Yeah my mistake, misspoke.

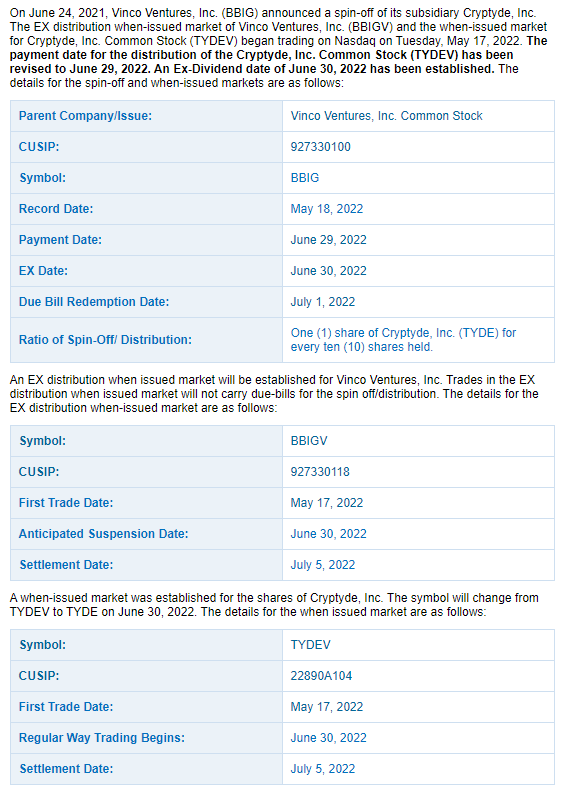

Current prices:

- BBIG: $2.76

- BBIGV: $1.47

- TYDEV: $13.80

Therefore:

- BBIG - BBIGV = $1.29

- TYDEV/10 = $1.38

Close enough… this is telling us that the market is assigning roughly equal value to the new entity and the residual entity.

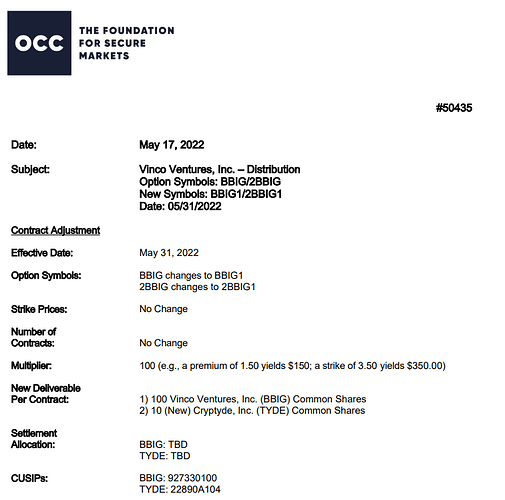

Question for our strategists - what are the implications of the OCC Memo?

Seems like strike prices will not change and if exercised, the TYDE will come with the BBIG if exercised.

Any way to leverage this info?

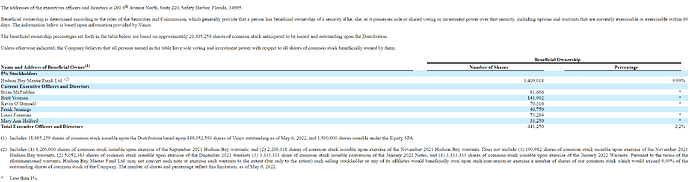

I’m struggling to find out what the float on TYDE will actually be, the BBIG float is 190m so it’s atleast 19m.

Theres apparently TYDE warrants too but I have no idea how many.

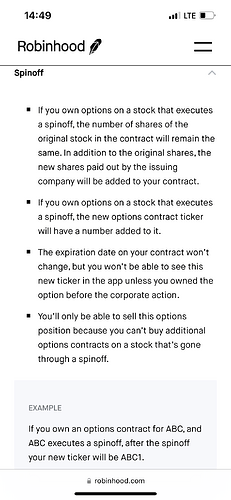

So I plan on switching to puts on Thursday/ Friday. Does the spin off mean I’ll also get puts in TYDE?

If I’m reading this right, we’ll just get puts in BBIGV?

This seems to suggest our puts will be for 10 shares of TYDE and100 shares of BBIG?

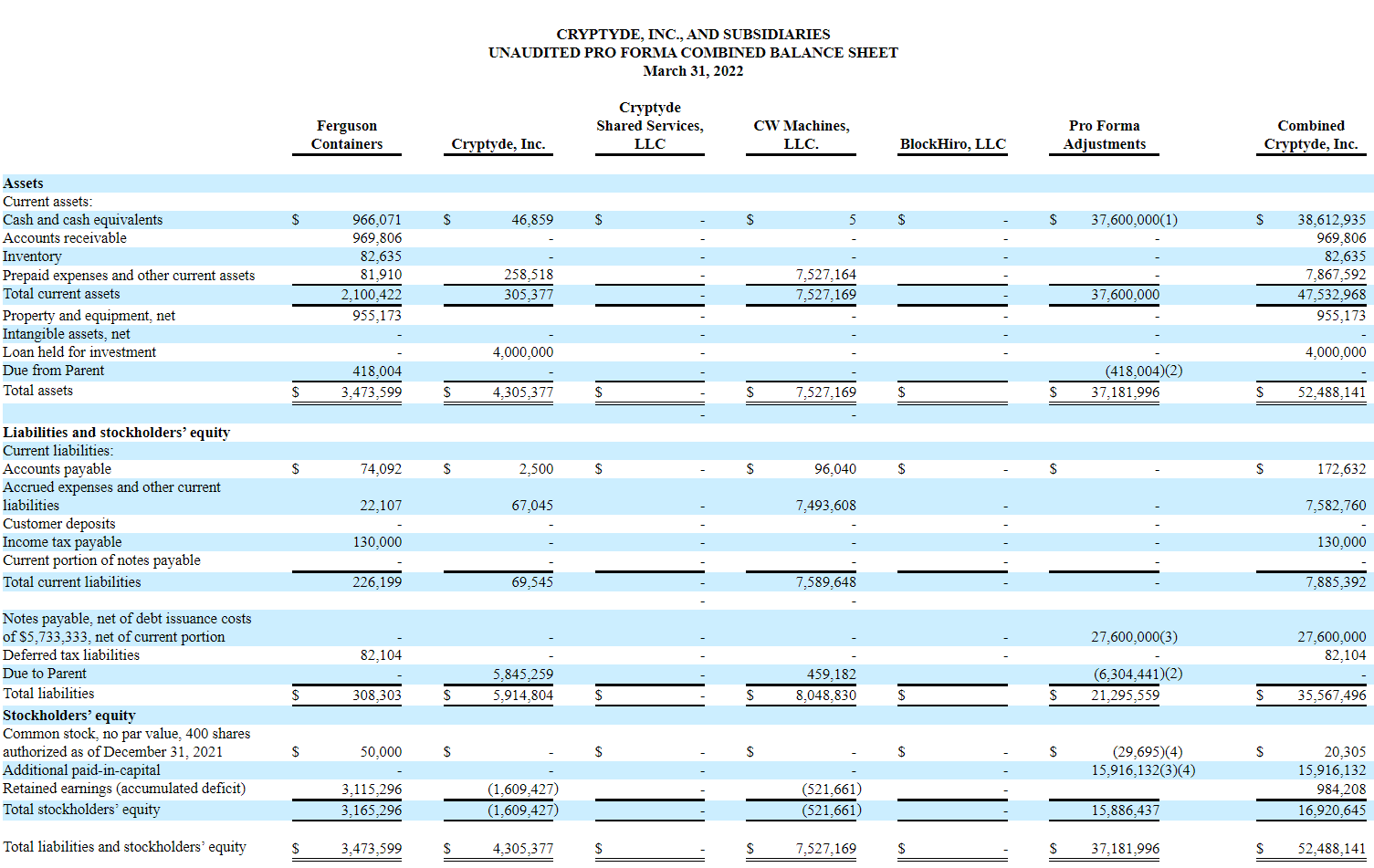

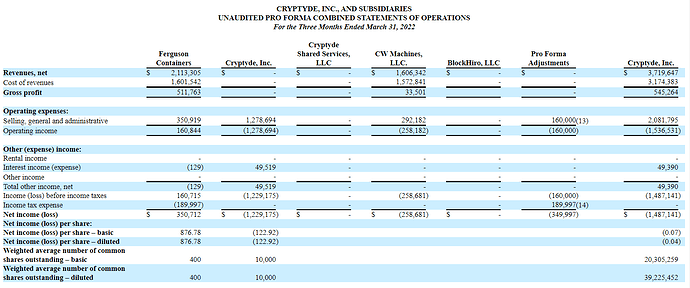

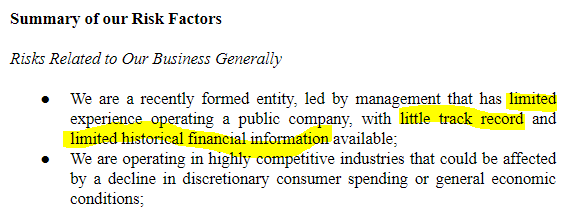

TYDE’s S-1A came out, has financials.

Balance sheet for Q1, 2022:

Income statement for Q1, 2022:

What a Frankenstein. And they had priced this at $360M (24M shares at $15 each). Right now market is pricing TYDEV at $8, I imagine it will freefall when it can trade freely.

At least they are being honest.

Too bad BBIG is at $2 already… will have to wait for TYDE options to come out, which is a bit after TYDEV is released to the market as such. Hope there is meat left to pick from =P

After many, many, many delays and periods of confusion, looks like TYDE will finally be released into the wild on June 30.

In that month, TYDEV has fallen from $15 to about $6 now. If we are to trust the process of price discovery, this may fall lower as those who got TYDE for “free” will get whatever they can for it and move on.

There is an investors’ vote on Jul 1 too. One of the major items being voted on as a 3x increase in shares, which will likely be exercised at some point soon as management has indicated they need money. BBIG fans are asking for a “No” vote in the hopes that a smaller float - still at 120M - will facilitate a squeeze. The outcome of this vote could tank the price if a “Yes” and hold the price if a “No”.

I do not have any short positions yet as the TYDE spinoff and the vote have jacked premiums a bit. Will wait to see it play out for a day or two. Still have a few Dec calls in case this volatility persists - price doesn’t have to increase much, just spasms in the IV can work out well.

Not surprisingly, the BBIG/TYDE spinoff event was a complete clusterf*ck.

TYDE opened premarket at the 3-handle, which was a bit weird since it closed yesterday at the 6-handle. Then it proceeded to go down to $2.

Folks are up in arms also because some brokers had not delivered Tyde shares yet. So while some got out while they could, the rest are watching helplessly. Chances are they will add to the sell-off and get out as soon as they can.

Incidentally, the vote tomorrow to let the company raise more through share issuance has been pushed back by about a month. Understandable, since asking investors who are mad at the constant stream of screw-ups if they can dilute more is probably not the smartest thing to do right now.

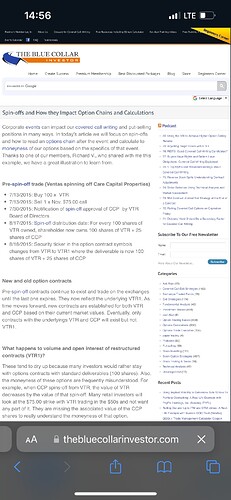

By the way… found this - apparently shorting spin-offs is a thing:

Looks like they added a new standard option chain for BBIG overnight.

With the stock down to $1.38 I’m not really sure it is worth touching it unless we see some serious OI buildup or bankruptcy talk.

Oh, excellent!

One catalyst might be the fact that a bunch of brokers have still not handed out TYDE shares. I think yesterday’s dump was at least in part from people selling both BBIG and TYDE because they’d had enough. I expect that to continue from the folks who are stuck, providing continued sell pressure. So this thing might still go sub $1 by the time the meeting happens in a few weeks.

Also, unlike other shareholder meetings, this one is a bit contentious. So IV should be even more jacked than it will be now, near that event. Possibility of vega play?

To no one’s surprise, both BBIG and TYDE have been going nowhere but down, though TYDE did have one day where is squeezed up 40%, before falling again.

This piece here lays out details of various considerations we’d talked about, and notes that if they do not get approval for additional shares, they have money for a quarter. If they do get approval, they have money for a year.

Growth through mergers is hard enough at this size because “synergies” tend to be elusive; that their senior management is so incompetent really seems to be killing them slowly but surely.

Will keep half an eye on this going forward, but barring some major news, there probably isn’t much of a play here, as it bleeds out.

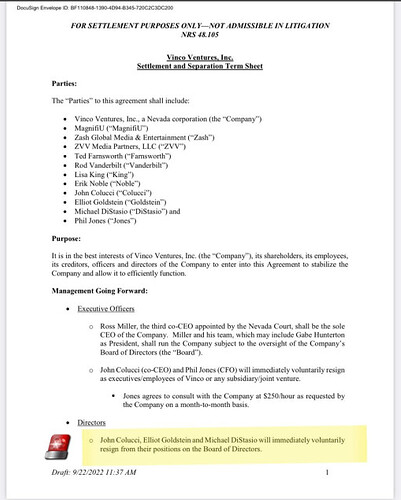

Hilarious press release from BBIG on the eve of the dilution authorization vote:

They did a musical chairs thing with three co-CEOs over the last week, and apparently they are all as incompetent at palace intrigue as they are running a microcap. The most amusing part - they accidentally $33M, and now have $20M left:

On July 22, 2022, the Company was, potentially due to the action or inaction of certain members of the Farnsworth Group, required to make the $33,000,000 cash payment under the Company’s previously disclosed Senior Secured Promissory Note dated as of July 22, 2021 (the “Secured Note Payment”). After the Secured Note Payment was made, the Company had approximately $20,000,000 of cash and cash equivalents at its disposal. We also have $80,000,000 of cash that is subject to certain conditions pursuant to a deposit account control agreement, meaning this cash is not readily available for Company use. The Company is currently in the process of implementing a cost reduction plan.

RIP.

This disaster keeps on giving.

ZASH, the company supposed to merge with BBIG using the latter’s funds and putting little of their skin in the game by comparison, has appointed a 24-yr old child with no relevant experience as a CEO. His main claim to fame seems to be that he didn’t’ make it through high school, but that he got lucky gambling during the biggest crypto bull market we’ve had, making him the “youngest crypto millionaire.” And has paid lip service to taking down short sellers and taking down shorts, so may also qualify as a meme-CEO.

Quite likely the proverbial “fool that rushed in where angels feared to tread.” But I suppose where things are now, a Hail Mary is probably the only thing that will work.

Only regret - prices are sub $1 already. So little room to short.

Maybe they will do a reverse-split to bring the stock price back up? Heheh…

The three-CEO company now has one. Colucci the usurper is out, but the judge didn’t deem the prior CEO worthy either, so the court-appointed caretaker CEO, Miller, will be the sole CEO for now. ![]()

Possible course of action - Miller gets the merger done and the man-child CEO of Zash takes over the combined company.

I think the whole outfit is still still hosed, but given the cult following, a merger could make the price spike again. Will put in buy orders for Dec calls on Monday, maybe.