Today was an interesting day as yields began to drop in treasuries but also corresponded with a drop in SPY. As always, The_Ni does a great job of presenting the thesis as to why: Bonds r screwed - #22 by The_Ni?

In short, bonds could be back in fashion as investors are pulling their money out of equities for the stability of treasuries and guaranteed returns. Frankly, I didn’t expect such a strong move into bonds but like every change, there should be an adjustment period before the markets digest the strength of the USD and the relative weakness of the Yen. Yields can only go down so much as the Fed is going to announce interest rate increases for the next two months regardless of the economic data. Also, it’s all relative and the USD should still appreciation to other struggling economies’ currencies:

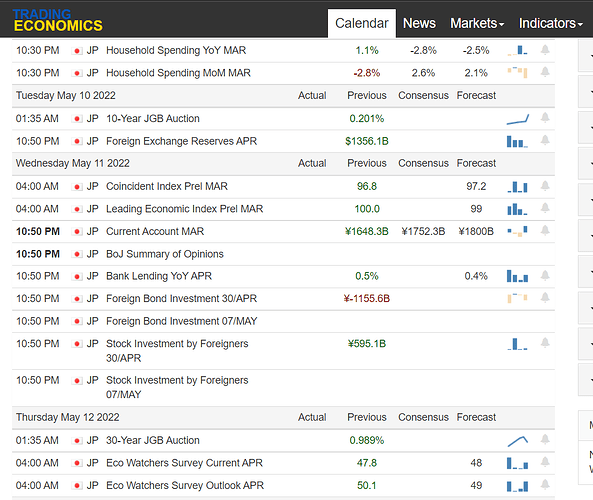

Here’s the calendar for Japan economic data release. At 1:35AM tomorrow, the 10-Year JGB Auction is going to be held and should gives us an idea about the appetite for JGBs.