Starting this thread to discuss the currently beleaguered Credit Suisse (NYSE: CS). Lots of direct and implied movement could be associated to their fall. Let’s bring the conversation out of Discord and into Discourse so we can all benefit from the conversation.

Stakeholders above

Interesting article that sums up their goal to do a “global review” of its business

Also a post on yield notes to raise some $

Credit Suisse stock has already been suffering from all the chit-chat about trouble in the bank, down almost 60% YTD. The stock price is also very low (around $4), making it difficult to play with options anyway. Where can profit be found? Are there shareholders exposed who can be shorted, or similar banks with potentially similar problems?

I did some quick research on the largest shareholders, and there doesn’t seem to be any one company exposed to more than 5% of the stock except Blackrock. Next I took a look at the bank’s top competitors who could very possibly be having similar issues on a smaller scale. Keep in mind: banking depends heavily on its clients, and if those clients are losing money and pulling, or can’t pay debts (this is beginning to happen on a larger scale as everyday people watch their money burn in the current hostile global economy) then the banks collectively will begin to have serious problems, not just a single isolated bank. Of course, someone has to go down first and Credit Suisse could be it.

https://craft.co/credit-suisse/competitors This is a list of the CS’ top competitors. Closest is UBS, a large cap bank with similar exposure and assets under management. Honorable mentions include GS and MS. I think puts on either MS or UBS or both with be one of my choices for positioning pre-earnings due to the potentially drastic effects of a major bank failure.

Rumors are that Credit Suisse is very close to pull a “Lehman” any moment. Trying at all costs to reassure their clients of Its liquidity and capital position it’s their last effort, which I’m assuming their efforts won’t have a positive outcome. Their collapse is unavoidable. They lost their top executives and this could be the main reason why. Deutsche Bank also could go down with Credit Suisse.

https://finance.yahoo.com/news/credit-suisse-ceo-seeks-calm-133223291.html

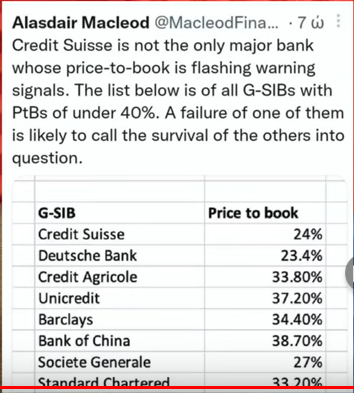

I found this post, it’s pretty self-explanatory. Basically these are the banks seriously exposed to a potential default.

Would you be able to point us the post? It would be great to be able to export this data and check on the general health of each of the tickers in here.

CS is down a ridiculous amount already, so I think we’d be looking for maybe a couple different things:

- Companies that may be willing to acquire them (result is CS goes up, some other ticker goes down)

- Companies that may also fall after CS

The latter I think is the most interesting. I see this as potentially setting up a bit of a domino effect whereby CS is just the first domino and serves as the call to action for us.

For whatever it’s worth and I should have posted it above, the first bullet is why I’d maybe think twice about taking puts on Monday at market open. If they get an offer for purchase, the opposite of falling through the floor happens and you could be burned badly. Open to disagreement and conversation here, but I’m not looking at CS as a put play right now but rather broader industry sympathy.

Monthly Charts here, and most of them look dead already…

CS

Possible delisting, if ever? I’m not comfortable playing puts against anything under $10.

DB

Same story here.

Credit Agricole (LSIN)

I think we already missed their dumps back in 2008.

Unicredit (LSE)

A bit over $10, but eh.

Barclays

Big office in Times Square, lolz.

Bank of China (HKE)

Seriously, these are all dead, but may have futures?

Societe General (Euronext)

Might be a possible play here, if we/you have access to Euronext.

Standard Chartered (HKE)

This one can be a good play, Hong Kong listing, though.

There must be a better list of exposed tickers that have room to give.

In the Think Thank Macro thread, I listed some of the most attractive charts that still have much room to dump: The Think Tank: Macro Discussion and Opportunities Brainstorming - #125 by rexxxar

Thank you @Endermike for your contribution, and @SuckyMayor for starting this thread.

Came across this thread on Twitter stating that CS and DB are on an international list of banks that are too big to fail.

This reply is various credit agencies’ ratings on CS holdings in comparison to other banks. It’s a monthly report and should be updated this week?

https://twitter.com/investbridge/status/1576662643003490305?s=12&t=2dGbyPXRWtacKcE3Xu9Y8A

Also, we might have to make the distinction from the IB side and if it’s able to be carved out or folded in light of the whole bank.

https://twitter.com/goodalexander/status/1576724677225246720?s=46&t=ke4rEbTME-rwpUelVXz3qA

https://twitter.com/macroalf/status/1576641291961520129?s=46&t=ke4rEbTME-rwpUelVXz3qA

Two in-depth threads on CS stuff for anyone interested, worth the read.

Both DB and CS have had a string of bad things happen to them (because of their own boneheaded decisions - no one else to blame), so they already had a weaker balance sheet than other international financial institutions. Then, Europe happened, which they have much exposure too. And finally, Treasury and other govt bonds are some of the assets held by CS; as bond values have plummeted, so has their Tier1 capital gotten reduced. Suggesting they may need capital injection soon.

Given their size, it is almost impossible that they will be allowed to fail spectacularly. Since it is a European bank, it could go into public receivership for a while, if it truly does keel over. Parts of it might also be excised and sold off - word is their investment banking division is in more trouble than their wealth management and retail banking ones.

They are expected to declare a strategic plan by the end of this month. This sequence of events may force their hand. The CEO had previously said he would not create a “bad bank” with troubled assets, so hard to see how they get out of this pickle easily.

One low probability option is one of the US banks picking up its wealth management business, which would be quite a coup.

Sadly I cannot link the post, I snipped it from a youtube video, as I do not have a twitter account myself, I try to stay out of socials mostly. I think Deutsche Bank and Barclays are solid targets here as Deutsche has been a semi-zombie bank ever since 2008 anyway so I’m not surprised that they are exposed here.

Yes, this is certainly to be taken into consideration. I am not rushing into any positions, and I don’t think CS should even be played with their low stock price and high IV. We should keep a close eye on the banking sector in general, which I am thinking could be a juicy place to take longer term shorts on some banks that to all appearances seem fine, but must be having at least some impacts from bonds, interest rates, and the DXY strength, not to mention ghost runs from people seeing this news from Suisse.

This was my thoughts for most part. CS is a European financial entity and largely wouldn’t have same effect as a US entity such as Lehman brothers going down.

I’d caution most to expecting this to have some 08 domino affect to tread carefully as I’d think if this were to truly come to fruition the Swiss government to step in. Likely will cause some downward pressure on market from the fear factor.

But it’s not exactly JPM going under with the whole doomsday scenario.

I was about to type up a bunch of stuff but I think your post has covered my thoughts.

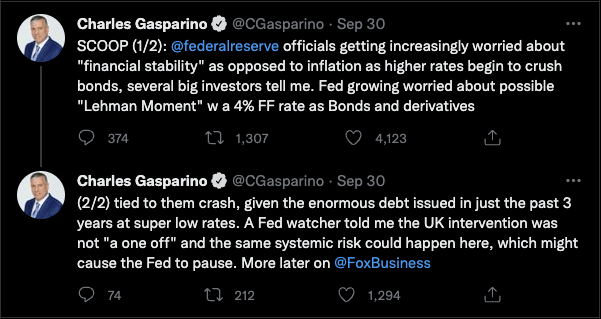

I think this does have an affect on US markets however, in that our Fed is paying attention to everything else that’s happening around the world, the BOE and pension funds for example. Here are a few things circling that have caught my eye in lieu of this Bank/CS stressed weekend news

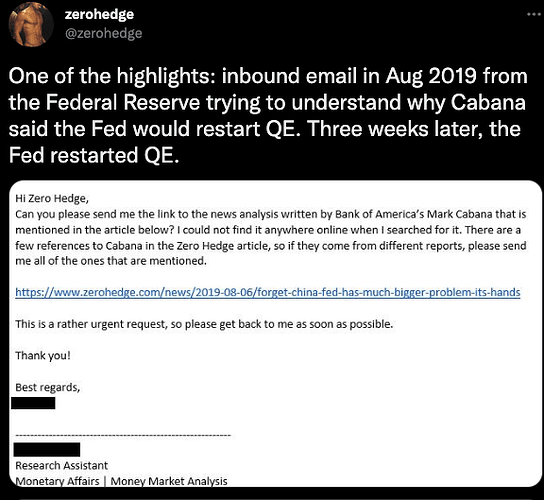

Zerohedge highlighting BoA Cabana -

Link - x.com

Followed by this that they also tweet in reference to Cabana calling for QE back in 2019

Link - x.com

Gasparino on Friday with this, there are others essentially saying the same thing

Link - x.com

This headline out of Bloomberg, I had the full document but I didnt save it, if any1 can chime in with a copy of the article because I dont actually pay the $300 a year for Bloomberg

Fed Begins to Split on the Need for Speed to Peak Rates

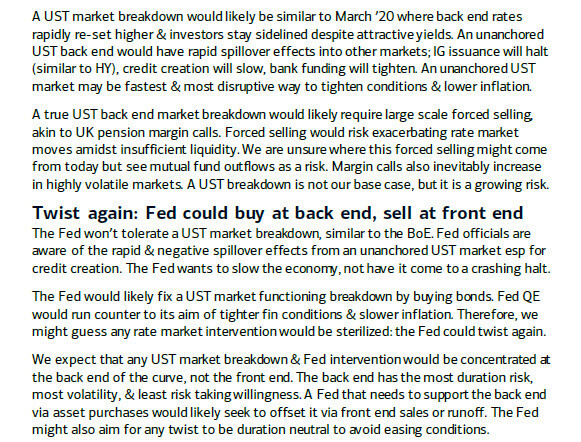

I am of the opinion, that while not a reversal in rates or a hard stop on increases, I would not be surprised to see a change in language temporarily, and some actions taken, such as what Cabana suggests in that the fed purchase bonds, preempting a lehmanns event, and I imagine this could trigger a bear market rally if things play out this way.

CNBC article just dropped

Credit Suisse is not the only major bank whose price-to-book is flashing warning signals. The list below is of all G-SIBs with PtBs of under 40%. A failure of one of them is likely to call the survival of the others into question.

Article with a different point of view

https://www.efinancialcareers.com/news/2022/10/credit-suisse-the-next-lehman