Just now looking into bonds and whatnot so my knowledge is quite rudimentary. Stumbled upon a conversation from other traders and thought to share.

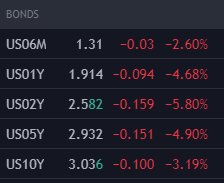

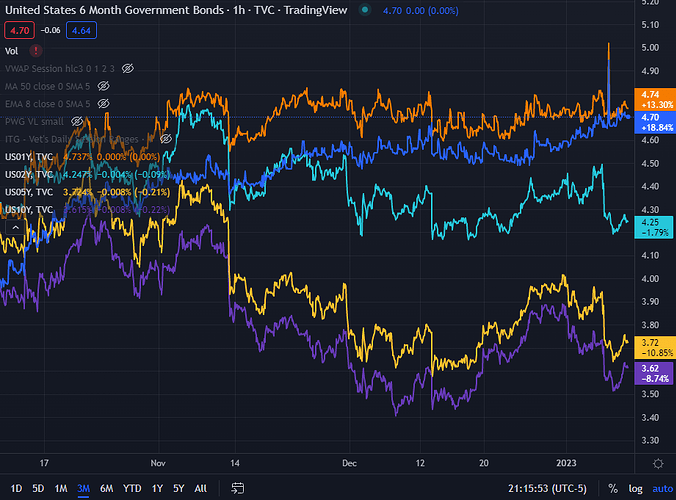

From what I gathered it seems the US Treasuries yield curve has been inverted for a few months now in favor of short-term bonds with higher interest rates. And so the convo begins:

Trader 1: "So think about a bond, what is it? A bond is an agreement that is made that Person A will give money to Person B after the Bonds reach maturity, Person B will buy back the bond and pay the interest that is on the Bond. So, let’s say I’m person A and I issue a $1,000 bond with a coupon/interest rate of 2%. You as person B say, okay, and buy the bond. As the market moves the bond price moves up and down but so does me issuing new Bonds to other people so let’s say Person C wants to buy a bond from me, now price is down on my bond because Interest rates went up from 2% to 2.5%. So, his Bond is $900/2.5%. Same maturity date of 2 years. So, your Bond matures, and the bond issued to you has dropped in price and interest rates have gone up more. You purchase another bond from me again because you know now interest has gone from 2.5% to 3%. So, you are still collecting interest even though the price of the bond has gone down. This is how it should work I believe.

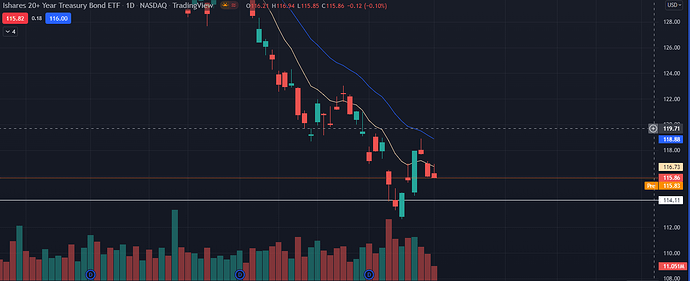

But the Bond market has been so weird lately that even though Papa Powell keeps raising rates the bonds dip (sometimes dip hard) but get bought right back up. Why is this: (here comes the tinfoil hat) because people don’t care about the Price of the Bond, they want to collect the interest. The market isn’t going to crater where a Treasury bill that matures 30years from now will not pay. They are taking it on the chin early to play the long game."

Trader 2: " So effectively the price of the bond doesn’t matter because these players are really just betting that the US won’t become insolvent."

Trader 1: "That is my theory, yes. The big boys collecting on interest and continue to buy because they get a better interest rate. "

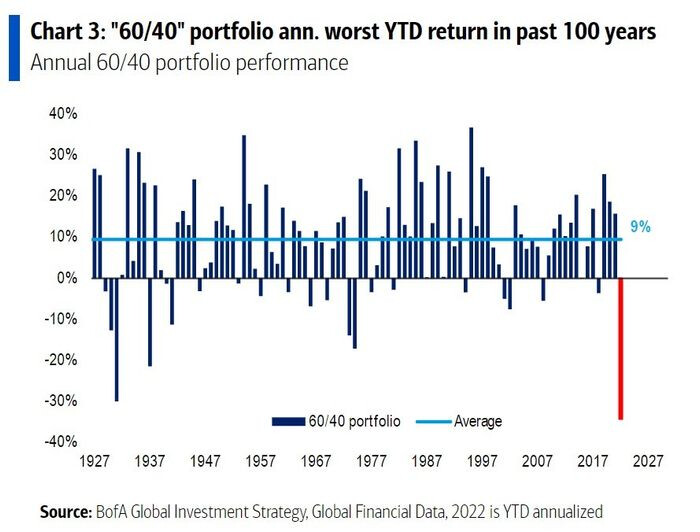

Trader 2: " I mean, it makes sense. Especially if you’re a big pension fund or similar that needs to put capital to work and won’t risk dipping into equities. Might as well take advantage of historically high rates."

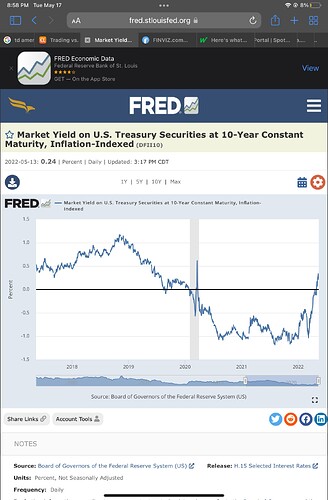

Trader 3: " Don’t forget the bonds/gold have a negative correlation to real yields. The bond market and the market was pricing in a rate cut. Breakeven which are inflation expectations for bonds haven’t been breaking lower which shows inflation isn’t breaking, but the narrative is. The bond market is now starting to price in another 25 bps rate hike in June. So, remember you also need to pay attention to the nominal rate but more importantly the real rate Us10y (nominal 10 y rate) - t10yi2(10-year inflation expectations) real rate. It is telling us inflation is going to be stickier than expected. Meaning CL is at a very attractive risk to reward set up. DXY is about to have a bullish trend.

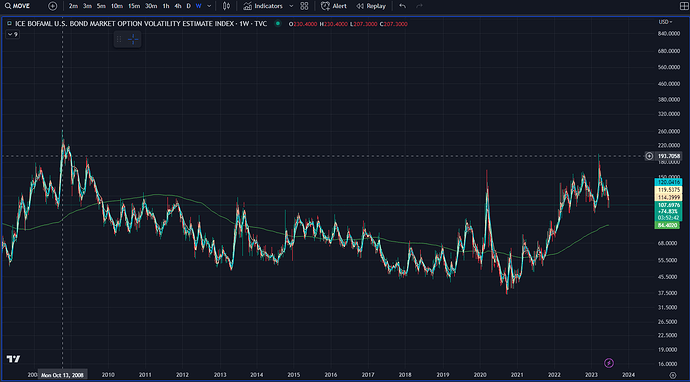

Bond people: have you observed the same in the bond market in respect to the price of bonds trading with such volatility?