GETY, HKD, QRTEB, MGAM not mentioned at all on this forum. Ok. Lol

GETY has two threads, one of which has 3’ timeframe signals which called the main run and almost caught the exact peak.

If you see other tickers catching sentiment feel free to make a thread.

You’re in the “long term” section of the forums, brochowski.

Hoping to see a run up to the launch in September. Already in quite a few of Nov/Jan calls but might look to enter some September ones in case it catches some momentum. As noted above it does have a decent amount of SI so could see some interest from the tard community now that we have some very big catalysts in the coming months (launch, successful unfurling, successful testing from orbit) Going to be an interesting end of year, really hoping they can pull this off.

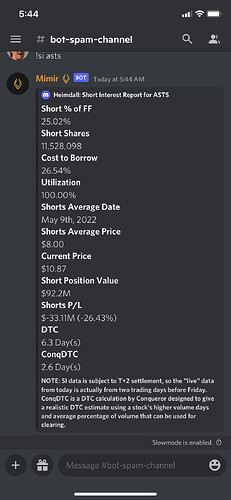

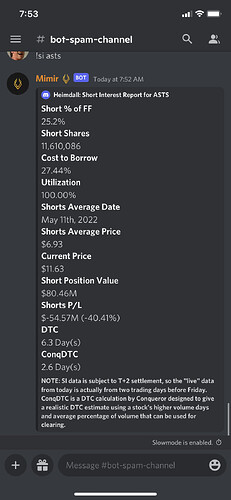

This now seems potentially well poised for a short squeeze, with shorts ~20% underwater, days to cover still around 10 as volume remains low, and positive catalysts potentially coming over the next few weeks.

Have been scalping calls around my core position of shares/warrants, but currently out and waiting for a slight pullback to re-enter calls.

Last time this pushed over $10 it was on 50 million and 10 million daily volume.

This time it’s doing it on 1-2 million volume, suggesting that there is still a lot of fuel for a squeeze.

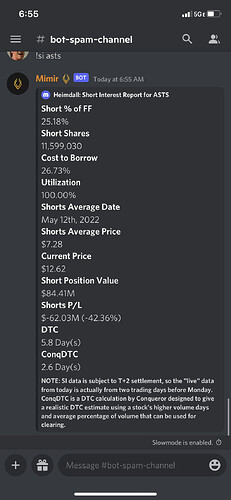

Updated short info as of this morning:

Seems also to be growing in meme power.

I have been scalping September 10c around a core position of shares/warrants that I won’t be touching much.

Updated short info based on closing price of $11.63 on Friday.

Cost to borrow is not extremely high but this seems to tick most of the boxes for a continuing short squeeze if the macro holds up okay.

Earnings call is end of day on Monday so there might be some sell-off shortly before. They have already pre-released the financial information, however, so there is always the possibility that the company announces a certain launch date (within the expected mid-September window) or has other impactful news.

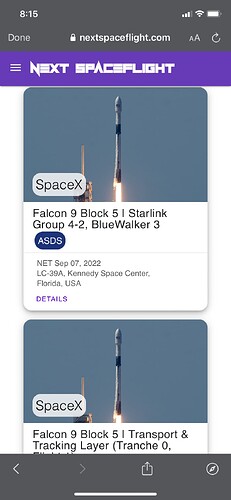

Launch window apparently opens September 7th:

So the catalyst that we are banking on for this play is an announcement of a launch date after hours tomorrow correct? Because we essentially already know everything else so that would be the only news we can think of that could give this a boost.

It’s hard to draw a circle around all of the potential catalysts, but yes most likely the only news we can “expect” tomorrow would be: (1) Clarifying the exact Bluewalker 3 launch date (likely September 7th plus or minus a few days), and (2) an update on the factory to produce Bluebirds (which appears to have made progress based on satellite images from the Midland, Texas site, and will be hugely important in producing the satellites necessary to build out the Phase 1 constellation in 2023). A dream scenario would also include an update on their seeking non-dilutive financing or 5G Fund money but those are still likely 6+ months away.

This could still go either direction, but my hunch is that so long as the macro environment holds, share price will continue to climb approaching the launch date. And there might not need to be much of a spark with this much short interest fuel.

I’m probably going to take a few lottos on this one for tomorrow see if it pops off any news may take a long position even if it doesn’t pop pending on what they report

So theoretically according to conq dtc they may have to start covering tomorrow

It’s another $BBBY in the making. I’ll be doing TA tonight.

DTC doesn’t mean anyone has to cover, just the time it would take if all shorts tried to close their position based on average daily volume… also idk how much TA will matter in this play, it’s news driven sentiment at this point and as long as we don’t see dilution news or the launch date getting pushed back then I’d assume we will either start to consolidate or even drift upwards as we get closer to the launch. However this is not a rocket company, the next big catalyst after tonight’s earnings imo is the successful unfurling of their test satellite which I believe will take 1-2 weeks after successful launch… SpaceX falcon 9 series has like a 99% success rate so I’d assume a successful lunch will get priced in very soon if it hasn’t done so already…

DTC (and ConqDTC) is accurate, it’s short average price and P/L that are in accurate. When I say that, it’s the same as everyone uses but it’s an innately flawed calculation that we could improve on.

This is all good to know, and I’ll be doing my own research tonight. It seems like the forum mostly talks about fundamentals and news and speculation instead of doing actual TA which I believe is super important. We have to look at everything, not just fundamentals, news and speculation.

Highlights from the earnings call

-12 months cash runway

-5 bluebirds (twice the size of test sat) will be launched late 2023.

-all other BB expected to be launched in 2024 and will be monetized as they go

-16million is the cost per BB, they need 300-350million to complete phase 1

-will seek financing deals and not just focus on dilution

-launch window for test satellite opens early September

Mostly all known information so nothing really unexpected. However, I’m sure refrigerate will update more in depth

Conq mentioned that the P/Ls are inaccurate, and this is definitely a good example of that.

Last few days it has shown average short share position going DOWN when it is almost guaranteed that shorts have been covering and repositioning higher. Very unlikely average short share position is going down.

Showing some major resilience after the company’s business update yesterday.

Currently at $13.67 (52 week high), up over $2 from the dip this morning.

Will do a more thorough update in what we learned from the call yesterday when I have a spare hour.

Covered my cost basis on $25c Jan 2024 leaps before the earnings crash and now it’s back over what I sold them for. Still have half and letting them ride. Very high hopes for the technology this company is developing.