have you observed the same in the bond market in respect to the price of bonds trading with such volatility?

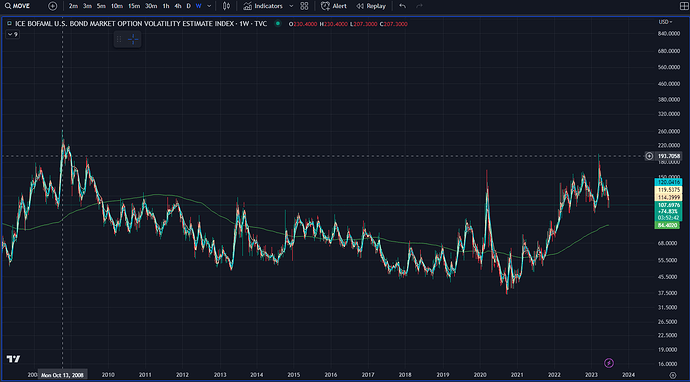

Yes. This is reflected through the MOVE index - which is the bond version of the VIX. In March, it was at 08 levels. You can also tell by how tall the candles on TLT were around then.

Regarding the Discussion You Pasted

This is part of a larger picture, but it’s pretty accurate in the way they describe the value dynamics of bonds. This cycle we learned that bond values are more sensitive to interest rates (and why) rather then them just being a small stock hedge.

Position Update

I have around $4,000 in TLT @ 103.91 and plan on adding another $4k thru the end of the year. I mentioned why I’m averaging into bonds during this cycle here in case you missed it.