a couple points on the day, back to work. good luck nerds.

for whatever it’s worth, the volume arms index turned bearish for the first time today

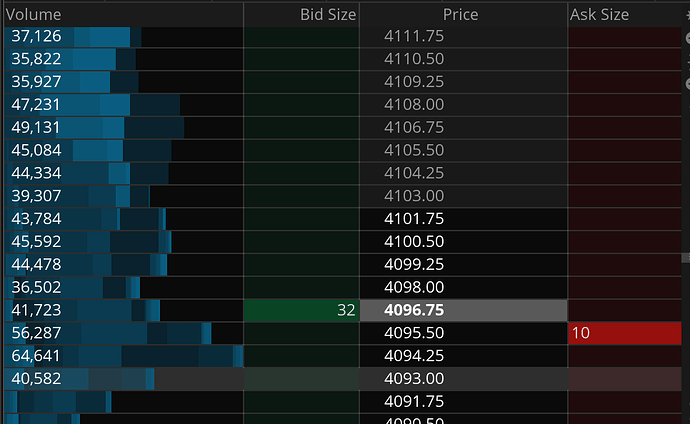

if we open above 4095 ill be looking to ride calls on the support line. If we open well below it, then will be playing the lower range of 4060-4070 for call position.

Took cvs calls at open on good earnings and guidance. May add more on dips <@&895135662867619930>

Sorry sold them for 65%. Will wait for dip to reenter. Couldn’t pass it up. <@&895135662867619930>

Pending news, my top play is CVS. Buying the 100 strike for this week at either 99.50 or 98.50 support. I bought just 2 at that dip and holding for now. Beat earnings and guidance but watch out for market news etc <@&895135662867619930> Recent high near 110 so I dont expect it to go more than 105 -110.

Out of CVS there. It needs to break 100.50 for next push up and it may run a good amount but my time is limited today. I may try 1-2 more but will wait for a support bounce. <@&895135662867619930>

INVZ had a nice breakout from the 5 resistance called out yesterday. <@&895135662867619930> Missed it as was playing CVS but 5.50 next resistance.

CVS if it holds here I will go in again on 1-2 calls for the 100 strike <@&895135662867619930>