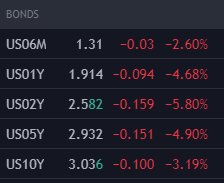

@KneifKneif and other bond gurus, bonds seem to have done what we were expecting for a while - yields went down, and appreciably:

The bond volatility MOVE index is also down compared to a week ago:

When I check the IV on 5/20 TLT options, both calls and puts have lost value, which supports this idea of bond volatility reducing appreciably:

On one hand, this means that the market is behaving as it should - out of equity, and into bonds.

Except, we have not been doing this until now. Both bonds and equity were going down. Are here indications that the market has now accepted that we are not at the bottom, and there is more to fall, so they are parking money into bonds now? Aka… a precursor to capitulation?

Don’t mean to fear monger, just trying to make sense of this change in sentiment.