Yngwar

March 22, 2023, 7:35pm

3

Tl;dr: Rising rates screwed SIVB as it had to sell securities at a loss to meet significant withdrawals. Down 80% in one day, and not clear yet. Risk of contagion to the greater banking sector unclear.

Shares of SVB ($SIVB), the parent of Silicon Valley Bank, fell more than 60% during regular trading hours and another 20% AH, after it disclosed losses of nearly $2 billion following a larger-than-expected “decline in deposits”. It raised raise $2.25 billion in fresh capital by selling new shares, but word is a bank run is continuing. Probably didn’t help when the CEO said “stay calm” and “don’t panic”.

This could be a canary-in-the-coalmine incident.

SIVB is a decent sized bank with 200B in assets. It’s not SI, or even SBNY - no crypto exposure. It has fallen victim to something that is hitting every single bank now - rising rates. When rates rise, bond values fall. Banks buy treasuries (usually bonds) with deposits from customers. Normally, if there are significant withdrawals, banks just sell the treasuries and meet the withdrawal request. Trouble starts when they have to sell assets at a loss to meet withdrawals.

Banks will mark a portion of its assets mark-to-market (MtM) (and take losses on as value falls, as rates rise). They have $26B of this. However, there is another $91B that is not MtM because they intend to hold them to maturity. Things like MBS and CBS. But if they were forced to MtM, this would be worth $76B. In other words there is a $15B gap. Note also that they have $16B in equity.

Under normal circumstances this would be fine because they would, really, hold those assets to maturity. But if there is a bank run, then things get real ugly. This $2B could be just the tip.

To make matters worse, Peter Thiel has advised funds to withdraw their money from the bank, and some are reporting wire transfers are not going through. In other words, a bank run on SIVB is underway.

Is this a Lehman moment? Unlikely right now, as SIVB is not systemically important. However, this can act as the match for a potential Lehman moment. Regional banks (ETFs IAT and KRE - graphs below) are down 8% too. Only the largest banks with a diversified asset base will likely not be affected at all by this rising rates issue.

This is a developing situation, and we should keep a close eye on it.

By the way, this is a good example of Fed rate hikes breaking things. Might give JPow a reason to keep the next hike at 25bps.

[image]

[image]

Good discussion on the Think Tank thread in respect to banks. Read from the post above to the most recent.

And this CS one.

Starting this thread to discuss the currently beleaguered Credit Suisse (NYSE: CS). Lots of direct and implied movement could be associated to their fall. Let’s bring the conversation out of Discord and into Discourse so we can all benefit from the conversation.

Discussed tickers.

[size=4]Individual bank Tickers [/size]

[size=4]Bank ETFs [/size]

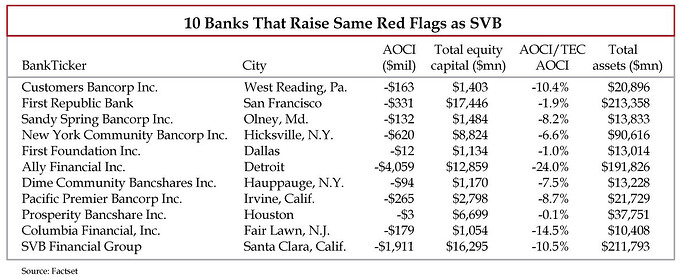

small cap banks from @Catalyst_59 Twitter post

Full ArticleToo Small to Not Fail - by Danielle DiMartino Booth (substack.com)

Any thoughts on how you can potentially play this, whether it be short term or long term, are welcome. Saw a couple of you play some calls on the FRC dip and made profit, congrats!

Also, if any of you can provide your take of Powell’s speech and the effects of what it means, that’d be great.

4 Likes