Starting a thread on Boeing (#ba) as I’ve been hearing multiple rumors (emphasis on rumor) that Boeing has acquired some big military contracts that haven’t hit the news yet, possibly from or through LMT (My friend’s guy…yeah yeah, I know…claims LMT defaulted on a contract and it was given to BA, and was also saying something about unusual shipping labels from LMT->BA. Will update this as I get some clarity on all that).

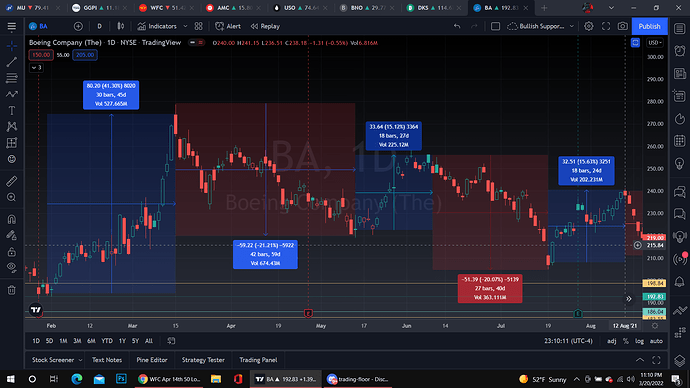

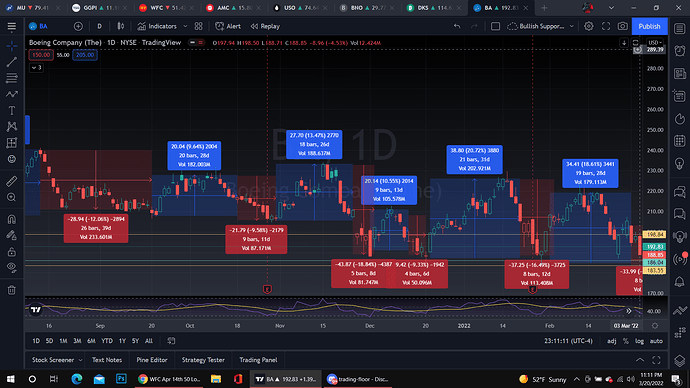

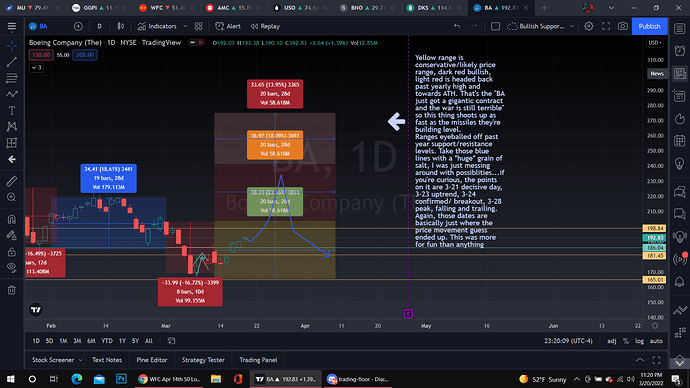

I’m still digging into the veracity of the rumors, but even from a technical standpoint, BA looks to be ready to pop into one of it’s uptrends on the daily time frame, and as far as sentiment…well, they make weapons during war. LMT has had everyone’s eye lately, so I also hope for some OI coming in on aircraft ticker fever. We’ve all seen how volatile these war time tickers can get, but I’m confident enough looking off the chart to open a position.

So far took just one 3/18 180c @$4.75 for a swing based on chart technicals this week, but as far as a possible news run goes, obviously further out dates are better, my real goal here is gonna be to build out a position for April or May before the (alleged) news hits. Again, I cannot stress enough that as of now these are just rumors, play accordingly

News dumps-

Bullish

“BA ‘misunderstood’ by market as civilian aircraft manufacturer”, while 40% of sales come from defense contracts (expected to rise)-

Neutral

FAA finalizes Boeing 777 safety directives after fan blade failure (bearish issue, neutral-bearish resolution)

Bearish

Boeing worried about missing key 737 Max certification (bearish, especially while the market still views Boeing as mainly commercial)

3-13: Slow, Neutral-Bearish news this weekend, most revolving around the EoY deadline for the 737 MAX certification

(Website is an asshole with AdBlock on) Interesting in that it concentrates on the executives’ options expiring worthless, strange spin to put on it

https://www.seattletimes.com/business/boeing-aerospace/despite-boeing-woes-executives-get-big-paychecks/

An anonymous BA insider says there’s ‘no way’ they meet the deadline

https://www.airwaysmag.com/industry/boeing/boeing-737-10-cert-deadline/

A few more like that, a couple with the helpful reminder that last month Netflix released a documentary about Boeing crashes ![]() Looks to remain neutral bearish for a bit, will watch PA this week to potentially play downward movement, as this downtrend is likely to continue until a catalyst comes through, catching that catalyst as early as possible is the goal here

Looks to remain neutral bearish for a bit, will watch PA this week to potentially play downward movement, as this downtrend is likely to continue until a catalyst comes through, catching that catalyst as early as possible is the goal here

Will add more as I see it, though remember this is going off anticipated news, not current. Watching $178-$180 to sell the 3/18, and $165-$175 on pullback for Apr/May entry