One thing I’m averaging into this year is bonds. As we’re approaching the tail end of the hiking cycle (hopefully), rate cuts will start to be priced in and I don’t want to miss the boat.

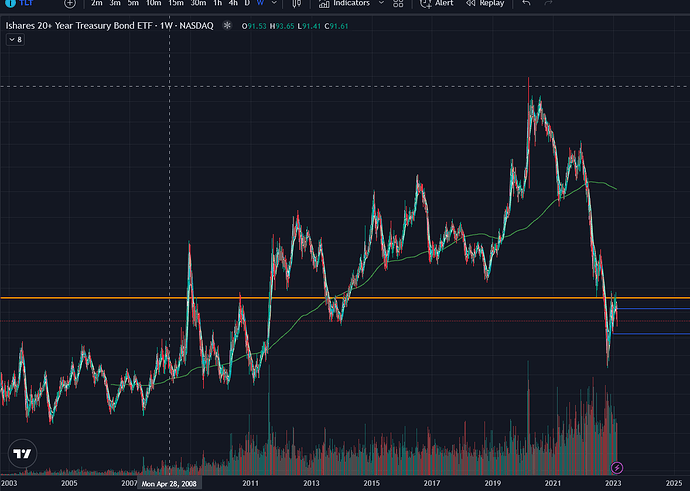

I personally think this a no brainer at this point due to the fact that if the economy does suffer, the Fed will have no choice but to cut interest rates ahead of schedule which will shoot up the value of bonds like they did in '08.

If the economy is stable throughout this hiking cycle, then they’ll start melting up again and to me it looks like there’s been an overreaction/correction to the current value of these 20+ Year Bonds. Just look at the the gap between the current value and the Weekly 200 MA (currently at 2013 levels).

By averaging into bonds once a quarter, I won’t have to worry about timing the bottom or missing out when money starts rotating in. Also, should inflation be stickier than anticipated, I won’t suffer as big of a drawdown (compared to those who’ve been holding this entire time).

I’m excited to see where this position will be in a couple of years.