Hoping someone with wiser eyes could look at this…

I’ll keep an eye on it but I don’t see how it doesn’t fall apart when almost 3x the current float gets added @10.15. Obviously the price hitting doesn’t necessarily mean the backstop investors will sell out immediately but you’ve got to consider part of the float at that point.

For OI I’m seeing:

18.8k @ $10

8.4k @ $12.5

1.6k @ $15

So at $15 you’d had 2,880,000 shares that potentially need hedged which is a little less than 1x the float before backstop and only a quarter of the float once backstop isn’t locked up. I don’t really see enough here for a gamma play.

I also don’t see anything in the DD about any upcoming catalysts or why sentiment would change other than the poster saying the company is undervalued. But who knows, SPACs are crazy and it could get pumped

I agree with @wahoowa and their assessment. The numbers especially on the float aren’t very favorable.

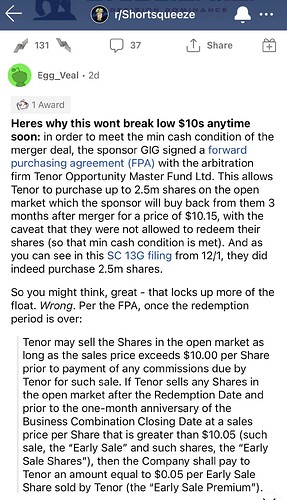

@thots_and_prayers said this already but look at this:

8 million shares unlocked when it hits $10.15?? This kills any gamma squeeze unless there’s 110,000+ ITM OI?

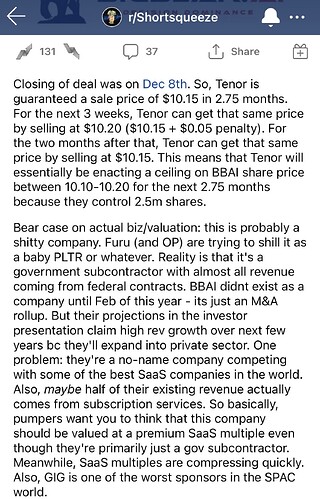

Found this evaluation of the $10 price point. Seems to be what the consensus is on the expanding float. I’m curious though, if there can be an argument made to explain why they wouldn’t sell immediately at $10? I’d imagine, if the the options chain starts to gain a lot of OI, they would let it run a little before offloading their shares.

Why wouldn’t this be a great trade to take an opposite position? Let reddit run this up to near $10 and open some ITM 3 month+ puts seems like a no brainer to me.

Hmmm seems like it’s still risky. In other words could use funds on better plays.