CVS: added 2 calls at 99.50 but waiting to add more as I am not sure where it goes from here. That was a decent drop in market so playing it safe with tight stop loss now. <@&895135662867619930> Remember 99.50 or 99 safer buy area for support

Probably one of the last callouts for today. CVS holding that 99.50 area support. If it pushes up above 100 here then I may quickly add a few more calls and sell once it peaks to end my day. Good luck all and stay green <@&895135662867619930>

Sold cvs there. Big gains if you followed the callouts. Let look for more of these vs trading something like spy. Bigger gains and less stress. GL all <@&895135662867619930>

taking QQQ Dec 2023 230p because ![]()

Watch AMC if it breaks 18.15 then 18.40 for new recent high. I will prob watch from sidelines as our entries should have been day ago and earnings come out tomorrow. <@&895135662867619930>

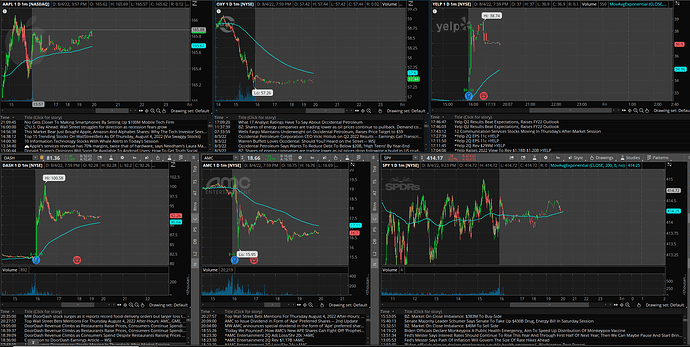

CVS - This is another area that is great to take profit. I think it will come down a bit from this run, maybe tomorrow or Friday, but will be surprised if it pushes past 102-105 area. However, if market goes crazy, it could run off a support dip. I will be watching this and market tomorrow to see if I want to enter again. May also scalp AMC calls around open time tomorrow if we see good movement. SPY watching 415 resistance and around 420 resistance for me. Still no position currently <@&895135662867619930>

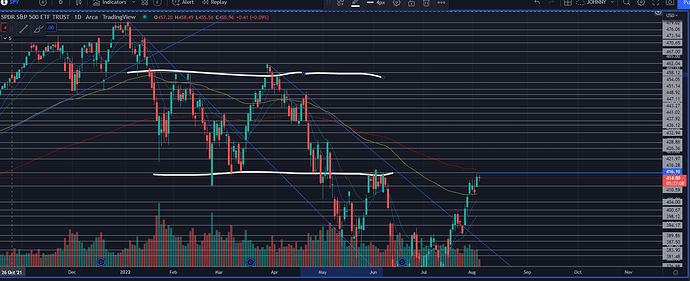

we tapped the 4170 level exactly before coming back down, so still channel bound. If I’m not swamped with work then I’ll be playing the upside should we open red tomorrow.

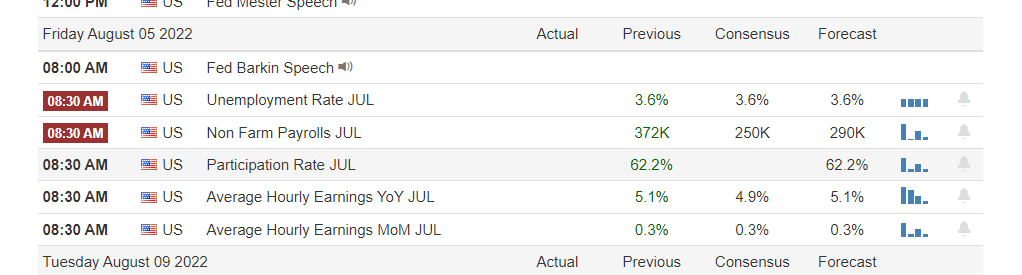

May enter calls on AMC at open or watch for dip buys around 19 or 18.75. LCID bad earnings so if it tries to push up a bit I may try puts and see if it rides closer down to 15. BCRX fda unhalted their clinical hold, could be good for calls but on dip. Let’s see how market reacts to job numbers at 8:30 <@&895135662867619930>

Just remember on AMC the safest play is waiting for it to bounce back to 10, 12 or 14 for the next catalyst such as earnings. It has been running up since Monday. Much riskier now <@&895135662867619930>

SPY making a symmetrical triangle, scalped the rejection off of the top one. Waiting for a break to either side.

Sorry all as I have been in meetings all day. Was unable to trade any of my ideas and will be off most of the day. Hope to be active tomorrow. Stay Green <@&895135662867619930>

The 416.28 daily level together with the 200 Daily EMA (red line) are going to be big overhead inflection points. Maybe tomorrow will be a more eventful day where it manages to get up there. The consolidation range being drawn in white is a big general area of overhead resistance that it needs to break if it want’s to get back in it’s range. I’ll probably only trade SPY off of those points for the next few days unless something clear sets up.

riding a call for this momentum

big 5 woke up as well

im out here for a tiny gain

Ok, for tomorrow, and I will change this a bit once I see pre market. I am going to be watching AAPL/SPY, OXY,YELP,DASH,AMC, and anything else that pops on scanner from pre market earnings. I want to focus on some earnings plays pre & post and take a break from SPY. These this week have been much more profitable for me (CVS & AMC) on smaller movements and less stress. SS of my charts in TOS. more alerts in am and a lot of this is also in our forums now. Also, use the forums more. Thanks. <@&895135662867619930>

For our call plays to work, we need to see close or better/bullish numbers tomorrow at 8:30 <@&895135662867619930>

Promise last one tonight. YELP IMO did better on earnings and didn’t pop up as much as DASH. However, DASH might have better sentiment too -resistance at 90 then 100(and this could mean nothing) but I will pick YELP for now. YELP -resistance at 35 then 40 area. Of course, pending tomorrow’s trend. <@&895135662867619930>

PEGY 4.25 break I am in just at 4 <@&895135662867619930> SL under 3.75 or 3.50 or could average down there

Up 10% on PEGY will be closing soon. <@&895135662867619930>